Shares of Skyworks Solutions (SWKS) HAVE dropped more than 14% in the past three months, underperforming the overall market.

The stock has several catalysts which could make its share price rebound strongly.

Furthermore, as the downturn pushed the share price below the 50-day moving average value of $165.92 and the 200-day moving average value of $177.03, this investment opportunity looks interesting. Thus, I am bullish on this stock. (See Analysts’ Top Stocks on TipRanks)

Skyworks Solutions was incorporated as a semiconductor company with the head office in Irvine, California.

The company provides analog semiconductors to several businesses operating in the aerospace, automotive, communication services and consumer electronics industries.

Skyworks also has customers in the entertainment and gaming industry, amid industrial operators and healthcare companies.

The semiconductors company operates globally.

Earnings

Total revenues came in at $1.31 billion for the fourth quarter of fiscal 2021 and were $5.11 billion for the entire fiscal year.

The quarterly turnover increased 37% year-over-year, topping projections by $10 million. Annual turnover increased by 52% year-over-year.

Skyworks’ adjusted EPS was $2.62 for the fourth quarter of fiscal 2021 versus $1.85 in the prior-year quarter, topping the average consensus by $0.09. The adjusted EPS for the whole fiscal was $10.50 versus $6.13 in 2020.

A Great Outlook Ahead

The ongoing strong expansion in the smartphone market size will continue to drive the profitability of Skyworks Solutions and other operators up in the next year and for several years ahead.

Undoubtedly, the COVID-19 pandemic worked as a tailwind for the demand for smartphones whose usage increased exponentially on digital platforms.

Furthermore, the going green project for a cleaner world adds to opportunities for growth as polluting activities will be converted into zero-emission ones through electrification.

The introduction of 5G technology in communication services requires Skyworks Solutions and other semiconductors to double their efforts to empower infrastructures.

Looking Ahead To Q1 Fiscal 2022

For the first quarter of fiscal 2022, the company expects total revenues to be approximately $1.5 billion. The average projection of analysts is for a straight $1.5 billion. The company also anticipates an adjusted diluted EPS of $3.10 versus the average consensus of $3.12.

Wall Street’s Take

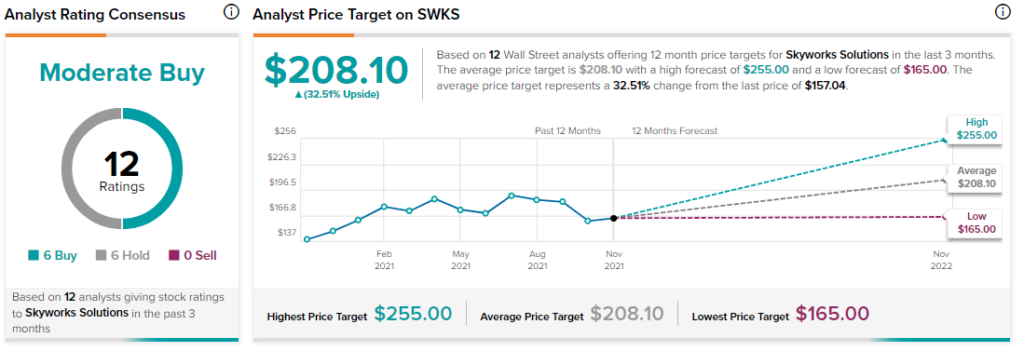

In the past three months, 12 Wall Street analysts have issued a 12-month price target for SWKS.

The average Skyworks Solutions price target is $208.10, implying 32.5% upside potential. The company has a Moderate Buy consensus rating, based on six Buys and six Holds assigned.

Summary

The stock has underperformed in the past three months. However, it is well positioned across global markets to bounce back remarkably well, especially with the support of the fast-growing smartphone market.

Disclosure: At the time of publication, Alberto Abaterusso did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >