In an environment wherein logistical and shipping services are being pushed to their limits and prices are soaring, could an investment still be the right choice?

Shipping services appear to be in exceptionally high demand in today’s world. With economic activity steadily picking up, global trade has accelerated, and the shipping industry is responsible for conveying a massive amount of the items involved in global trade.

Furthermore, growing demand for dry bulk commodities and a relatively moderate fleet development has resulted in a large supply-demand mismatch. In 2022, this mismatch is likely to enhance the freight rate market even more.

Above all, capacity issues and port congestion will continue to combine with robust global demand in the consumer products sector, making freight rates unlikely to return to pre-COVID levels. Even as the pandemic fades, the situation in Ukraine threatens to disrupt global transportation routes, opening up additional opportunities for investors.

What’s more interesting for the long-term investors is the fact that these dynamics do not look to be changing anytime soon. The strain on global supply systems is expected to last until at least the end of this year.

With the shipping business looking up in 2022, adding shipping stocks to one’s portfolio seems like possible choice to make. We’ve put together a list of three dividend-paying shipping firms that have posted great earnings results and have strong upside potential in 2022.

Eagle Bulk Shipping (EGLE)

Eagle Bulk Shipping is the largest owner of Handymax dry bulk vessels in the United States. Through the ownership, charter, and operation of dry bulk boats, the company transports a wide range of cargoes around the world.

The company is well-positioned to benefit from ongoing strong dry bulk market fundamentals, given its track record in fleet renewal.

Eagle recently announced a fourth-quarter financial performance that set a new high. In the most recent quarter, revenue increased by 146% to $184.7 million. The diluted EPS was $4.28 per share, compared to a diluted loss of $0.29 per share in the same quarter last year.

Further, Eagle Bulk has paid out $53 million in cash dividends since October, including a $2.05 per share fourth-quarter payout. The current dividend yield is 6.5%, which is significantly more than the 1.342% sector average.

Buoyed by this upbeat scenario, the company’s stock rose above 90% over the past year.

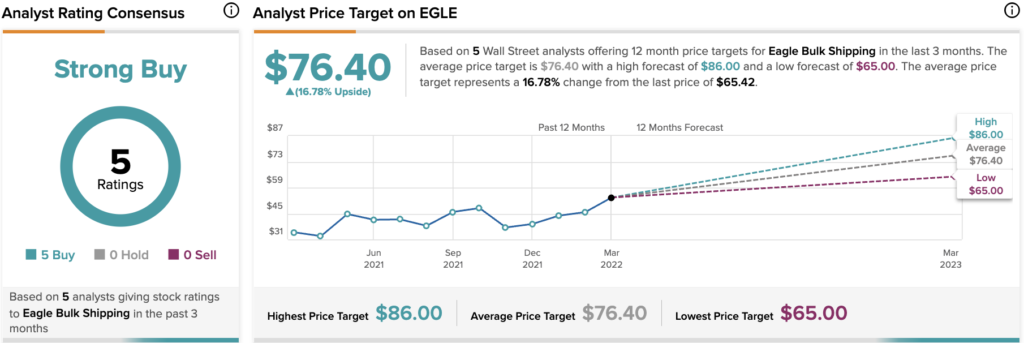

Eagle Bulk has a Strong Buy consensus rating on TipRanks, based on five unanimous Buys. As for price targets, the average EGLE stock price prediction of $76.40 implies a 16.78% upside potential from the current levels.

Star Bulk Carriers (SBLK)

The next company on the list is Star Bulk Carriers, which is a key player in the dry bulk industry. The company specializes in transporting dry bulk goods like iron ore, minerals, and grains.

The company posted strong Q4 earnings earlier this month, with voyage revenues of $499.9 million, up 169% year-over-year. Meanwhile, adjusted earnings per share came in at $2.96 per share, up from $0.30 per share in the previous quarter.

SBLK also paid a $2.00 per share quarterly cash dividend in the fourth quarter, giving it a current dividend yield of 14.51%, which is quite high.

Star Bulk has received a Strong Buy consensus recommendation from Wall Street analysts, based on four unanimous Buys. The stock is currently trading at $29.61, with an average SBLK price target of $36.29, representing a gain of 22.56% from the current levels.

ZIM Integrated Shipping Services (ZIM)

ZIM is an international freight shipping company based in Israel that has grown in valuation by about 337% in the last year.

This month, ZIM posted a fourth-quarter financial performance that was nothing short of spectacular. In the most recent quarter, revenue increased by 155% to $3.47 billion. The company’s net income soared 366% to $1.71 billion or $14.17 a share.

Furthermore, ZIM pays a significant dividend. The business announced an annual dividend of $17.00 per share, resulting in a current yield of 24.4%, in conjunction with the earnings announcement. The company has paid out $2.6 billion in dividends since its IPO in January 2021, including a special dividend in September 2021.

On the operational front, ZIM is working to enhance equipment investments and extend its operating fleet capacity in order to take advantage of increased ship demand.

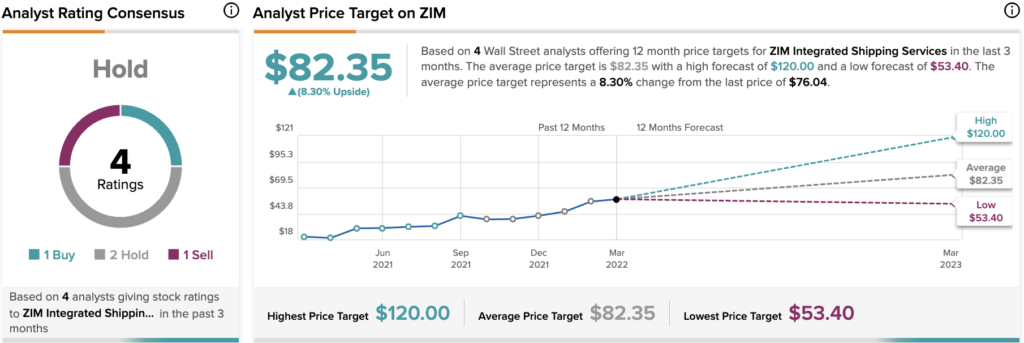

ZIM stock has a Hold consensus rating on TipRanks, based on one Buy and two Hold ratings. In terms of price forecasts, the average ZIM stock price prediction of $82.35 implies almost 8.3% upside potential from current levels.

Wrapping it Together

In a time of global uncertainty, these three shipping names offer not just strong dividends but also benefit from global supply-chain difficulties which impact other firms more negatively, all while offering considerable potential upside.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure