Shopify (SHOP) provides businesses with an e-commerce platform to build online stores. Its stock’s meteoric rise has been nothing short of remarkable.

Shopify stock recently hit a new all-time high (although it has pulled back) despite posting a rare quarterly earnings miss just a few weeks ago. The quarter (Q3 2021), which was dragged down by the ongoing economic reopening and pandemic wind-down, was nothing to write home about. Still, it was not nearly as bad as what many investors seemed to be bracing themselves for.

Despite the hefty premium multiple on the stock, which left little in the way of error, the company has continued to demonstrate that its epic rise is more than sustainable. In fact, continued momentum suggests that investors weren’t bullish enough when the stock was trading at nosebleed-level valuations that would have frightened all but the most growth-savvy of investors.

Indeed, high-growth investing is a complicated game, and sometimes, it can pay to buy and hold, even in the face of intense volatility.

With many growth levers and a brilliant management team that knows how to innovate in its corner of the SMB (small and medium-sized business) market, shares of Shopify may still not be expensive enough at 47 times sales.

Shopify’s valuation is undeniably steep by almost every valuation metric (like price to sales). Still, it’s hard to be anything but bullish on the stock if you’ve got a long-term horizon.

Although analysts are pretty split on their views on Shopify, I remain bullish, as many growth prospects may still yet be on investors’ radars. Further, the sustainability of Shopify’s growth in more challenging environments may still be underestimated. (See Analysts’ Top Stocks on TipRanks)

Shopify Stock’s Strange Post-Quarter Moves: Rally on an Earnings Miss; Plunge on a Beat?

For the third quarter, Shopify missed the mark on per-share earnings. Given that Shopify has done nothing but beat or blowout in any given quarter, the post-miss rally was not only unexpected but quite jarring. Despite reopening headwinds, Shopify maintained incredibly respectable levels of top-line growth in the mid-40% range.

Few would have expected such a positive post-earnings reaction after a rare fumble when SHOP shares have historically sagged following all but the most surprising of blowout beats.

Undoubtedly, the company is continuing to invest heavily in cutting-edge innovations. Over the next several years, such investments will continue paying off in a big way, as the company looks to continue swimming forward, whether or not the tides move in its favor.

Shopify Holds Its Own as Pandemic Tailwinds Fade

Over the past several quarters, many top-performing pandemic stocks have suffered massive falls from grace as the post-lockdown environment began to set in, turning 2020 tailwinds into 2021 headwinds.

Peloton (PTON) is just one example of a firm whose shares shed over half of its value from peak to trough, as it became more apparent that 2020 levels of growth would be difficult, if not impossible, to stack up against.

Shopify, a significant pandemic beneficiary, has demonstrated it’s no Peloton.

As Warren Buffett once put it, “Only when the tides go out do you discover who’s been swimming naked.” In the case of Shopify, it was one of the few companies that had its swimwear on when tides went out and pandemic tailwinds faded. Many investors are rewarding the stock because of this.

Pending a growth-focused market pullback, shares of SHOP aren’t likely to surrender the vast gains posted over the past one and a half years. In fact, Shopify is likely to continue benefiting from its pandemic boost for years to come, as it has an opportunity to upsell new customers with a growing line-up of value-adding innovations.

Moreover, the SMB market has still yet to be penetrated fully, and with an improving Shopify Plus product, the firm could also go after much larger fish in the vast ocean that is the e-commerce space.

Wall Street’s Take

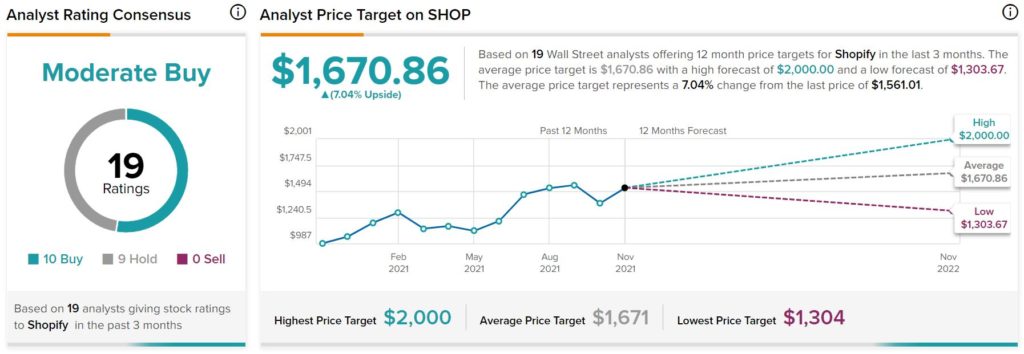

Turning to Wall Street, Shopify has a Moderate Buy consensus rating, based on 10 Buys and nine Holds assigned in the past three months. The average Shopify price target of $1,670.86 implies 7% upside potential.

Analyst price targets range from a low of $1,304 per share to a high of $2,000 per share.

The Bottom Line on Shopify Stock

Shopify has already proven the resilience of its growth. With COVID-19 cases picking up in various parts of Europe, it’s plausible that Shopify could get at least some of its pandemic tailwind back, all while year-over-year comparisons become easier. Unlike most other pandemic beneficiaries, though, the company doesn’t depend on the pandemic to sustain its high double-digit growth numbers.

Disclosure: Joey Frenette doesn’t own shares of any mentioned companies at the time of publication.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.