Back in the depths of 2020, Shopify (SHOP) kept many businesses from going under altogether. When COVID-19 shut down businesses all over, going online was the only reasonable alternative.

Shopify led the way and helped those businesses make the necessary moves. Now, Shopify is expanding its operations, and producing new potential opportunities.

Shopify’s recognition of its own potential troubles ahead, and moves to beat them, makes me bullish overall. (See Insiders’ Hot Stocks on TipRanks)

Shopify stock spent most of this year looking for an upside. It spent most of January plateaued around the $1,200 mark. With the end of January came an explosive rise upward to breach $1,400 a share.

A slip back down to the $1,200 mark followed. That lasted until June, when the company started a new leg upward. Shopify stock went from around $1,200 to over $1,500 in the space of about two weeks.

Ever since, Shopify has established a new trend line around the $1,450 mark.

Shopify’s latest move proves its plans to cement its future after being the go-to option for businesses to stay open during COVID lockdowns.

It recently announced that it was partnering with the likes of Microsoft (MSFT) and Oracle (ORCL) to add a slate of new cloud-based tools to Shopify’s operations. The end result: a complete, global enterprise resource planning (ERP) system for its end users.

Users will be able to get in on Oracle’s NetSuite and Infor, as well as Microsoft Dynamics 365 Business Central. Previously, those interested in using ERP systems with Shopify had to do so in a much more roundabout fashion.

They needed to turn to third parties to connect tools like inventory management systems, and financial trackers. This will allow Shopify to better compete against the likes of Amazon (AMZN), and its Amazon Web Services platform.

Growing Alliance of E-Commerce Operations

AdRoll recently announced its own partnership with Shopify. That move will allow Shopify merchants access to the full range of AdRoll tools.

Those tools range from advertising and email, to reach-measurement tools. This allows Shopify merchants to better understand the nature of their markets, and modify their available goods and services accordingly.

Last month, Roku (ROKU) rolled out its own Shopify connections. Roku will allow Shopify customers to create and launch their own streaming ad campaigns. With that move, Roku became the first-ever streaming app in the Shopify App Store.

It’s likely no coincidence that all this is being done ahead of the holiday shopping season. Shopify has made itself that much more attractive to businesses, and it was already doing well on that front.

The only real problem that Shopify was facing was that it was running out of low-hanging fruit. Businesses moved rapidly online in the early-2020 frame thanks to COVID. Eventually, that supply would run out and leave Shopify needing an alternative.

Thanks to the growing array of cloud partnerships, Shopify is making itself more valuable to those already with the platform. It’s also making itself more attractive to newcomers.

Wall Street’s Take

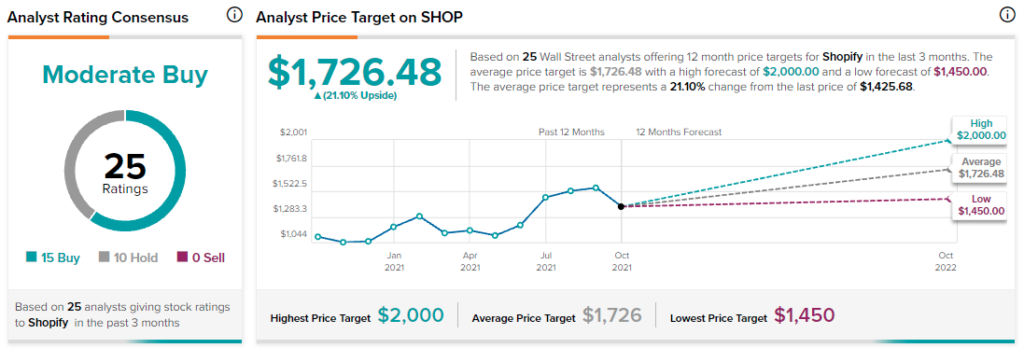

Wall Street consensus analysis calls Shopify a Moderate Buy. Based on the projections of 25 analysts that have 12-month price targets on the company issued in the last three months, 15 consider it a Buy. The remaining 10 call it a Hold. Shopify’s status as a Moderate Buy goes back all the way to this time last year.

The average Shopify price target currently stands at $1,726.48, with a high of $2,000, and a low of $1,450.

Concluding Views

Shopify reaped massive benefits from the COVID rush. That couldn’t last forever, and Shopify likely knew it needed a way to continue appealing to businesses.

The fact that Shopify understands this, and is working accordingly, should make it attractive to investors.

Even Shopify’s massive per-share pricing isn’t too much of a distraction. There’s still room to grow, after all.

Disclosure: At the time of publication, Steve Anderson did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.