The third fiscal quarter’s earnings season continues to roll out new chapters to ongoing sagas. While some tech earnings have been impacted by inflationary pressures and supply-side constraints, others have been fortunate enough to circumvent the brunt of these issues. Music streaming platform Spotify (SPOT) reported earnings late last week, and was able to pull off an impressive quarter, bolstered by ad revenues and podcast engagement. (See Analyst Top Stocks on TipRanks)

Delineating his views on the matter is Andrew Uerkwitz of Jefferies Group, who bullishly asserted that “this is the best quarter we’ve seen from SPOT since our initiation [of coverage].” His positive outlook on the company, combined with Spotify’s reasonable valuation, could provide investors with an attractive long-term entry.

Uerkwitz rated the stock a Buy, and assigned a price target of $358 per share. This target suggests a possible 12-month upside of 23.70%.

The five-star analyst noted that Spotify is starting to see the fruits of its labor in regard to its increased revenue streams. “Podcasts, marketplace activity, and music advertising operating leverage” are driving healthy gross margins for the firm, and its ad supported revenue recently topped Wall Street consensus estimates.

Spotify has famously invested heavily in its podcast segment, inking high profile deals with some of the world’s most popular names. This tactic drew criticism over the last few quarters; however, SPOT is now experiencing record numbers of podcast consumption. This high level of user engagement has also helped drive ad revenues.

The company’s management has minimally amended Spotify’s Q4 guidance, but Uerkwitz sees this as net positive. He argues that investors need to see a few quarters of accurate guidance in order for management to be taken seriously. For now, the firm is capturing productive amounts of monthly active users, which will aide it going forward.

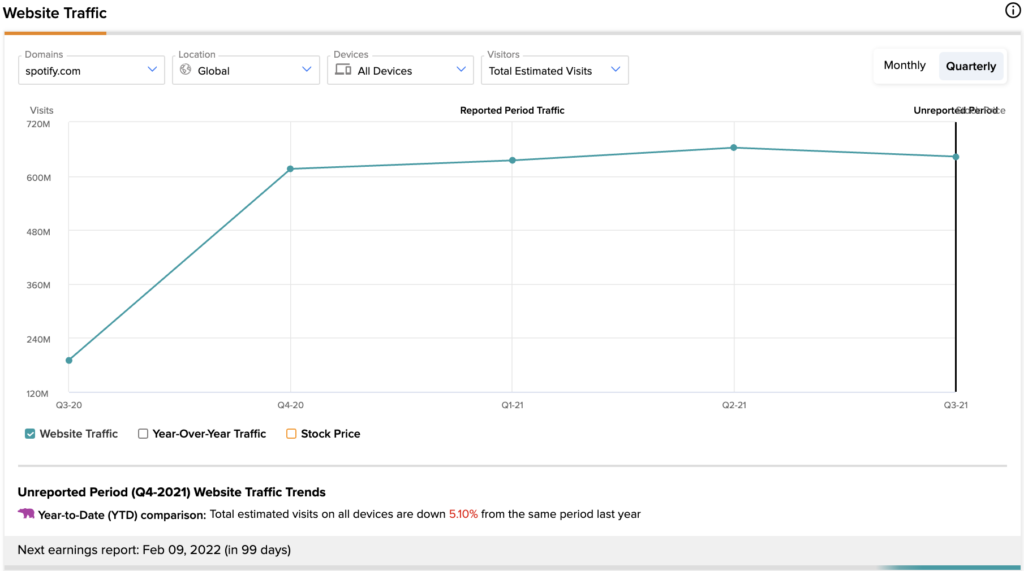

TipRanks’ Website Traffic tool shows that quarter-over-quarter, visits to spotify.com have declined –2.98%. During this same period, the share price has fallen –18.23%. When comparing the year-to-date of 2021 to the same period of 2020, it can be identified that total device visits are down –5.10%. The decline in both traffic and share price have yet to reflect the company’s strong earnings print, and thus Uerkwitz’s Buy rating is warranted.

Disclosure: At the time of publication, Brock Ladenheim did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.