Sometimes an earnings miss isn’t enough to sink a company. Online music vendor Spotify (SPOT) found that much out after posting missing on EPS but offering a few choice figures in the mix that turned everything around. The stock is currently up 14% on the day.

Spotify’s earnings report was somewhat of a mixed bag. The company posted a loss of $0.86 per share, which stacked up poorly against Street projections calling for a loss of $0.72 per share.

However, SPOT posted a win on revenue, coming in at $2.91 billion against $2.85 billion. It also posted a gain in monthly active users, with 433 million signing in against the 428 million expected.

The last 12 months for Spotify shares are still down, though leveling off from where I last discussed the company back in April. Ever since April 25, the company has maintained a tight range between $90 and $110 per share. Today’s gains have popped it out of that track slightly, putting it up around $119 per share.

I was bearish on Spotify before, as there wasn’t much to distinguish it from the field. After seeing some of the latest developments over the last four months or so, there’s still not a lot to like here.

However, the company is making progress. If Spotify can keep making some changes—particularly if it can maintain that revenue—then there may be something to it. Thus, I’m shifting my stance to neutral.

Wall Street’s Take on SPOT Stock

Turning to Wall Street, Spotify has a Moderate Buy consensus rating. That’s based on 11 Buys and 10 Holds assigned in the past three months. The average Spotify price target of $143.05 implies 20.2% upside potential.

Analyst price targets range from a low of $103 per share to a high of $230 per share.

Investor Sentiment is on the Decline

Currently, Spotify has a Smart Score of 5 out of 10 on TipRanks. That puts Spotify in a state of perfect neutrality, right in the middle of the rankings. Despite this, investor sentiment is turning down in several separate metrics.

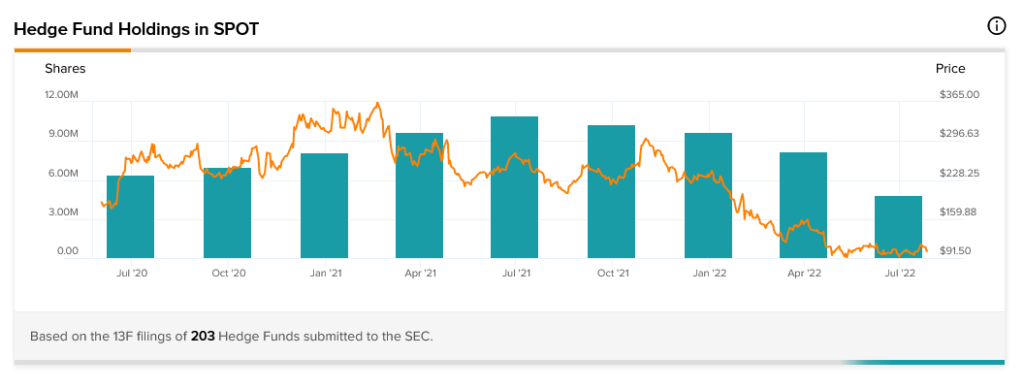

Hedge fund involvement, based on the results of the TipRanks 13-F Tracker, is one such declining metric. Hedge funds have sold 1.5 million shares of Spotify since the last quarter.

Further, this is the fourth consecutive quarter that hedge funds have sold SPOT stock. There seems to be no “buy-the-dip” plan in place here. Hedge funds are simply running for the exits more rapidly than seen previously.

Insider trading at Spotify, meanwhile, is little more than a blank slate. No data is currently available about insider trading at Spotify in any direction.

Meanwhile, retail investors are following the hedge funds’ lead. The number of TipRanks portfolios that held Spotify stock dropped 0.3% in the last seven days. That’s on top of a decline of 0.6% in the last 30 days.

Finally, there’s Spotify’s dividend history to consider, or, rather, Spotify’s lack of dividend history. As a growth stock, Spotify is generally more focused on building its share price. This strategy worked well a year ago but hasn’t gone so well in more recent months.

Strange Moves at Spotify Make a Puzzling Picture

Things at Spotify are looking downright puzzling these days. Its subscriber numbers are up, which is fantastic. Investor sentiment figures, meanwhile, are down about as hard as the subscriber numbers are up. That’s a strange picture, but the farther down you go, the stranger it looks.

One, Spotify quietly stopped production on its Car Thing dashboard device. The Car Thing was designed to serve as a means to ease control of Spotify while driving, making it a fairly natural selection to replace car radio and streaming options like Sirius XM (SIRI).

Great, so why did it stop? Spotify reps noted that several factors killed the Car Thing, including “product demand and supply-chain issues.” While currently-released Car Things will continue doing their work, finding replacements will be a much harder proposition.

The Spotify reps noted that the device “unlocked helpful learnings” and that Spotify was not abandoning the notion of it being a worthwhile car radio replacement. With growing numbers of original car radios offering an easy connection to Spotify, the notion of a separate Car Thing may not have been so useful.

Worse, Spotify’s push into podcasting has taken a bit of a hit. While back in April, we heard about Spotify’s push to add DC content, now, two big hits for Spotify are out of the picture.

The “Reply All” podcast aired its final episode back in June, as its hosts left the Gimlet production company. Meanwhile, the Obamas turned down an extended deal with Spotify to go with Audible instead.

Spotify’s subscriber numbers are up, and that’s certainly good news. Premium subscribers were up 14% against this time last year, hitting a hefty 188 million, and total revenue was up around 23%.

Spotify expects this growth to continue, reaching 194 million premium subscribers by the end of the quarter and clearing roughly EUR$3 billion in revenue by the end of the quarter.

That may prove to be a bit too pie-in-the-sky for a market like the one we’re seeing. Certainly, cheap entertainment will likely not go unappreciated by folks paying more at the gas pump and the grocery counter.

However, the idea that this will be their cheap entertainment of choice may be a bridge too far. There’s no shortage of cheap entertainment sources, after all. Dozens of streaming services are currently in play, and most of them are either at or below Spotify’s price of $9.99 per month.

Though Spotify has an edge in that it’s one of the best audio entertainment sources around, it may find itself playing second fiddle to visual services.

Broadcast radio is still free, after all. Additionally, with most cars having auxiliary jacks and USB ports, plugging in a thumb drive full of curated songs or even podcasts is a more available option than ever.

Conclusion: Looking Up, but Maybe Too Far Up

Give Spotify some credit here: despite soaring inflation, its subscriber rates have gone up to match. This does suggest a certain resilience on Spotify’s part. However, if the macroeconomic environment worsens further, Spotify subscribers may not have much choice but to abandon the platform.

This level of uncertainty leaves me neutral on Spotify. It’s made great strides, but most of its recent news has been setbacks. The decline in investor sentiment also makes me wary of involvement with Spotify. With the company also trading above its lowest price targets, it has room to fall.

Spotify’s gains have been impressive. It’s what Spotify might do for an encore that concerns me here. There is the potential for further gains, but there’s almost as much potential for further decline.