Shares of the online personal finance and bank holding company SoFi Technologies (NASDAQ:SOFI) lost over 33% in three months. This decline comes despite the company’s back-to-back solid quarterly performances. While SoFi stock has dropped in value, its technical indicators show a bullish signal, suggesting a recovery from current levels.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

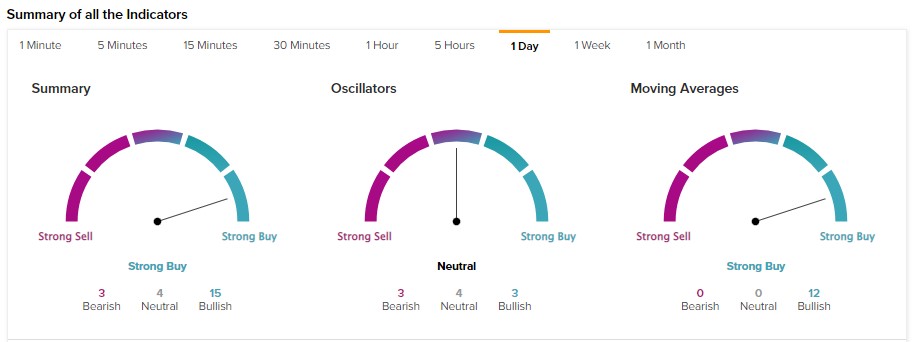

According to TipRanks’ easy-to-understand technical analysis tool, SoFi stock’s 50-Day EMA (exponential moving average) and 20-Day EMA stand at $5.92, while its price is $4.91, implying a bullish signal. While moving averages indicate Buy, SoFi stock could face immediate resistance at $8.24, which is its swing high. (See the chart below.)

What’s the Prediction for SOFI Stock?

Overall, SOFI is a Buy based on our summary signals (which combine the moving averages and the technical indicators to provide a summarized signal).

SoFi stock fell despite strong Q1 performance. While the underwhelming guidance (indicating softness ahead) explains the decline, Wall Street analysts remain buyers of the stock.

Citi analyst Ashwin Shirvaikar sees the drop in SoFi stock post-earnings as unwarranted. The analyst highlighted the ongoing strength of the company’s lending business. It’s worth highlighting that SoFi’s personal loan origination hit a record $3 billion, up 46% year-over-year. Further, its net interest income increased by 113% in the Lending business in Q1.

Highlighting strong financials, Shirvaikar rated SoFi stock a Buy.

SoFi stock has six Buy and one Hold recommendations, reflecting a Strong Buy consensus rating. Analysts’ average price target of $8.50 implies 73.29% upside potential.