On the surface, the overall poor financial results that image-sharing platform Pinterest (PINS) delivered for its second quarter of 2022 earnings report should have been enough for investors to stay away. However, intense interest has buoyed PINS stock on the basis that Q2 was “less bad” than anticipated. Still, I am bearish on Pinterest.

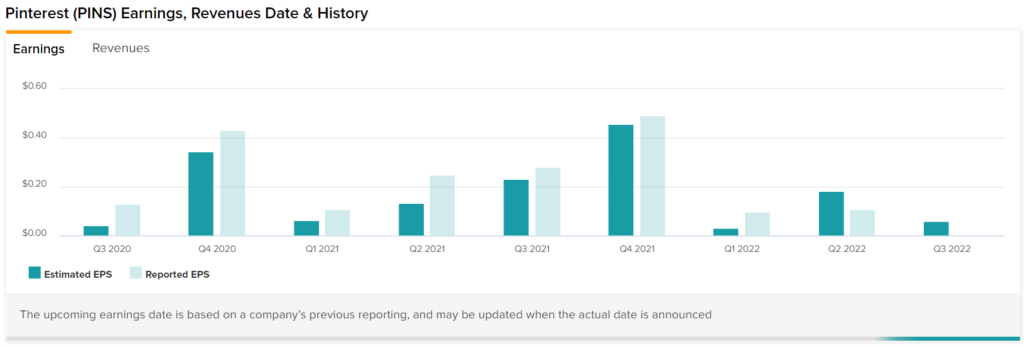

Presumably, in most other circumstances, a public firm delivering a miss in both the top and bottom lines spells bad news for the underlying security. In Pinterest’s case, it delivered earnings per share of $0.11 on revenue of $666 million. Unfortunately, according to Refinitiv, covering analysts anticipated earnings of $0.18 per share and top-line sales of $667 million.

Further, Pinterest revealed that its global monthly active users (MAUs) declined by 5% from the year-ago quarter to 433 million. While that’s not great news, this tally came in higher than expected, with analysts targeting a steeper decline to 431 million. As well, it’s noteworthy that other social media firms have not fared well. Thus, in some ways, PINS stock was the best house in the worst block.

Still, avoiding the caboose of mediocrity might not be enough for Pinterest against significant industry challenges.

Advertising Woes Present Dilemmas for PINS Stock

Although the dip in global MAUs may appear like a serious problem since social media outlets treat traffic volume like oxygen, it’s fair to point out that Pinterest suffered a similar situation in prior quarterly results. Nevertheless, it’s important not to get too complacent about this issue since it relates directly to the broader advertising dilemma.

Even last year, shifting ad trends provided a warning sign that investors needed to head to the sidelines regarding popular social media-based investments. With economic pressures building – particularly due to soaring global inflation rates and subsequent central bank rate hikes – fewer companies are incentivized to open their wallets to spend on marketing campaigns.

If the increasing layoffs in the technology sector are anything to go by, corporations are tightening their belts. By logical deduction, the total addressable market for PINS stock has declined. Piling onto the pessimism, though, is that Pinterest’s MAUs are likewise fading.

If a company is going to risk spending sizable funds on advertising in this potentially recessionary environment, it’s going to want a spotlight where the audience is at least stable, not steadily heading for the exits. Therefore, over the long run, any kind of erosion in MAUs is likely to be problematic.

Demographic Imbalances are a Dark Cloud

Usually, for a social media platform to be successful, it needs to be as universally appealing as possible. While that might be the case for Meta Platforms (META) and its Facebook network, one cannot say the same about Pinterest, which has a clear demographic imbalance. Specifically, data compiled by Statista.com reveals that 76.7% of Pinterest audiences were female, while just over 15% identified as male.

On the one hand, to have a platform that strongly attracts a certain cohort represents a powerful element. However, if a company desperately requires advertising dollars, cutting out roughly half a given population is not conducive to long-term viability.

Indeed, Pinterest’s latest Form 10-Q revealed that it’s still in the early stages of its monetization efforts. Further, management admits that its growth strategy “depends on, among other things, attracting more advertisers.”

Unfortunately, it’s difficult to see how the company can accomplish this goal by largely being attractive to female audiences as opposed to males.

Wall Street’s Take on PINS

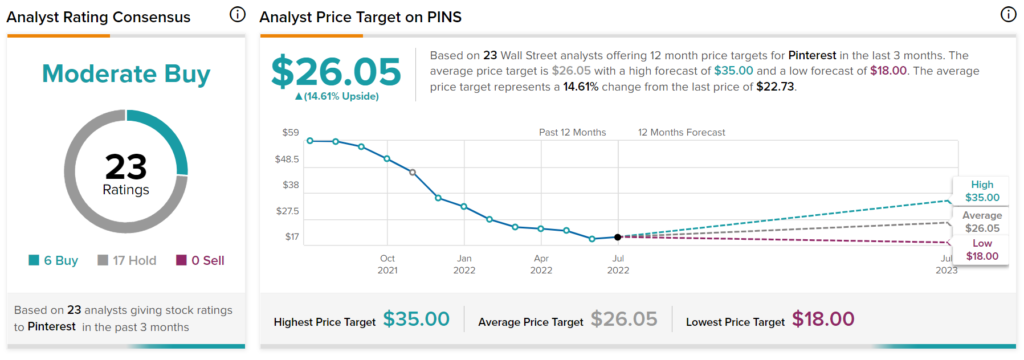

Turning to Wall Street, PINS stock has a Moderate Buy consensus rating based on six Buys and 17 Holds assigned in the past three months. The average Pinterest price target is $26.05, implying 14.6% upside potential.

Takeaway – Pinterest Faces Many Headwinds

Although PINS stock is up nearly 19% between the July 29 and Aug. 4 session, on a year-to-date basis, it’s down 38%. At some point, it’s difficult to get cute with the numbers. Global MAUs are declining, which then translates to lower incentives for advertisers. In addition, factors unrelated to Pinterest, such as inflation, are also knocking the wind out of potential advertisers’ sails.

As if those challenges weren’t enough, Pinterest appeals very strongly to female audiences but not so much to males. Given that every cylinder needs to be firing for social media companies, prospective investors must exercise extreme caution with PINS stock.