This earnings season, things weren’t so good for ServiceNow (NOW), which is a top enterprise software company. The stock plunged by 9% to $505 in response to its first quarter report.

However, the company did beat the Street’s estimates. Adjusted earnings jumped by 45% to $1.52 per share and revenues grew by 30% to $1.36 billion. As for the Street consensus, the estimate for the bottom line was $1.34 per share, and $1.34 billion for the top line.

Unfortunately, the guidance was a bit of a disappointment. Management guided for second quarter revenue growth of 27%-28%, to $1.29 billion-$1.295 billion, but analysts were looking for $1.305 billion.

Another red flag was that ServiceNow had a tougher time landing $1 million-plus deals for the quarter, which came in at 53. In the prior quarter, the number was a much more robust 89.

It should be noted that when it comes to large deals, the numbers can get choppy as it’s easy for them to slip into another quarter. That said, it’s a warning sign when there is a significant drop-off.

The Product Roadmap

Even though ServiceNow is a large company, it has still been able to maintain a strong pace of innovation. The latest version of its platform – called Québec – is certainly evidence of this.

There are more than 1,700 new functions, and yes, many of them are focused on cutting-edge AI (artificial intelligence) technologies. The company has the advantage of a massive installed base that generates huge amounts of data. This means that ServiceNow can create rich AI models.

Another important focus for the company has been on low-code approaches. As a result, a non-technical employee can effectively create bots and workflows on the ServiceNow platform. This greatly expands that effectiveness and scale of the technology – leading to higher ROI (return on investment).

And finally, ServiceNow has been investing heavily in RPA (robotic process automation). This essentially allows for automating tedious and repetitive processes.

The leader in the category is UiPath (PATH), which recently pulled off a highly successful IPO. However, ServiceNow is catching up. For example, the company recently announced the acquisition of Intellibot, which will greatly expand the RPA capabilities.

Bottom Line On ServiceNow

The COVID-19 pandemic has been a major catalyst for ServiceNow. Companies have had little choice but to find ways to automate systems in order to handle remote workforces.

Now, it’s true that the growth may start to decelerate as the pandemic fades, which is perhaps why investors might be jittery about ServiceNow stock.

But despite all of this, its long-term prospects do remain promising. The digital transformation trend is secular and SeviceNow has a strong platform to help customers with the journey.

CEO Bill McDermott stated on the earnings call, “ServiceNow is the strategic authority for digital transformation across the enterprise. We have expanded the boundaries from IT to employee, customer and now creator workflows for citizen developers.”

Based on research from IDC, the market opportunity is poised to reach a whopping $7.8 trillion by 2024. In other words, there is lots of runway left for growth.

Wall Street’s Take

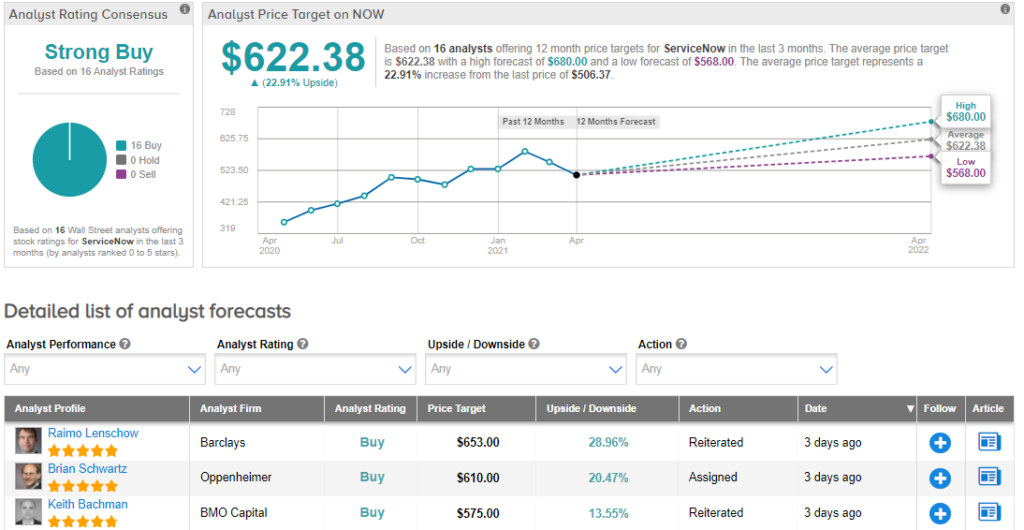

Even with the recent drop in the share price, Wall Street is generally upbeat on the prospects.

In the last three months, only Buy ratings, 16 to be precise, have been assigned. So, NOW has a Strong Buy consensus rating. Given the $622.38 average analyst price target, shares could gain 23% in the year ahead. (See ServiceNow stock analysis on TipRanks)

Disclosure: On the date of publication, Tom Taulli did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.