Salesforce (CRM) will report its fourth-quarter earnings on March 1 after the market closes.

The business is a leading cloud-based provider of customer relationship management (CRM) software.

As it’s a cloud-based corporation, tracking user visits to Salesforce’s website is critical to assessing the demand for its CRM solutions (sales, service, marketing, collaboration, etc.). Salesforce earns the majority of its money from cloud service subscriptions, so more visits might lead to more subscriptions, which would result in more revenues for the company, and vice versa.

So, ahead of the Q4 print, we dug into Salesforce’s monthly user statistics, utilizing TipRanks’ new online tool to get a better sense of the company’s current state.

Salesforce Monthly User Visits Show Downward Trend

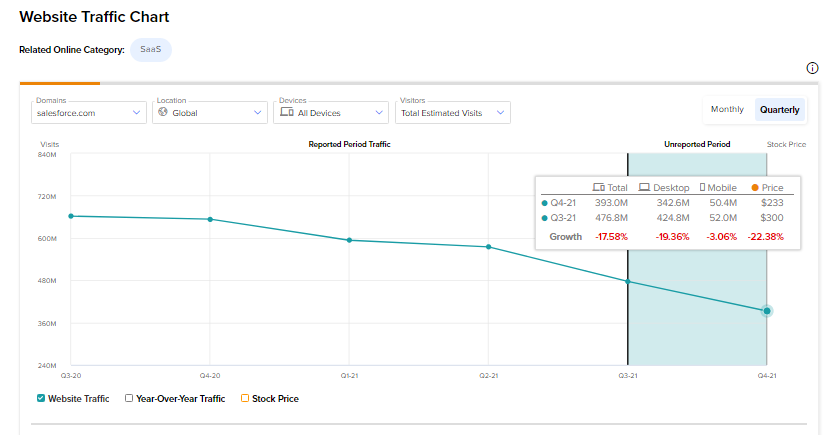

We discovered through the tool that overall projected visits to the Salesforce website decreased in Q4. Notably, there was a sequential decline of 17.6% in total estimated global visits to salesforce.com from the Q3 quarter.

The decrease in monthly visits suggests that the number of Salesforce platform subscribers has decreased in the to-be-reported-on fourth quarter. This might have a negative impact on subscription revenues, and as a result, on the company’s top-line performance in the fourth quarter.

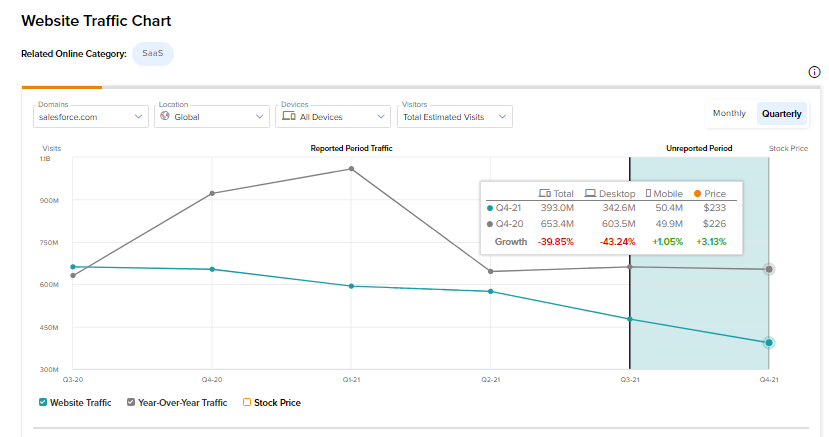

In addition, TipRanks’ new methodology revealed that website visits to salesforce.com decreased 39.9% year-over-year to 393 million in Q4 2021, compared to Q4 2020.

Though website traffic figures indicate slower growth in the to-be-reported quarter, Salesforce could benefit from the rising digital transformation. As a consequence, Salesforce might still be a good investment.

Wall Street’s Take

The Wall Street analysts are optimistic on Salesforce, with a Strong Buy consensus rating based on 21 Buys and 3 Holds. The average Salesforce stock prediction of $320.14 implies upside potential of approximately 53.9% to current levels for this stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure