Although hard to believe, in a recent conference call, Starbucks CEO Howard Schultz predicted that the company’s “business in China will be eventually larger than our business in the U.S.” This just goes to show that today’s premier businesses must have a global vision in order to survive and thrive.

Seattle-based Starbucks (SBUX) operates a chain of restaurants that primarily serve coffee and related items. I am bullish on the stock.

Still, Schultz’s statement might shock some investors during a time when Chinese businesses are grappling with renewed outbreaks of COVID-19. In light of this, it’s gutsy for Starbucks’ CEO to look to China as the company’s potential primary business focus.

It’s yet another example of how Starbucks is a flexible and ever-changing business, which isn’t necessarily a bad thing. At the end of the day, investors must weigh Starbucks’ recent data and developments – which we’ll cover in a moment – and decide for themselves whether to take a sip of SBUX stock now.

Struggling to Meet the Demand

It’s a tale you’ve undoubtedly heard many times this year. The demand for commodities remains intense, and supply-chain bottlenecks have made it difficult for today’s businesses to fulfill orders for certain products.

When you’re sipping on a delicious cup of coffee, it’s easy to forget that coffee beans are a commodity that’s traded much like gold or oil. Moreover, as it is with other commodity-based products, the price of coffee and its availability depends on the dynamics of supply and demand.

So, when Schultz said in a recent earnings call, “we do not today have the adequate capacity to meet the growing demand for Starbucks coffee,” SBUX stock traders might be alarmed, but they really shouldn’t be too surprised. Coffee is still as tasty and addictive as it’s ever been, and the coffee-bean market is susceptible to supply-chain woes just like other commodity markets are.

The Starbucks CEO cited other challenges, as well. Beyond supply-chain issues, Schultz noted that a “combination of shifts in customer patterns, accelerating demand and algorithms built for different customer behaviors has placed tremendous strain” on the company’s U.S. store partners.

Of course, Starbucks isn’t just going to let these problems weigh on the company’s bottom line without taking action. Thus, Schultz outlined essential changes, including new technology and equipment in existing stores, introducing digital tipping for workers, and implementing drive-through service at 90% of Starbucks’ new stores. These seem like viable approaches to meeting the customers’ demand for coffee in 2022, and hopefully Starbucks will soon be able to put the supply-and-demand balance back in its favor.

Delivering Despite the Challenges

Big plans for changes are all fine and good, but undoubtedly many SBUX stockholders want to know whether Starbucks is able to demonstrate revenue growth today, not years down the road. In that vein, Starbucks’s financial report for the fiscal second quarter ended April 3, 2022, should shed some light on the company’s fiscal status.

First, we should tackle the bad news. Disappointingly, Starbucks’ comparable-store sales in China decreased 23% year-over-year. This might make Schultz’ prediction of Starbucks’ business in China eventually outpacing the company’s U.S. business, somewhat incredible. Still, he’s the CEO and he probably knows a thing or two about the global coffee market, so perhaps we should take his word for it.

The good news is that Starbucks’ comparable-store sales increased 12% in North America, and 7% globally. Plus, the company reported a 15% year-over-year increase in consolidated net revenue, to a Q2 record of $7.6 billion – not too shabby, one must admit.

If you’re looking for forward guidance, however, you might be disappointed to know that Starbucks opted to suspended guidance for the company’s third and fourth quarters. That’s understandable, though, in light of the uncertainty in China right now.

Moreover, despite the challenges presented by COVID-19 lockdowns in China and inflation-related headwinds, Starbucks still managed to post decent bottom-line results. These included Q2 GAAP earnings per share (EPS) of 58 cents, as well as non-GAAP EPS of 59 cents.

So, where does this leave SBUX stock traders now? The share price is down sharply from its 52-week high of $126.32, and really, anything in the ballpark of $80 is a steal. Therefore, taking a long position in Starbucks shares isn’t a bad idea at all.

Wall Street’s Take

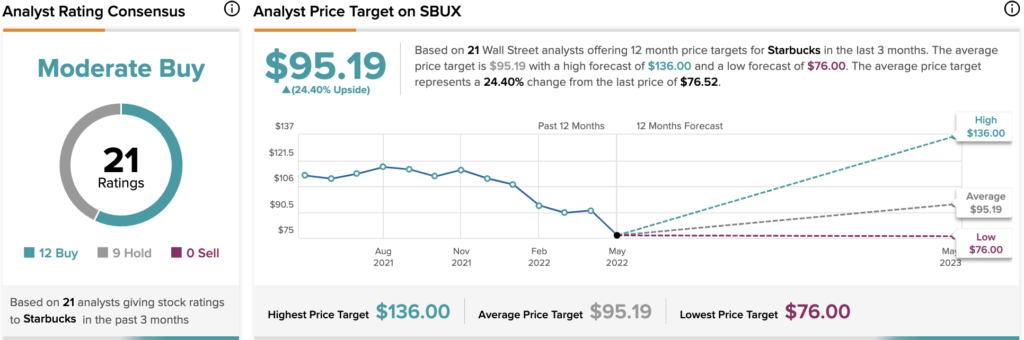

According to TipRanks’ analyst rating consensus, SBUX is a Moderate Buy, based on 12 Buy and nine Hold ratings. The average Starbucks price target is $95.19, implying a 24.4% upside potential.

The Takeaway

Will Starbucks actually shift its business focus toward China like the company’s CEO is suggesting? Is this even a viable strategy as China struggles with COVID-19 lockdowns?

Only time will tell, but Starbucks is still a coffee shop giant and is making proactive changes to meet the intense demand for its products. Besides, SBUX stock is relatively cheap and there’s plenty of room for upside, so investors might want to grab a cup of coffee and a few Starbucks shares in anticipation of robust profits in the long term.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure