SoFi Technologies (SOFI) stock is down more than 50% year-to-date. Although the share price has declined drastically, SoFi’s business is stronger than ever. Hence, it is safe to say that you can buy this high-growth stock and hold it confidently, as SoFi’s diverse set of revenue streams and its robust risk management program isn’t going anywhere. As a result, we are bullish on the stock.

SoFi is a one-stop shop for all financial services and has gained massive traction since it went public via a SPAC merger in 2021. After its debut, the stock price almost doubled due to the company’s spectacular finances and rapidly growing consumer base. However, SoFi’s selloff has presented investors with an interesting opportunity.

SoFi is Making Acquisitions at Super Sonic Speed

SoFi has used acquisitions to help it expand. This year in February, SoFi became an actual bank after it acquired Golden Pacific Bancorp. This acquisition has allowed the company to fund its loans using customers’ account deposits. Therefore, SoFi is less likely to face hindrances when dealing with cash.

Also worth mentioning is SoFi’s acquisition of Galileo, an application programming interface (API) specialist. This acquisition has shown plenty of promise because financial companies such as Robinhood will have to turn to an API when they want to issue payment cards or run a digital banking service. This means SoFi will have big companies on its doorstep in the future.

In addition, there’s one more acquisition that deserves praise. In March, SoFi acquired Technisys, a technology that helps banks and fintech companies to launch new products quickly, control data, and manage loans. The company hopes this purchase will reduce its operating costs by $75 million to $85 billion between 2023 and 2025, allowing SoFi to expand its profit margins and offer more personalized services to customers.

According to SoFi’s CEO, Anthony Noto, the company operates in the fintech industry similarly to how Amazon Web Services operates in the cloud computing market. This means SoFi is aiming to stand out from its competitors and lead the market.

SoFi is Currently a Bargain

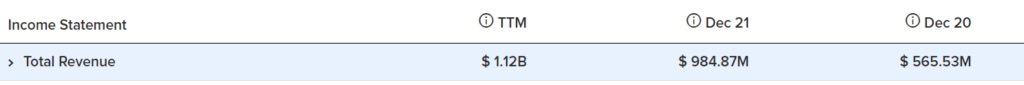

SoFi’s stock is the cheapest it has ever been. In October 2021, SoFi was trading at over seven times forward sales; today, it has a price-to-sales ratio of 4.2. This sounds a bit shocking, considering SoFi’s whopping 70%+ revenue growth in 2021 and double-digit growth expectations in 2022.

Dominick Gabriele, an analyst at Oppenheimer, said that SoFi is highly driven today, and its originated loans are here to stay. On the recent earnings call, SoFi’s management added that the company’s average FICO score across its borrowers base is 746, which is quite impressive compared to its competitors. This means SoFi’s lending will be less risky, and the company won’t struggle a lot if a recession hits the country.

Wall Street’s Take on SoFi

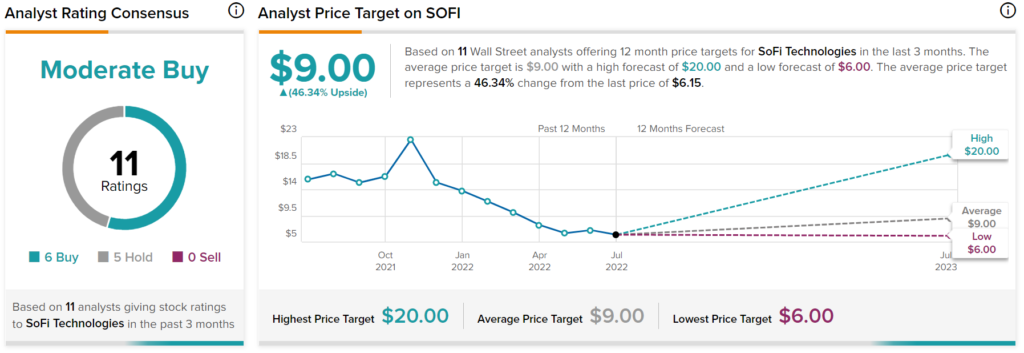

Turning to Wall Street, SoFi has a Moderate Buy consensus rating based on six Buys and five Holds assigned in the past three months. The average SoFi price target of $9 implies 46.3% upside potential. Analyst price targets range from a low of $6 per share to a high of $20 per share.

Bottom Line – Is SoFi Stock a Buy?

We believe SoFi is a buy, as its diverse revenue streams are helping it enjoy strong sales growth despite high-interest rates and recession fears. In addition, SoFi continues to portray its ability to expand despite multiple headwinds, such as the student loan moratorium, proving that it is prepared to take on challenges.

Furthermore, the company has made multiple acquisitions that portray its ability not just to expand but also to frighten competition. As a result, its membership base has grown from 36 million in Q2 2020 to a whopping 110 million in Q1 2022. Nevertheless, SoFi continues to trade at an affordable valuation, despite its rock-solid performances of late.