SoFi Technologies (NASDAQ:SOFI) raised its full-year guidance for the third time this year despite a challenging macro backdrop. The fintech company generated lower-than-anticipated third-quarter loss and market-beating revenue. Nonetheless, SOFI stock has plunged 69% year-to-date as investors continue to be wary about growth stocks amid rising interest rates.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Adding to investors’ worries, four Democratic lawmakers on the Senate Banking Committee have now urged federal regulators to review SoFi’s crypto trading activities.

SoFi Growing Rapidly

SoFi had over 4.7 million total members at the end of the third quarter, reflecting a 61% growth compared to the prior-year quarter. The company’s growth from a student loan refinancing provider to a complete financial services platform has been remarkable. By the end of Q3, products offered by SoFi increased 69% to 7.2 million products.

Furthermore, SoFi’s bank charter, earned via the Golden Pacific Bancorp acquisition, is helping in bringing down its cost of capital and boost net interest income. SoFi Bank generated about $29 million of net income in Q3, at a margin of 11%.

The decline in home loan originations due to rising interest rates and the impact of multiple extensions of the student loan moratorium are weighing on SoFi’s performance. Nonetheless, the company is benefiting from an impressive rise in its personal loan originations.

Is SoFi a Buy, Sell, or Hold?

Keefe, Bruyette & Woods (KBW) analyst Michael Perito noted that SoFi’s banking business has been the “engine” behind its solid results this year, as the company is gaining from “a larger balance sheet and strong loan origination capacity.”

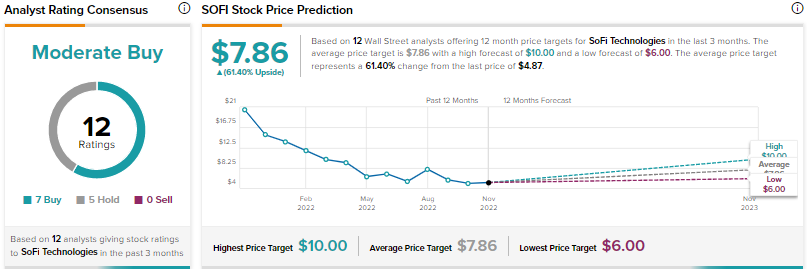

That said, Perito feels that it will be difficult for SoFi stock to sustain any momentum amid the ongoing macro uncertainty until investors see improvement in the company’s earnings. Consequently, Perito has a Hold rating on SoFi stock with a price target of $6.

Overall, the Street’s Moderate Buy consensus rating on SoFi Technologies stock is based on seven Buys and five Holds. The average SoFi stock price target of $7.86 implies 61.4% upside potential from current levels.

Conclusion

SoFi’s revenue grew 56% to $424 million in the third quarter, but its loss per share increased to $0.09 from $0.05 in the prior-year quarter. Investors are concerned that SoFi is still unprofitable despite robust growth in its customer base and product portfolio. Also, high interest rates and macro uncertainties could continue to impact SoFi over the near term.