These are trying times for the markets. Macroeconomic challenges, geo-political tensions, rising inflation, a global pandemic, rising fuel prices, and expected rate increases can make even a seasoned investor second guess her stock pick.

Moreover, apart from picking a winning stock, the art of constructing the right overall stock portfolio is also a challenging but very crucial process in the quest for investment gains.

While the task may seem daunting, the Tipranks Smart Portfolio tool comes to the rescue. The tool considers a number of data points to help investors make the right allocation by also considering age, income level, and risk appetite.

Furthermore, investors can see how their portfolio has performed during different periods, compare it with the broader indices, track the latest developments in the invested companies, see what analysts forecast for these stocks, and compare stocks on key metrics such as beta.

Additionally, investors can also compare their portfolios to the best performing portfolios on TipRanks (these are the top 10% of portfolios that consistently outperform the markets!). Investors can also track the major holdings according to different sectors in the best-performing portfolios.

Let us have a deeper look at the top two stocks in the Industrial Goods space that are part of the best-performing portfolios.

Energy Transfer (NASDAQ: ET)

Energy Partners has one of the largest and most diversified energy asset portfolios in North America. It is engaged in complementary natural gas midstream, intrastate, and interstate transportation and storage assets, including crude oil, natural gas liquids (NGL), and NGL fractionation. It also owns the Lake Charles LNG company.

In its recent fourth-quarter showing, revenue jumped 94% over the prior year to $4.95 billion. Net income attributable to partners was $921 million, an increase of $412 million as compared to the year-ago period. A combination of increased NGL transportation and export volumes, higher realized prices, and the Enable acquisition drove these results.

Notably, Energy Transfer’s portfolio has both product and geographic diversity. In 2021, no single segment contributed over 30% of its consolidated adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). Further, a majority of its segment margins are fee-based, which means they are less impacted by commodity price gyrations.

The stock has risen 26.7% so far this year, and a dividend yield of 5.5% provides further returns for investors. The stock has positive ticks on other criteria as well. TipRanks data shows hedge funds have increased holdings by 2.6 million shares in the last quarter, and insiders have bought company shares in the last three months as well.

Morgan Stanley analyst Robert Kad has reiterated a Buy rating on the stock alongside a price target of $12. The analyst noted that despite having a diversified and vertically integrated asset portfolio, Energy Transfer has been trading at a discount when compared to its peers in the past.

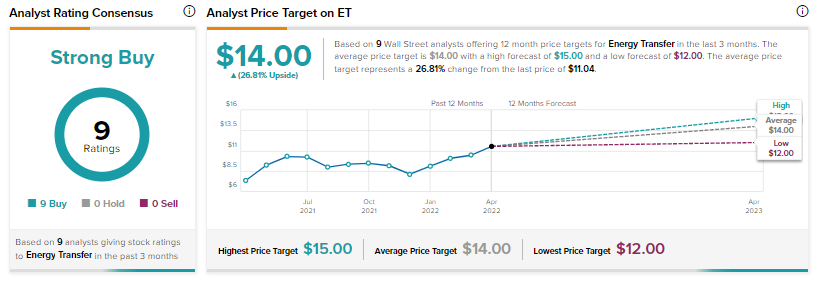

Overall, the Street is Bullish on the stock based on nine unanimous Buys, with a Strong Buy consensus rating and a price target of $14, implying a potential upside of 26.8%. That’s on top of the recent gain in its share price.

Enterprise Products Partners (NASDAQ: EPD)

Enterprise Products Partners have gained 15.8% so far this year. It is a North American midstream energy services provider with assets including about 50,000 miles of pipelines, a storage capacity of 260 million barrels, and 14 billion cubic feet of natural gas storage capacity.

Revenues in the recent fourth-quarter jumped 61.4% year-over-year to $11.37 billion. Concurrently, net income attributable to common unitholders for 2021, increased to $4.6 billion from $3.8 billion in 2020. For 2022, Enterprise expects growth in crude oil, natural gas, and NGL production in the U.S. driven chiefly by the Permian Basin and Haynesville shale.

Further, Enterprise anticipates that the present energy supply disruptions and geopolitical developments in Europe could result in higher long-term global demand for U.S. crude oil, natural gas, and NGLs as a source of reliable supply.

As with Energy Transfer, Enterprise ticks on other major criteria as well. The stock has a dividend yield of 6.96%. Both blogger and news sentiment (tracked by the good folks at TipRanks) are Bullish. Additionally, while hedge funds have increased holdings in Enterprise by 890,900 shares in the last quarter, insiders have bought Enterprise stock worth about $593,600 in the past three months. These are major positives for boosting investor sentiment.

Wells Fargo analyst Michael Blum has reiterated a Buy rating on the stock while increasing the price target to $28 from $27.

Overall, the Street is cautiously optimistic about the stock with a consensus rating of Moderate Buy based on seven Buys and four holds. The average Enterprise Products price target of $29 implies a potential upside of 10.6% for the stock.

Closing Note

These two names are expected to benefit from rising energy prices, and as the world looks for a reliable supplier of energy needs, these U.S. stocks may benefit.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Costco: Strong March Sales Make Analyst Bullish

Uber to Expand Scope in the UK After License Win

Murphy Oil Corporation Bumps up Quarterly Dividend by 17%