Skillz stock has been among the biggest under-performers in the last six months. During this period, the stock of this mobile game platform has declined by 73%. The sustained decline has resulted from a few negative business developments. However, a potential reversal in key growth metrics seems likely. SKLZ stock therefore looks interesting for a rally.

The trend in monthly active users is the biggest reasons for the stock trending lower. For Q1 2021, the company reported 2.7 million monthly active users. On a year-on-year basis, MAUs were stagnant. Furthermore, for Q2 2021, the monthly active users declined to 2.4 million.

It’s worth noting that for Q1 2021, Skillz reported selling and marketing expenses of $96.3 million. Aggressive spend on marketing, however, did not translate into user growth. Clearly, there is a strong reason for the markets to be unhappy with Skillz. (See Skillz stock chart)

However, Skillz seems to be taking measures to ensure that key growth metrics improve in the coming quarters. There are reasons to be cautiously optimistic about this stock.

Possible Growth Acceleration In Active Users

One positive that’s worth mentioning is the trend in average revenue per user. For the first half of 2021, the company reported ARPU of $11.44. On a year-on-year basis, ARPU was higher by 72%. Even on a sequential basis, the ARPU has improved. If sustained upside in ARPU is coupled with growth in active users, SKLZ stock is likely to witness a trend reversal.

One factor that’s likely to accelerate the growth in monthly active users is the inroads it is paving in international markets. As of Q1 2021, the company reported 90% revenue from North America. Skillz has plans to launch in India towards the end of the year. With a population of 1.2 billion, that is a big addressable market. This is one potential trigger for upside in active users. It’s worth noting that the company plans to expand in other international markets in 2022 and beyond.

Another important point to note is that the company ended Q2 2021 with cash and equivalents of $693 million. Further, the company has a zero-debt balance sheet. With high financial flexibility, Skillz is positioned for organic and acquisition driven growth.

In June 2021, Skillz announced the acquisition of Aarki, which is a technology-driven marketing platform. In the near-term, the biggest advantage of the acquisition is likely to be Aarki’s reach of more than 465 million monthly users. Skillz can leverage on this acquisition to boost its own user growth.

In another recent development, Skillz has formed a strategic partnership with Exit Games. The company will be investing $50 million in this partnership. Exit Games is the developer of the most advanced synchronous multi-player gaming technology. The partnership is likely to accelerate the company’s presence in the genres of racing and fighting. As the company’s offerings expand, it’s likely that user growth will accelerate.

Wall Street’s Take

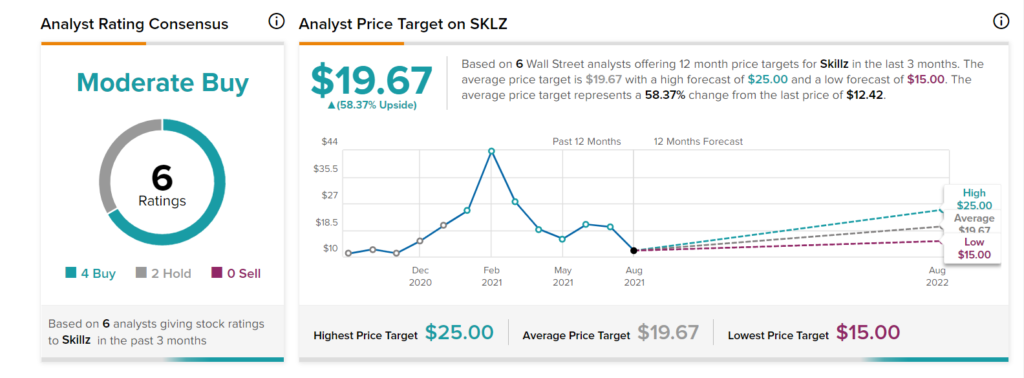

According to TipRanks’ analyst consensus rating, SKLZ stock comes in as a Moderate Buy, with 4 Buy and 2 Hold ratings assigned in the last three months.

As for price targets, the average Skillz price target is $19.67 per share, implying around 58.37% upside potential from current levels.

Concluding Views

Skillz reported adjusted EBITDA loss of $31.6 million for Q2 2021. For the comparable period in the prior year, adjusted EBITDA loss was $3.3 million. However, cash burn would not be a concern if it’s associated with growth in users. Over the next few quarters, this is one metric that needs to be closely monitored.

Overall, there are reasons that the markets are punishing SKLZ stock. However, the worst seems to be over and the next few quarters might provide an early indication of reversal in trend. It might therefore be a good time to consider some exposure to the stock.