The first-quarter earnings of Snap Inc. (SNAP) are expected on Thursday, April 21. In its fourth-quarter showing in February, Snap shares gained 58% during after-hours trading after the company posted a profit for the first time.

In Q4, the company posted a 42% topline growth alongside a $22.6 million profit. Needless to say, investor interest is piqued this time round too.

Snap Inc. is an American camera and social media company that has developed technological products and services, namely Snapchat, Spectacles, and Bitmoji.

TipRanks Website Traffic Data

Let’s try and find out what the TipRanks website traffic tool can potentially reveal about the forthcoming earnings.

During the previous reported quarter, the website traffic for Snap had increased to 56 million in December 2021 from 44 million in September 2021. This increase in traffic coincided with a surprise fourth-quarter profit for the company.

Now, considering the period for the upcoming first-quarter release, total website traffic has increased to 74.2 million in March from 56.4 million in December. This indicates a traffic growth of 31.6% in Q1 as compared to 27.2% in Q4.

Cumulatively, in Q1, the total visitors to its site increased by about 25.6% to 188.9 million as compared to Q4. Moreover, when compared to the year-ago figure of 67.2 million visitors, the 188.9 million visitors indicate a 181.2% year-over-year increase.

Analyst Take

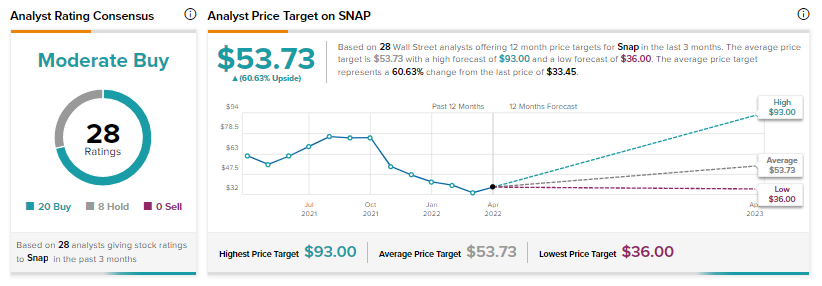

Yesterday, Monness analyst Brian White reiterated a Hold rating on the stock without assigning any price target. Overall the Street is cautiously optimistic about Snap with a Moderate Buy consensus rating based on 20 Buys and eight Holds. The average Snap price target of $53.73 implies a potential upside of 64.6%. That’s after a 30% slide in share price so far this year.

Closing Note

The Street anticipates Snap posting a Q1 revenue of $1.07 billion alongside earnings of $0.01 per share. These figures compare favorably to the year-ago revenue of $769.6 million. Moreover, while the website traffic trend for Q4 reinforced the financial performance of the company, we may find a similar uptick on April 21 as well, as indicated by the Tipranks website traffic tool.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Volta Posts Mixed Q4 Results

Western Digital Teams up With Kioxia Corp

Nektar & Bristol Myers Halt Their Combination Therapy Trials