Founded in 1985, Starbucks (SBUX) is a Washington-based roaster and retailer of specialty coffee, with over 30,000 stores in 80 markets. It operates through three segments: Americas, International, and Channel Development.

The company recently reported earnings, which saw better than expected sales. Although the share price surged following the announcement, it has since given up most of those gains.

Despite the share price action, Starbucks is still a solid business that has a measurable competitive advantage. As a result, we are bullish on the stock.

Does Starbucks Have a Competitive Advantage?

There are a couple of ways to quantify a company’s competitive advantage using only its income statement. The first method involves calculating the company’s earnings power value (EPV).

Earnings power value is measured as adjusted EBIT after tax, divided by the weighted average cost of capital, and reproduction value (the cost to reproduce the business) can be measured using SBUX’s total asset value. If the earnings power value is higher than the reproduction value, then a company is considered to have a competitive advantage.

For SBUX, the calculation is as follows:

EPV = EPV adjusted earnings / WACC

$48.666 billion = $3.796 billion / 0.078

Since Starbucks has a total asset value of $29 billion, we can say that it does have a competitive advantage. In other words, assuming no growth for Starbucks, it would require $29 billion of assets to generate $48.66 billion in value over time.

The second method to determine a competitive advantage is by looking at a company’s gross margin because it represents the premium that consumers are willing to pay over the cost of a product or service.

An expanding gross margin indicates that a sustainable competitive advantage is present. If an existing company has no edge, then new entrants would gradually take away market share, leading to decreasing gross margins as pricing wars ensue to remain competitive.

In Starbucks’ case, its gross margin has contracted in the past several years, going from 31.6% in Fiscal 2016 to 27.9% in the last 12 months. As a result, its gross margin indicates that a competitive advantage is not present in this regard. However, we don’t rule out the possibility that the trend can reverse going forward.

Risk Analysis

To measure risk, we will start off by analyzing the company’s earnings quality. We want to determine if the earnings figures are reliable or if they are being manipulated by the accountants. To do this, we will employ a method known as the Beneish M-Score, which can help us identify if a company is an earnings manipulator.

The interpretation is quite simple. If the M-Score is greater than -1.78, then the company is likely an earnings manipulator. In contrast, if the M-Score is less than -2, the company is not likely an earnings manipulator. Lastly, a score between -1.78 and -2 is a possible manipulator.

Although the interpretation is simple, the calculation is not and requires many steps. The formula for this method is as follows:

M-Score =

-4.84

(+) 0.92 × DSRI

(+) 0.528 × GMI

(+) 0.404 × AQI

(+) 0.892 × SGI

(+) 0.115 × DEPI

(+) -0.172 × SGAI

(+) 4.679 × TATA

(+) -0.327 × LVGI

Where:

DSRI = Days Sales in Receivables Index

DSRI = (Net Receivables t / Sales t) / (Net Receivables t-1 / Sales t-1)

GMI = Gross Margin Index

GMI = [(Sales t-1 – COGS t-1) / Sales t-1] / [(Sales t – COGS t) / Sales t]

AQI = Asset Quality Index

AQI = [(Total Assets – Current Assets t – PP&E t) / Total Assetst] / [(Total Assets – Current Assets t-1 – PP&E t-1) / Total Assets t-1]

SGI = Sales Growth Index

SGI = Sales t / Sales t-1

DEPI = Depreciation Index

DEPI = (Depreciation t-1/ (PP&E t-1 + Depreciation t-1)) / (Depreciation t / (PP&E t + Depreciation t))

SGAI = Sales General and Administrative Expenses Index

SGAI = (SG&A Expense t / Sales t) / (SG&A Expense t-1 / Sales t-1)

LVGI = Leverage Index

LVGI = [(Current Liabilitiest + Total Long Term Debt t) / Total Assets t] / [(Current Liabilities t-1 + Total Long Term Debt t-1) / Total Assets t-1]

TATA = Total Accruals to Total Assets

TATA = (Income from Continuing Operations t – Cash Flows from Operations t) / Total Assets t

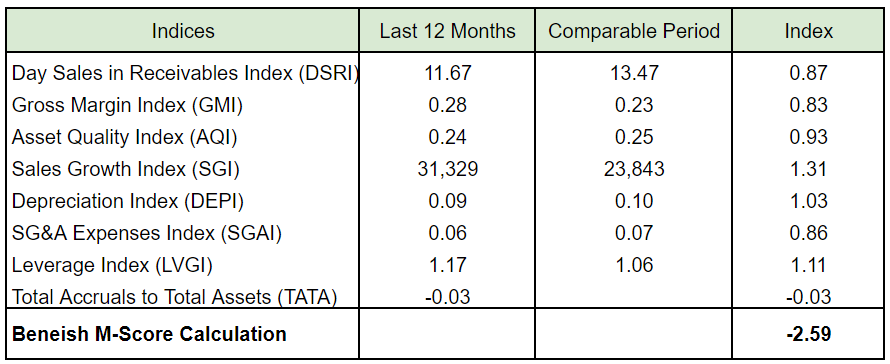

Now that we have defined the formula, we need to gather the data to input into the equations, which you will find in the image below:

Now that we have the required data, we can carry out the calculations, which we have summarized in the image below:

Therefore, Starbucks is not an earnings manipulator because it has an M-Score of -2.59.

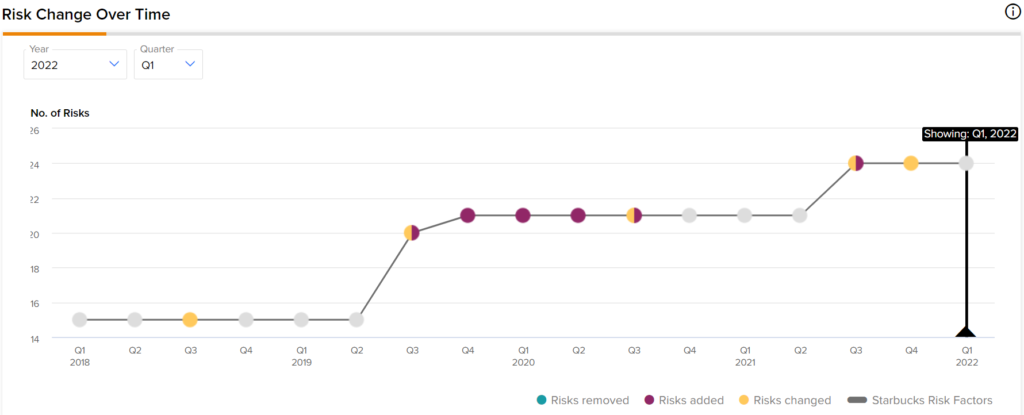

However, there are other risks associated with the company. According to Tipranks’ Risk Analysis, Starbucks has disclosed 24 risks in its most recent earnings report. The highest amount of risks came from the Production category.

The total number of risks has increased over time, as shown in the picture below.

Although the number of risks has been trending up, it’s worth noting that 24 is still below the S&P 500’s average of 31. As a result, it is relatively less risky than the average company.

Wall Street’s Take

Turning to Wall Street, Starbucks has a Moderate Buy consensus rating based on 12 Buys, nine Holds, and zero Sells assigned in the past three months. The average Starbucks price target of $95.19 implies 25.5% upside potential.

Final Thoughts

Starbucks has a measurable competitive advantage that we can rely on because it’s not considered to be an earnings manipulator. With a beta of 0.9 and fewer risks than the average S&P 500 stock, it seems like a decent stock to own if you’re looking for something on the safer side. Furthermore, the recent sell-off has created a better margin of safety relative to analysts’ price targets.

As a result, we are bullish on the stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure