The SPDR S&P 500 ETF Trust (SPY), a top ETF that tracks the S&P 500 (SPX) Index, consists of over 500 companies from different market sectors. The SPY ETF stock has advanced over 13% year-to-date thanks to the rally in technology companies. The upside comes despite looming concerns over the recession, geopolitical tensions, and rising interest rates. Interestingly, both the technical indicators and Wall Street’s top analysts point to further upside potential in the SPY ETF.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

SPY ETF Technical Indicators

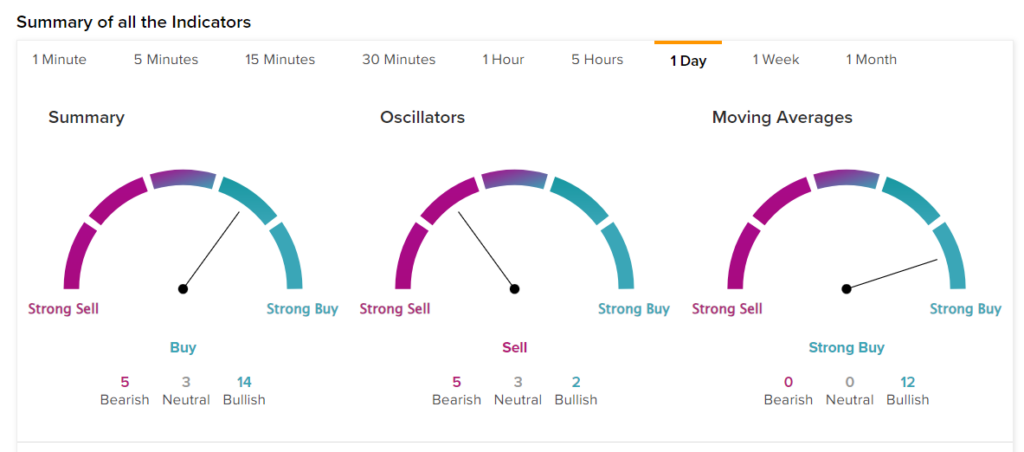

According to TipRanks’ technical analysis tool, the SPY ETF stock’s 50-Day EMA (exponential moving average) is 414.46, while its price is $429.9, making it a Buy. Further, the shorter-duration EMA (20-Day) also signals a Buy.

Meanwhile, its RSI (Relative Strength Index) is 66.67, implying a Neutral signal. At the same time, the SPY ETF’s price rate of change (ROC) of 2.69 points to a bullish trend.

In summary, the SPY ETF stock is a Buy based on TipRanks’ easy-to-read technical summary signals (which combine the moving averages and the technical indicators into a single, summarized call).

Is SPY a Buy, Hold, or Sell?

Out of the 4,138 top analysts who rated the SPY ETF’s holdings in the past three months, 60.32% assigned a Buy rating, 34.92% suggested a Hold, and 4.76% have given a Sell rating. Overall, top analysts have a Moderate Buy consensus rating on the SPY ETF. Moreover, the consensus 12-month price target of all top analysts of $481.24 implies an upside potential of 11.9% at present.

It is noteworthy that these top analysts have an impressive history of helping investors generate massive returns from their recommendations. Moreover, each analyst has a remarkable success rate.