Spotify Technology (SPOT) is the world’s largest music streaming service platform, counting more than 422 million monthly active users (MAUs). This includes 182 million active premium subscribers.

With a market-leading position in a growing industry, Spotify displays some attractive characteristics, including robust cash flow visibility and a relatively predictable revenue development path, moving forward.

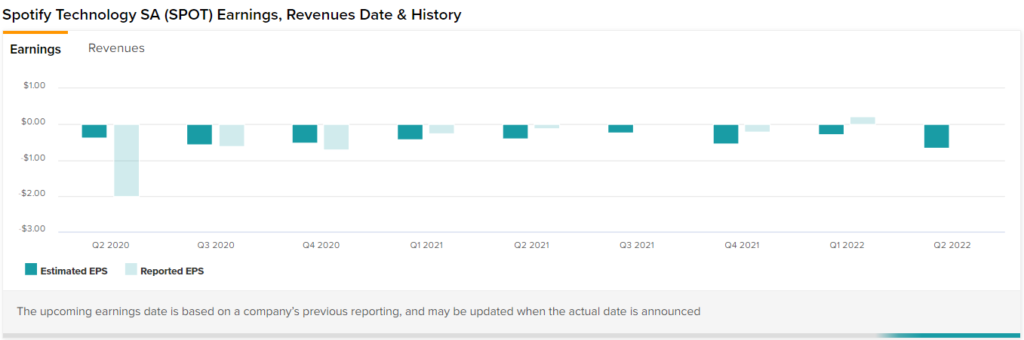

Despite that, the company has a serious issue when it comes to its business model. Its ultra-thin margins leave little to no room for sustainable net income generation. While Spotify’s revenues have been growing at a rather consistent pace, its net income margins have failed to expand meaningfully. Therefore, it’s very hard to say whether the company will be able to commence capital returns to shareholders any time soon.

The market has become increasingly aware of this reality. In fact, despite Spotify’s quality revenues due to its robust subscription business, shares have nosedived from their 52-week highs of $387 to $99.3 as of writing this piece. In my view, taking into account the risks attached to Spotify’s net income prospects, there could be more room ahead for the stock to plunge – especially during the ongoing touch macroeconomic environment.

Accordingly, I am neutral on the stock.

Subscriber Growth Decelerates

Spotify’s competitive advantage against the rest of its music streaming counterparts has been formed by its cross-platform availability and broadened access. Since Spotify can be accessed from virtually any device and operating system, the company’s platform has managed to grow faster than that of its peers.

Regarding access, Spotify’s ad-supported streaming model further helps the platform to grow its subscriber base, as it allows the free-side users to familiarize themselves with the service before they have to open their wallets.

Hence, Spotify’s MAUs have been growing sequentially every quarter quite invariably. The more MAUs are channeled through Spotify’s ad-supported business model, the higher the likelihood its subscriber base will continue to develop. This trend has been consistently demonstrated, including in the company’s latest results. That said, there are some concerns to consider, including deceleration in growth as of late.

In its Q1 results, Spotify recorded premium subscriber growth of 15% to 182 million. This indicates a deceleration from last quarter’s 16% and even further deceleration from last year’s 21%. It likely suggests that the company is entering a maturity phase amid having grown too much in the industry already.

Spotify mentioned that a churn of about 1.5 million subscribers was the result of the company’s exit from Russia. However, even if we adjusted subscriber growth for this event, it still wouldn’t make much of a difference.

Don’t get me wrong. Spotify’s subscriber base and revenues are of high quality. Specifically, it is very unlikely for Spotify subscribers to migrate to rival platforms. Once a subscriber grows familiar with the platform, including building playlists and sharing tracks with friends, switching platforms would be quite a hustle.

However, growth alone is not enough if it doesn’t translate to enhanced future net income potential. In that regard, the company appears to have a serious issue.

Limited Profitability Prospects

The problem with Spotify’s profitability prospects is that its margins remain very thin. In Q1, Spotify’s gross profit margins came in at 25.2%, declining sequentially from 26.5%. The company’s cost of sales primarily comprises royalties paid to artist/record labels. Accordingly, gross profits are doomed to remain very contained.

Of the €671 million in gross profits, €250 million were allotted to R&D, €296 million to marketing, and €131 million to administrative expenses. These amount to €677 million, more than its gross profits. Thus, operating income came in at -€6 million.

The company managed to record a net income of just €131 million. However, not only is this number essentially unworthy of attention, but it’s also only due to the company posting a €175 million gain in “finance income.”

This is nothing more than changes in the fair value of its exchangeable notes and favorable FX gains. Thus, the company essentially didn’t make any money from its core operations once again.

Wall Street’s Take

Turning to Wall Street, Spotify Technology has a Moderate Buy consensus rating based on 13 Buys and 12 Holds assigned in the past three months. At $151.52, the average Spotify price target implies 52.73% upside potential over the next 12 months.

Takeaway

Spotify’s business model is very sticky, resulting in the company featuring quality revenues and predictable cash flows. However, a slowdown in growth is quite notable recently, as the music streaming industry has become increasingly saturated. Simultunariously, Spotify’s gross margins continue to be quite thin and even declined further in the company’s latest results.

In my view, there is a strong possibility that Spotify lacks the prospects to produce sustainable profits at meaningful levels. With a number of costs pressuring its bottom line, Spotify could be more or less breaking even for years to come. Thus, I don’t see when and how the company will be able to start returning cash to shareholders.

During the ongoing macroeconomic environment, which is dominated by uncertainty, the lack of meaningful profitably prospects could drive shares further lower. Accordingly, investors should be wary when it comes to allocating capital to Spotify stock.