Starbucks (SBUX) is a roaster and retailer of specialty coffee worldwide. The company’s efficiency has improved over the years while also growing into one of the largest coffee chains in the world.

However, we estimate that the company is currently fairly valued. Thus we remain neutral on the stock. (See Analysts’ Top Stocks on TipRanks)

Measuring Efficiency

Starbucks needs to hold onto a lot of inventory in order to keep the business running. Therefore, the speed at which the company can move inventory and convert it into cash is very important for predicting success.

To measure its efficiency, we will use the cash conversion cycle, which shows how many days it takes to convert inventory into cash. It is calculated as follows:

CCC = Days Inventory Outstanding + Days Sales Outstanding – Days Payables Outstanding

Starbucks’s cash conversion cycle is 20 days, meaning it takes the company 20 days to convert its inventory into cash. In the past 10 years, this number has trended downwards, indicating that the company’s efficiency has improved.

In addition to the cash conversion cycle, let’s also take a look at Starbucks’ gross margin trends. Ideally, we would like to see a company’s margins expand each year. This is, of course, unless gross margins are already very high, in which case it is acceptable to remain flat.

In Starbucks’s case, gross margins have remained relatively flat in the past 10 years, hovering between 26.7% and 31.6%. There was an exception in 2020 when it dropped to 21.9% due to the pandemic.

In our opinion, this is not ideal because Starbucks’ gross margin was steadily declining from its peak in 2016 until 2020. Although Fiscal Year 2021 broke the downward trend, we would like to see if the company can keep the momentum going forward.

Risks

To measure Starbucks’s risk, we will first check if financial leverage is an issue. We do this by comparing its debt-to-free cash flow. Currently, this number stands at 3.2. In addition, when looking at historical trends, we can see that the debt-to-free cash flow ratio has been volatile, mainly due to fluctuations in its free cash flow.

Overall, we don’t believe that debt is currently a material risk for the company because its interest coverage ratio is 9.5.

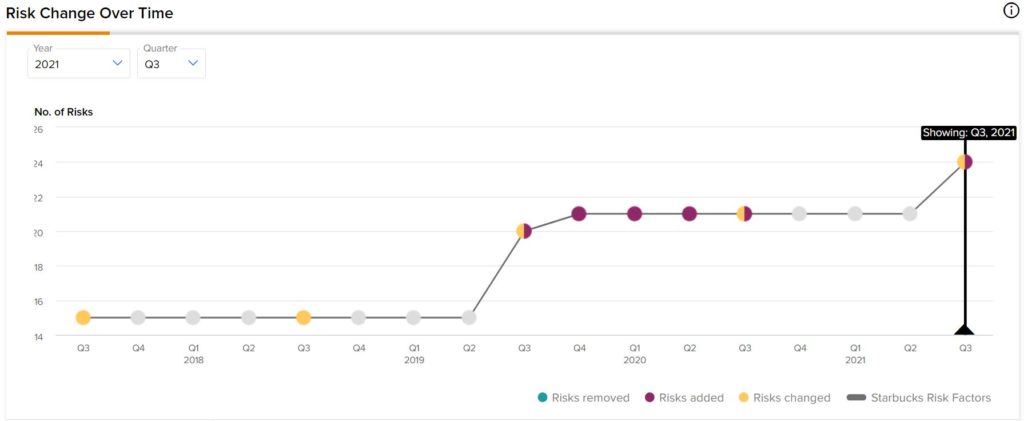

However, there are other risks associated with Starbucks. According to TipRanks’ Risk Analysis, the company has disclosed 24 risks in its most recent earnings report. The highest amount of risk came from the Production and Macro & Political categories.

The total number of risks has increased over time, as shown in the picture below:

Valuation

To value Starbucks, we will use a single-stage discounted cash flow (DCF) model because its free cash flows are volatile and difficult to predict. For the terminal growth rate, we will use the 30-year U.S. Treasury yield as a proxy for expected long-term GDP growth.

Our calculation is as follows:

Fair Value = Current FCF Per Share / (Discount Rate – Terminal Growth)

$118.15 = $3.84 / (0.0503 – 0.0178)

As a result, we estimate that the fair value of Starbucks is approximately $118.15 under current market conditions.

Wall Street’s Take

Turning to Wall Street, Starbucks has a Moderate Buy consensus rating based on 15 Buys and seven Holds assigned in the past three months. The average Starbucks price target of $125 implies 7.9% upside potential.

Final Thoughts

Although Starbucks is fairly valued by our estimates and undervalued by the consensus rating, we remain neutral on the stock because there isn’t enough of a margin of safety.

In addition, the current low-interest-rate environment has led to low discount rates, which boosts the valuation of stocks.

Thus, if you believe interest rates will increase going forward, you might find better opportunities elsewhere.

Disclosure: At the time of publication, StockBros did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >