And down it goes again. 2022 has been a sea of red for many, not least for shares of SoFi Technologies (SOFI). All months so far have ended in further depressed prices and following the latest news, it looks unlikely April will prove to be the turning point.

President Biden has just extended the federal student loan payment moratorium until the end of August (from the prior May 1). As a big chunk of SOFI’s revenue is derived from the refinancing of educational debt, following the news, the company lowered its FY22 guide.

The company now expects to generate net revenue and EBITDA of $1.47 billion and $100 million, respectively, compared to prior expectations of $1.57 billion and $180 million.

With the upcoming fall midterm elections also entering the equation, the company anticipates the moratorium will extend beyond August, and will persist into next year.

Covering the situation for investment firm Mizuho, analyst Dan Dolev notes that, in any case, the “specter of an extension has been weighing on the stock for weeks.”

While the analyst thinks many investors are concerned that the lowered estimates include another “implicit weakness in the business,” the analyst puts these worries to rest. “Our analysis shows the drag on the P&L is only due to extending the moratorium,” Dolev explained, before adding, “We see no incremental weakness.”

In another development investors probably did not take too kindly to, the company also announced the departure of three board members including Galileo’s founder. Here too, Dolev reassures, seeing this development as more of an “optics issue than an indication of a problem.”

Nevertheless, considering the “lower near-term revenue and a less hospitable environment for FinTech multiples in general,” Dolev lowered his price target on SOFI from $17 to $14. This suggests shares will now generate returns of 82% over the one-year timeframe. To this end, Dolev’s rating stays a Buy. (To watch Dolev’s track record, click here)

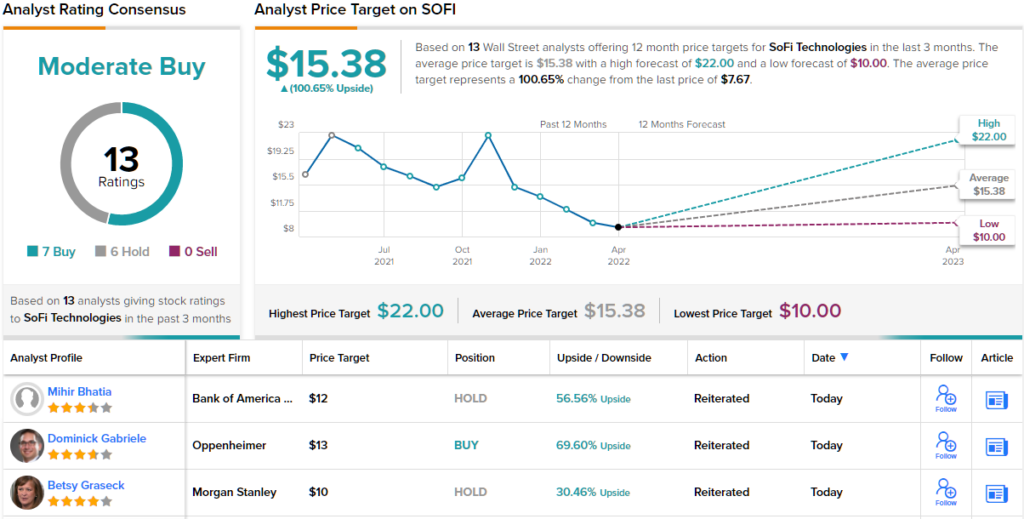

The Street is almost split down the middle on this one; Based on 7 Buys vs. 6 Holds, the analyst consensus views this stock as a Moderate Buy. However, the outcome is more conclusive where the price target is concerned; at $15.38, the figure makes room for 12-month gains of ~100%. (See SoFi stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.