It is a turn of events that has become increasingly familiar this earnings season. Cisco (CSCO) delivered better-than-expected quarterly results on Wednesday, but investors expressed disappointment in the company’s outlook and several soft metrics and sent shares lower in the subsequent session.

Both the top-and bottom-line results were solid. In F3Q21, the networking company generated revenue of $12.8 billion, amounting to a 6.8% year-over-year uptick and beating the estimates by $230 million. Non-GAAP EPS of $0.83 came ahead of the Street’s call by $0.01.

However, supply chain issues impacted gross margin (GM), which at 66%, came in below the previous year’s 66.6% GM. Cash flow from operations also dropped by 8% to $3.9 billion and Enterprise orders were flat year-over-year.

And although Cisco’s guidance for revenue growth of 6-8% in FQ4 was better than the Street’s forecast of 5.5%, the company’s EPS outlook of $0.81-$0.83 was lower than the $0.85 consensus estimate.

Wells Fargo’s Aaron Rakers understands why the shares were trending lower post-results. However, the analyst remains convinced in the Cisco story and says the “key tenants” of his positive thesis remain unchanged.

“We continue to believe CSCO shares offer an attractive risk / reward,” the 5-star analyst said, “As: 1) we continue to see a more visible narrative on the company’s set-up for a subscription renewal cycle into F2022 (expect this to be a key focus at Cisco’s now scheduled 9/15 Investor Day). Cisco reported software at $3.8B in F3Q21 (+13% y/y) w/ 81% via subscription. Product RPO exited F3Q21 at $11.9B, +15% y/y, 2) continued webscale momentum – +25% y/ y in F3Q21 (comp at >70% y/y in F3Q20; ~25% of Cisco’s Service Provider segment) – still very early in 400G cycle. 3) we remain confident in Cisco’s return to y/y growth in Enterprise.”

Overall, there’s no change to Rakers’ rating, which stays an Overweight (i.e., Buy) or price target, which remains at $65. The shares are therefore expected to add 24% of muscle over the next 12 months. (To watch Rakers’ track record, click here)

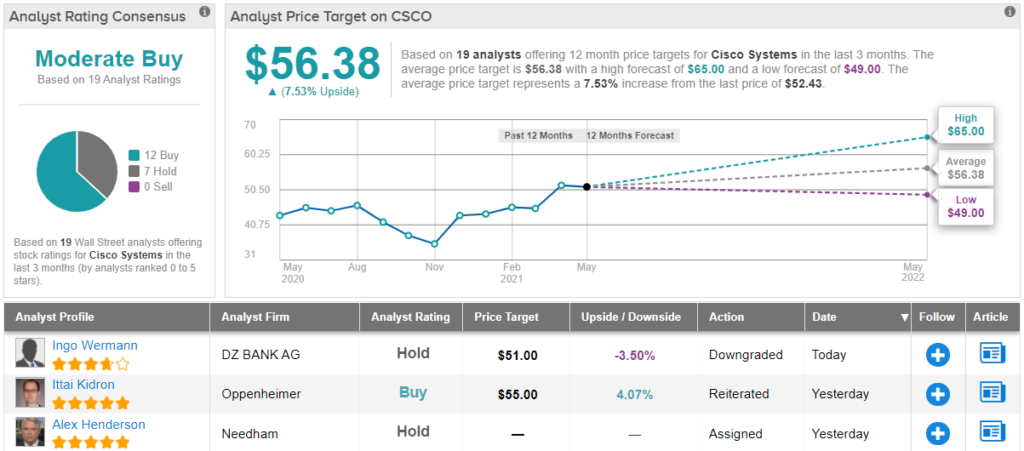

The Street’s average price target is a more modest one. At $56.38, the figure suggests one-year upside potential of 7.5%. The Cisco bulls have a slight edge, and based on 8 Buys vs. 5 Holds, the stock qualifies with a Moderate Buy consensus rating. (See Cisco stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.