On April 22, Skyworks Solutions, Inc. (SWKS) announced that it has entered into a definitive agreement with Silicon Laboratories, Inc. (SLAB), under which Skyworks will acquire the infrastructure and automotive business of Silicon Labs for $2.75 billion.

Skyworks is already one of the leading chip suppliers to smartphone manufacturers including Apple, Inc. (AAPL). The acquisition of this business line will not only help Skyworks gain market share in the fast-growing mobile networks industry, but will also help the company venture into the EV (electric vehicle) space.

The transaction will be funded with both cash and debt financing arranged by J.P. Morgan. The deal is expected to be finalized in the third quarter of this year and will be immediately accretive to company earnings.

Opening New Doors For Skyworks

Skyworks has a strong business relationship with Apple, which has been a key ingredient in the chipmaker’s recent success. Apple accounted for 56% of revenue generated by Skyworks in Fiscal 2020, a fact that also highlights the customer concentration risk faced by the company.

If Apple were to switch to another vendor of radio frequency content for its latest iPhone models, Skyworks would find it difficult to break even, let alone be profitable. Acquiring a business unit from Silicon Labs will help Skyworks diversify its revenue sources.

In addition, the automotive semiconductor market is one of the fastest-growing segments of the semiconductor industry, due to the increasing demand for advanced chips from both legacy and new-age automakers. This demand is driven by the high number of chips used to power EVs.

According to data from EV-volumes, just over 3.2 million EVs were sold globally in 2020. Deloitte projects annual registration of EVs to increase to 31.1 million by 2030, accounting for approximately a third of total vehicle sales in the world.

To achieve this ambitious goal, automakers are constantly trying to enhance the technology used in EVs to improve battery range. Skyworks, with the acquisition of the automotive portfolio from Silicon Labs, will be well-positioned to support automakers by designing the high-end chips needed for those technologies.

Its expected penetration of the automotive semiconductor industry will help Skyworks diversify its revenue sources meaningfully. That shift will likely expand the valuation multiples at which the stock is trading in the market.

Earnings Recap

The chip manufacturer reported earnings per share of $2.37 for the March quarter (fiscal second quarter), narrowly beating the Wall Street consensus estimate of $2.35. The reported revenue of $1.17 billion for the quarter reflected a year-over-year increase of 52.7%.

Those numbers confirm that Skyworks is continuing to benefit from favorable macroeconomic conditions, specifically the strong demand for 5G-enabled smartphones. (See Skyworks stock analysis on TipRanks)

Following the release of March quarter earnings, Skyworks’ stock fell more than 7%. It is likely that investors were expecting a larger earnings surprise due to the strong performance of iPhone 12 models since their release late last year.

Wall Street Weighs In

Immediately following the release of fiscal second-quarter earnings, Raymond James analyst Chris Caso raised the price target for Skyworks from $205 to $220, citing expected iPhone unit growth.

Meanwhile, Mizuho Securities analyst Vijay Rakesh followed the same path by raising the price target for Skyworks from $207 to $210, explaining that the rollout of 5G will lead to strong sales for mobile chips manufactured by the company.

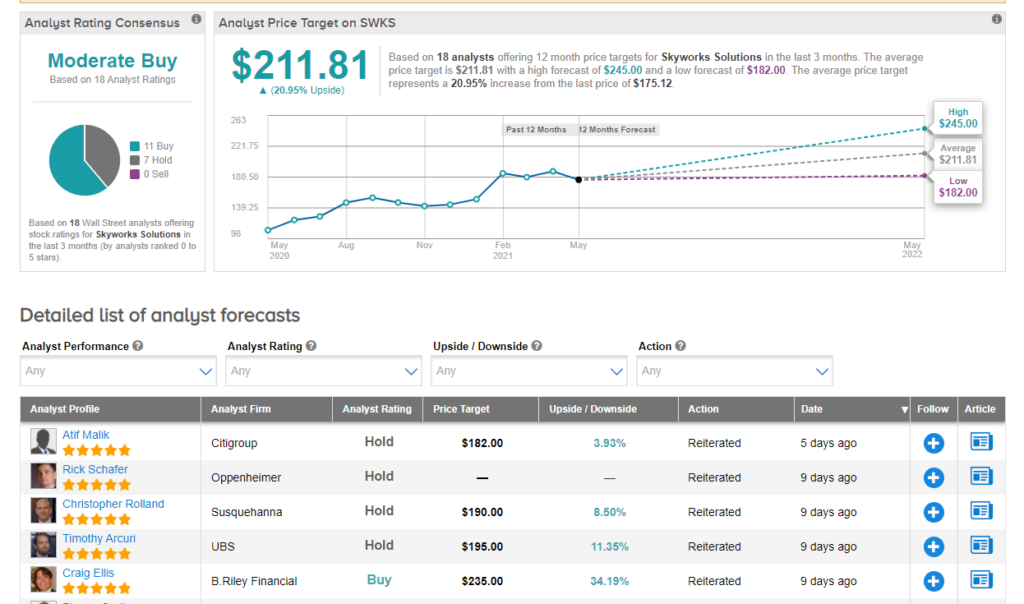

Turning to the rest of the Street, analysts have an average analyst price target of $211.81 for Skyworks shares, which implies an upside potential of 21% from the market price of around $175 on May 7. Additionally, its Moderate Buy consensus rating breaks down into 11 Buys and 7 Holds.

Takeaway

Skyworks Solutions has reached a definitive agreement with Silicon Labs to acquire Silicon’s infrastructure and automotive portfolio. This transaction is expected to help Skyworks gain market share in the automotive semiconductor industry.

The company does not have any long-term debt on its balance sheet. Together, the strong liquidity position of the company and the prospects for the semiconductor industry paint a highly promising picture. Overall, the company seems to be deeply undervalued in the market, presenting an opportunity to investors.

Disclosure: Dilantha De Silva owned shares of Skyworks Solutions and Apple at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.