One thing is certain already: the market environment for 2022 will not be the same as that in 2021. This may or may not be good for investors, per se, but like every shift in market conditions, it will present opportunities for those prepared to grasp them.

Some factors are just reruns. COVID is rearing its ugly head again, threatening us with lockdowns and shutdowns. That’s running against the grain of a resurgent economy, an economy that is trying to gain more traction – but it’s facing headwinds in a shaky labor market. Even though unemployment is back down below 4%, the labor force participation rate is still too low and December saw less than half the expected jobs gains. And to top this off, inflation is still rising and the Administration wants to push more multi-trillion dollar spending packages.

It’s in this environment that Morgan Stanley’s chief cross-asset strategist, Andrew Sheets, has two important insights. First, he notes, “…that global growth has become less sensitive to each subsequent COVID wave as vaccination rates have risen, treatment options have improved and the appetite for restrictions has declined.” And second, “…it would seem for the moment that central banks in a lot of countries are increasingly comfortable pushing a more hawkish line until something pushes back. And so far, nothing has.”

Now that’s a positive spin for an uncertain time, and it has led Sheets’ colleague and Morgan Stanley stock analyst Robert Kad to pick out a number of high-yield dividend stocks as potential winners for the coming year. We’ve used the TipRanks database to select two of his picks for a closer look. These are stocks with a ‘double whammy’ when it comes to dividend payers: a high yield, in this case, 6% or better, along with better than 25% upside potential. Let’s dive into he details.

Energy Transfer (ET)

First up is Energy Transfer, a midstream company in the oil and gas sector. Midstreamers are vital components of the hydrocarbon industry, moving the crude oil, natural gas, and natural gas liquids from the wellheads to the storage facilities and then from the storage tanks to the refiners, distribution hubs, and export terminals. In this sector, Energy Transfer is a major player. The $29 billion company has an extensive network of gas and crude oil pipelines and storage and processing facilities. While this network is centered mainly on the Texas-Oklahoma-Arkansas-Louisiana region, it extends to the Great Lakes, Florida, and the Dakotas as well. ET has export terminals on the Gulf coast and in the Chesapeake Bay.

Energy Transfer is one of the largest midstream companies in the US, and in December it completed an acquisition that boosted its total pipeline miles to 114,000. The company acquired Enable Midstream, an Oklahoma-based competitor in a deal worth $7.2 billion in stock.

ET’s most recent financial release, for 3Q21, showed $16.66 billion in total revenue, up 67% from the prior year’s third quarter. Net income had been negative in 3Q20, but has turned around. In the last quarterly release, total net income was up $1.29 billion year-over-year, to reach $635 million. Per share, this came to 20 cents, up from the 29-cent EPS loss recorded in the year-ago quarter. The company is expected to release 4Q21 numbers in the last week of February.

On the dividend, ET declared its most recent payment at 15.25 cents per common share, or 61 cents annualized. This was paid out this past November and marked the fifth quarter in a row with the payment at this level. The dividend yields a strong 6.7%, far higher than current interest rates – and higher than the average dividend found on the broader market.

Covering the stock for Morgan Stanley, analyst Robert Kad sees the current valuation as an attractive entry point.

“ET has traded at a discount to the group in recent years despite a high quality, diversified and vertically integrated asset base, likely attributable to several factors: elevated leverage that has risked IG credit ratings, concern with commitment to capital discipline and durability of FCF, execution risk around perceived acquisitiveness, regulatory risk around key projects (DAPL, Mariner), and suboptimal governance protections as an MLP. As a result, ET now trades at the lowest EV/EBITDA and highest FCF yield before dividends within our coverage. Given prevailing valuation and our view that some of these factors are likely to improve in 2022, we see meaningfully positive risk/reward skew at current levels,” Kad opined.

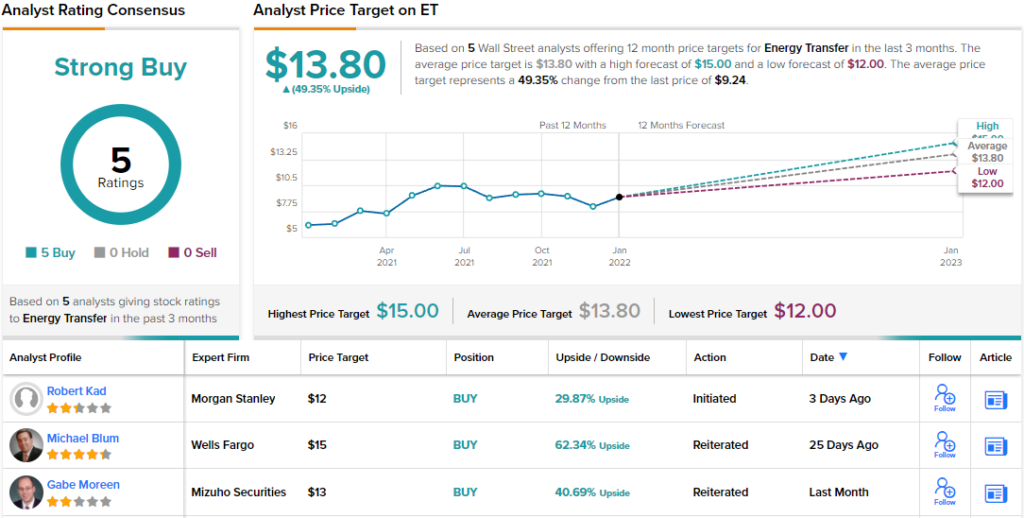

In line with his bullish take, Kad rates ET an Overweight (i.e. Buy). Should his $12 price target be met, a twelve-month gain of ~30% could be in store. (To watch Kad’s track record, click here)

Overall, ET has a unanimous Strong Buy consensus rating based on 5 positive reviews. ET has an average price target of $13.80, giving ~49% upside potential from the $9.24 trading price – even more bullish than the Morgan Stanley view. (See ET stock analysis on TipRanks)

Plains All American Pipeline (PAA)

Like Energy Transfer, the second stock we’re looking at, Plains All American, is another midstream energy company. PAA’s network includes oil gathering assets in California, and a network of pipelines and gathering/refining facilities in the Northern Rockies and Great Plains, stretching from Alberta into Montana and the Dakotas and south to Colorado, as well as a similar network centered in Texas, Oklahoma, and Louisiana. The company also has natural gas assets in the Great Lakes region and maritime hydrocarbon terminal assets in the Chesapeake Bay.

In October of last year, PAA entered into a joint venture (JV) with Oryx Midstream, a competing company in the Texas Permian Basin. The JV allows both partners to pool assets to mutual benefit. The two companies will offer improved ‘flexibility, optionality, and connectivity’ to their customers, while improving efficiencies and cash flow.

That last is important, as PAA’s earnings have turned to a net loss for the past two quarters. However, revenues have been rising over the past year. PAA has seen five quarters in a row of sequential revenue gains, and the last reported, for 3Q21, showed $10.8 billion at the top line. This was nearly double the $5.8 billion reported the year before. The company also reported $24 billion in total assets, including $213 million in cash and liquid assets. PAA reported Q3 free cash flow of $1.09 billion, or $927 million after distributions.

The distribution included the 18-cent per common share dividend payment, the seventh consecutive payment at this level. The dividend yields 7.1%, more than triple the average div payment found in the broader markets.

In his coverage of this stock for Morgan Stanley, Robert Kad writes: “PAA offers leverage to recovery in Permian Basin oil production, where we see strong growth in 2021/2022… PAA’s strategic combination with Oryx provides downside mitigation through a broader footprint with greater Permian gathering scale and customer/acreage diversification…. Valuation remains below that of large-cap peers, with a path to partial narrowing of the discount supported by way of above median FCF profile, expected de-leveraging cadence and potential upside to return of capital…”

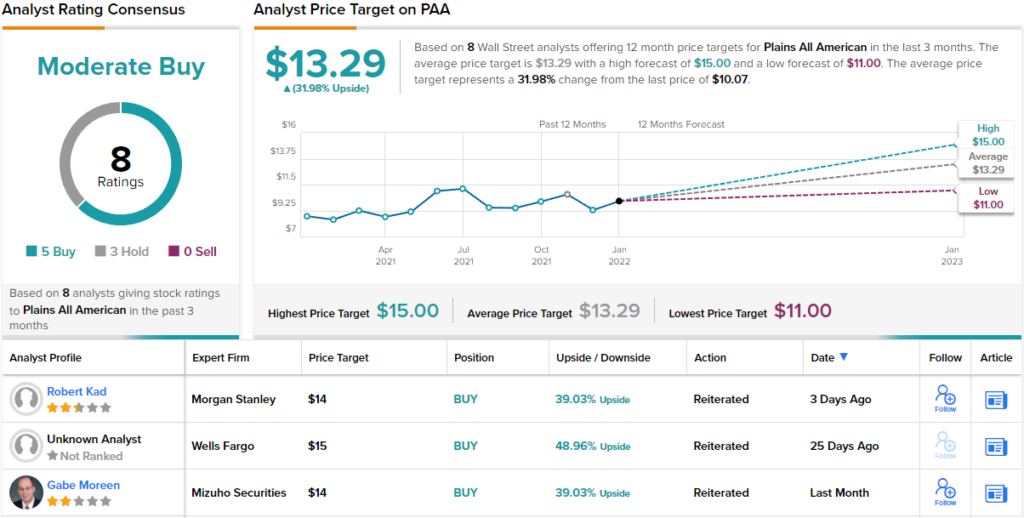

To this end, Kad gives PAA an Overweight (i.e. Buy) rating, while his $14 price target indicates room for a 39% one-year upside.

Plains All American has, like ET above, picked up 5 positive analyst reviews. But these are partially balanced by 3 Holds, for a Moderate Buy consensus rating. The stock is currently trading for $10.07 and the average price target of $13.29 suggests an upside of 31% for 2022. (See PAA stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.