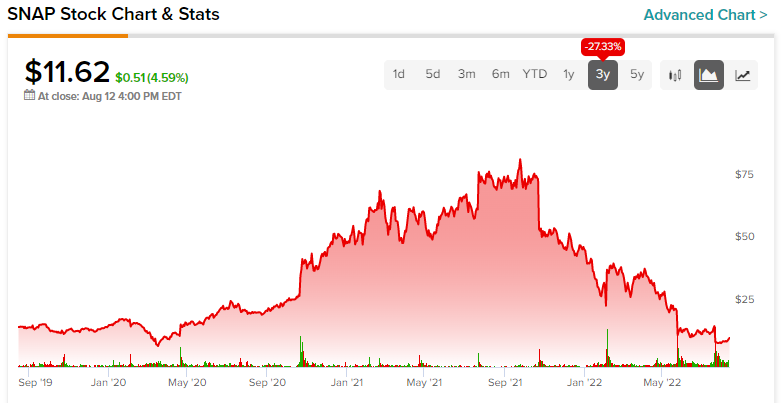

Social media platform Snap (SNAP) continued its run of posting nightmarish earnings with its most recent Q2 results. The weak economy, cut-throat competition, and privacy changes from Apple (AAPL) have stopped it in its tracks. As a result, SNAP stock has shed a whopping 85% of its value in the past year and now trades at a more attractive multiple. Despite its troubles, it has an excellent growth runway ahead, which investors should ignore. Hence, we are bullish on SNAP stock over the long haul.

Most investors have abandoned SNAP after another disappointing quarter. Its growth rates have normalized, and those hoping for the lofty growth rates it achieved in the past are likely to be disappointed.

On the flip side, there are positives from its recent performances, which point to the depth of its business. Its stock will likely pull back some more, considering a weak outlook in the interim. However, it might be an interesting time to pick up the stock at multi-year lows.

The Good

It’s not all gloom and doom with Snap’s quarterly results. Though its results mostly came in weaker than expected, plenty of bright spots point to a strong growth runway. Some of these areas include its growing daily active user (DAU) base, sound financial positioning, and opportunities in the Rest of World (ROW) region.

During the second quarter, Snap’s DAUs grew by 18% from the prior-year period to 347 million. Moreover, the number came in 1% higher than the market consensus of 343 million. Also, the company expects DAUs to come in at 360 million for the upcoming quarter, representing a healthy 18% bump on a year-over-year basis.

Snap’s management stated that the “overall time spent watching content globally grew” during the second quarter. Particularly, its latest TikTok-like feature, Spotlight, saw time spent on the platform increasing by 59% on a year-over-year basis in Q2.

The key growth driver was Snap’s ROW region, which saw a healthy 35% year-over-year increase in DAUs to 162 million. It shows that SNAP is succeeding in overseas markets. Moreover, it has the opportunity to expand its user base in non-U.S. markets.

Furthermore, Snap currently has a tremendous $2.3 billion in cash and another $2.57 billion in investments, comfortably covering its long-term debt of $3.74 billion. Hence, its liquidity requirements are effectively covered by its cash base. Fundamentally, Snap is a relatively sound company with positive free cash flow.

The Bad – Why Has Snap Stock Crashed?

Now, onto the bad, and there’s much to cover here. Snap’s revenues grew modestly compared to past quarters and came in well below estimates. Moreover, Apple’s privacy changes have weighed on Snap’s operating results.

Secon-quarter sales rose 12% to $1.11 billion, falling short of estimates of $1.14 billion. On top of that, it reported an adjusted EBITDA of just $7 million compared to $117 million in the prior-year period. Moreover, its net loss widened to $422 million, compared to a net loss of $151.6 million.

CEO Evan Spiegel states that the results hardly reflect the company’s ambitions. It’s looking to foster new revenue sources to diversify its top line. It will take time for the management’s plans to come to fruition, though.

In tackling Apple’s recent changes, Snap has implemented three main strategies to improve the advertiser experience. These measures involve improving privacy-preserving first-party (1P) measurement tools and ensuring Snap’s performance is represented well in third-party (3P) measurement solutions.

Again, it will take time to see the results of these measures, but Snap must take action, as it generates the bulk of its sales from advertising. However, bloggers like my TipRanks colleague Joey Frenette feel that ad fears have been overblown.

Furthermore, it doesn’t help that Snap is more leveraged than ever before. Its $3.7 billion in debt is well over its five-year average debt level of $1.2 billion. Consequently, its debt to equity ratio has risen over to 122%, significantly higher than its historical averages.

Is Snap Stock a Buy or Hold? Analysts Weigh In

Turning to Wall Street, SNAP stock maintains a Hold consensus rating. Out of 36 total analyst ratings, 10 Buys, 22 Holds, and four Sell ratings were assigned over the past three months.

The average SNAP price target is $14.93, implying 28.5% upside potential. Analyst price targets range from a low of $8 per share to a high of $35 per share.

Conclusion: Look Past Snap’s Near-Term Headwinds

Snap and its shares have taken a beating over the past several months. Its operating performance has been underwhelming, while its stock price has dropped at an alarming pace. However, if we look past its near-term headwinds and consider its strong future outlook and attractive price point, SNAP stock seems like an interesting Buy at this stage.

Overall, the business is financially sound, although it is not yet profitable on the earnings side. Its debt situation is well under control and shouldn’t pose much of a problem, at least in the near term. Growth prospects aren’t comparable to the past four years but remain relatively stable amid a challenging business outlook.

Perhaps the most attractive aspect of SNAP is its attractive share price. Its stock has been torn to shreds and trades at 4.2x forward 2022 sales. Its five-year average is at over 18x forward sales, representing a steep drop in value for SNAP stock.