Volatility might be the order of the day on Wall Street, but 2022 is already shaping up to be big on the M&A front too. Following in the footsteps of MSFT/ATVI, TTWO/ZNGA and several others, according to the WSJ, Cisco (CSCO) has put in a takeout bid for Splunk (SPLK), said to be worth more than $20 billion.

The acquisition would be Cisco’s largest to-date, more than 5x bigger than the 2017 AppDynamics purchase. Although the two companies are not yet reported to be at the negotiating table, Jefferies’ Brent Thill thinks there is “certainly strategic value in a potential deal.”

“SPLK’s strong presence in security would bolster CSCO’s waning market share while its observability platform is a strategic complement to AppD and ThousandEyes,” noted the 5-star analyst.

While Splunk is one of the observability market leaders, the narrative around this name has soured in recent times, as a “trifecta” of sales execution issues, a drawn-out cloud transition and ongoing leadership issues as the company is still on the lookout for a new CEO, have all played their part in keeping sentiment depressed. Therefore, a deal with Cisco could help to “alleviate concerns among investors regarding the search for a new Splunk CEO, the issues associated with a cloud model transition and general loss in mindshare.”

Meanwhile, shares have dropped by 48% from the September 2020 highs, with the lowered valuation making the company attractive as a takeover target.

On the other side of the fence, Cisco has been known to expand its platform via acquisitions and has been determined to augment its security offerings after bringing Duo Security on board in 2018 and ThousandEyes in 2020. Still, the company has fallen behind other vendors in the security operations space, and Splunk’s considerable presence in security would present a “significant opportunity” for Cisco. Therefore, Thill thinks it would make strategic sense for Cisco to buyout Splunk, with the merger providing a lot of “potential synergies.”

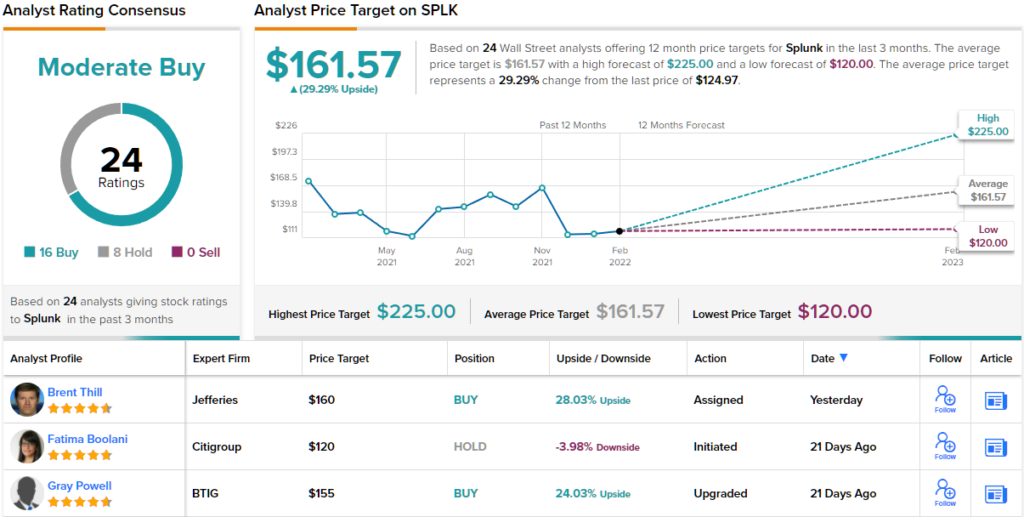

But what about the potential returns for investors? Thill rates SPLK stock a Buy, and has a $160 price target for the shares. (To watch Thill’s track record, click here)

Looking at the consensus breakdown, based on 16 Buys and 8 Holds, the analysts’ view is that this stock is a Moderate Buy. The average price target comes in at $161.57, almost identical to Thill’s objective. (See Splunk stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.