Shares of enterprise software behemoth Salesforce (CRM) are in the midst of a bear market after plunging around 27% from peak to trough. Marc Benioff’s empire has always traded at a lofty multiple, and for good reason.

The company has one of the most respected founder-led leaders at the helm, and the growth over the years has been remarkable.

Indeed, the Software-as-a-Service (SaaS) pioneer has surged into the clouds over the years, and it’s been tough to get into the name at anything less than an exorbitant valuation, at least from the view of traditional valuation metrics.

I am bullish on the stock.

Valuation

While traditional metrics may have historically been elevated, CRM stock has proven time and time again that it’s more than capable of growing into its multiple.

In late 2020 and early 2021, volatility over at Salesforce stock kicked it up a notch, as investors questioned the firm’s acquisition of Slack Technologies. Benioff’s appetite for acquisitions has been a source of negative pressure on the stock, despite the man’s lengthy history of extracting value out of such seemingly pricey deals.

Many bullish analysts see right through Salesforce’s previously high valuation metrics. At the end of the day, you need to pay a premium for an incredibly well-managed company, with a track record of raising the bar on its growth and market dominance.

Historical Perspective

After suffering such a steep decline, thanks in no part to broader weakness in technology names, Salesforce stock finally looks very cheap relative to historical averages. Indeed, recent depreciation in shares looks to have more to do with broader market factors, rather than a concerning slowdown or problems at the company-specific level.

Salesforce may have recently reported solid numbers, but investors seemed more jittery about a downbeat guide up ahead. Undoubtedly, noisy quarters could impact the near-term trajectory of the stock, but from a long-term perspective, it’s full-speed ahead.

Shares of the enterprise software kingpin trade at 10.2 times sales, 147.8 times trailing earnings and 57.8 times next year’s expected earnings. You could certainly pay up a higher multiple for a lower caliber of growth with other tech stocks in the market these days.

As the company better integrates Slack into its now extensive ecosystem of intriguing software products, I suspect it will be hard to keep CRM stock down, even if high-multiple tech continues taking the brunt of the damage. The digitization of work is still very much at play, and investors may be discounting the potential for Slack acquisition to go right.

Q4 2022 earnings are on tap for February 23, 2022. It will be interesting to see how the company performs in the face of rather muted analyst expectations.

Wall Street’s Take

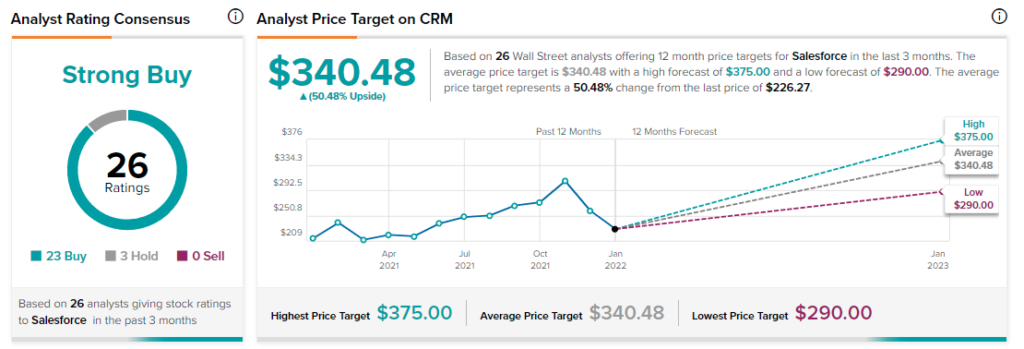

According to TipRanks’ analyst rating consensus, CRM stock comes in as a Strong Buy. Out of 26 analyst ratings, there are 23 Buy recommendations and three Hold recommendations.

The average Salesforce price target is $340.48. Analyst price targets range from a low of $290 per share to a high of $375 per share.

Bottom Line

Salesforce is a company you should expect to pay a pretty penny for. After a vicious slide, the stock trades at a slight discount versus historical average multiples.

Although 2022 is likely to be bumpy, long-term tailwinds from the ongoing digital transformation are likely to dictate the trajectory of the stock at the end of the day.

Though investors may be a bit jittery about management’s hints of slowed growth, it’s worth noting that Benioff and his team tend to set the bar low before leaping right over it. Further, Salesforce has a lot of margin expansion potential as it looks to mature.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure