Investors seeking reliable and high dividend yield could consider Innovative Industrial Properties (NYSE:IIPR). It operates as a REIT (Real Estate Investment Trust) focusing on acquiring, managing, and leasing industrial properties used as regulated cannabis facilities. IIPR stock offers a high dividend yield of over 7.5%. Moreover, its stock has a maximum Smart Score on TipRanks, making it an attractive dividend play.

IIPR’s Dividend Payment & Growth

Innovative Industrial Properties works with state-licensed cannabis operators and benefits from long-term leases (weighted average lease expiry term of about 16 years) and an increase in the number of properties. Further, its leases generate solid rental yields with a provision for annual escalation. Along with its long-term leases, a high rent collection rate (about 100%) supports IIPR’s financials.

Its fundamentals remain strong, with IIPR consistently delivering solid growth. It’s worth mentioning that IIPR’s net operating income has had a CAGR of 137% since 2017. Meanwhile, funds from operations have grown at a CAGR of 315% during the same period. Further, its EPS grew at a CAGR of 74% in the last five years.

Thanks to its growing earnings base, IIPR’s dividends have a five-year CAGR of 63%. Given its solid dividend payment and growth history and a stellar yield of over 7.5% (See: Dividend Yield Calculator), IIPR emerges as a solid income stock.

What is the Price Target for IIPR?

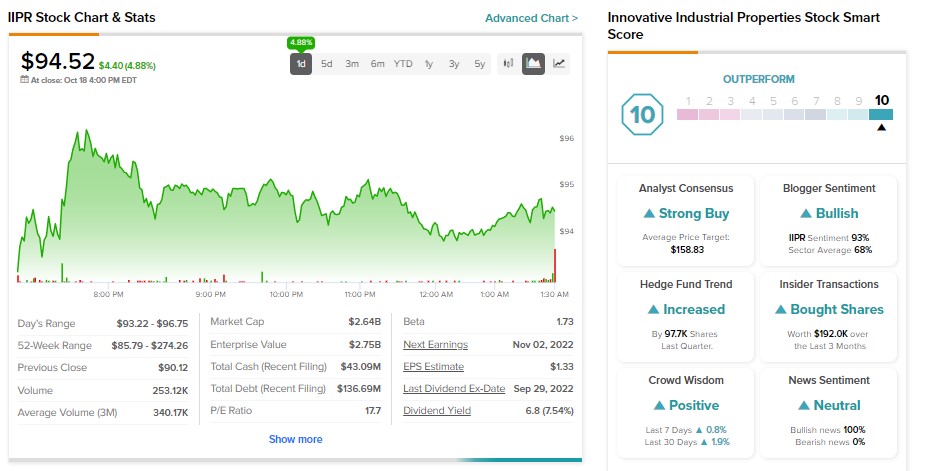

Analysts’ average price target of $158.83 indicates a solid 60% upside potential in Innovative Industrial Properties stock over the next 12 months. Meanwhile, it has a Strong Buy consensus rating on TipRanks based on six Buy and one hold recommendations.

Along with analysts, IIPR stock also has positive signals from hedge funds and insiders. TipRanks’ data shows that hedge funds bought 97.7K IIPR stock last quarter. During the same time, insiders bought IIPR stock worth $192K. Overall, IIPR stock sports a “Perfect 10” Smart Score on TipRanks, implying it is more likely to outperform the broader markets.