Rumble (NASDAQ: RUM) certainly expresses a particular political viewpoint. However, investors should leave their biases at the door and consider Rumble’s potential to thrive among a specific swath of disaffected streaming-content consumers. While this isn’t the place to comment on Rumble’s political views, from an investment standpoint, I am bullish on RUM stock.

There are red states, and there are blue states – but is your portfolio in a green state? At the end of the day, what matters is whether you voted with your investment capital for a long-term winner of a business venture. It’s still too early to know for sure, but Rumble might fit that description as it courts conservatives and emphasizes the First and Second Amendments.

Granted, politically unbiased investing is easier said than done. Nonetheless, you’re invited to, at least for the moment, forget what you feel and concentrate on what you know as we get ready to Rumble with RUM stock.

Rumble Received a Sizable Cash Infusion with Its SPAC Transaction

Rumble was once part of the SPAC boom of the early 2020s, and that’s not necessarily a bad thing. Notably, Rumble is set to score a sizable chunk of change as it graduates from SPAC to de-SPAC.

So, let’s start at the beginning and recount how this all unfolded. RUM stock was always RUM stock, believe it or not. Until recently, Rumble traded indirectly as CFVI stock, which doesn’t exist anymore. Once Rumble completed its business combination with shell company CF Acquisition Corp. VI, it was time for Rumble to get its own ticker – and some funding to start the company off on the right foot.

The RUM ticker, which began trading on September 19, was actually meant to represent freedom; think of rum-swigging American colonists protesting against excessive taxation. Yet, there’s another type of freedom to consider: financial freedom, which Rumble should enjoy as the company stands to gain around $400 million in gross proceeds from the SPAC merger transaction.

Of those funds, the net proceeds will be used to “attract new content creators to the Rumble and Locals platforms” and “begin robust marketing of the platform and services,” among other things. Rumble also teased the idea of financing “future acquisitions,” so Rumble’s investors should be on the lookout for that.

Rumble Occupies a Niche with an Often-Ignored User Base

Let’s face it: not every Millennial and Gen Z streaming content consumer is fond of the mainstream media. You might or might not relate to this, but Rumble appeals to consumers who want something right of center – a platform that expresses alternative viewpoints and gives a voice to populist, conservative content creators.

This begs the billion-dollar question, though: Can this vision be monetized? It seems that the answer is yes, as Rumble counted an astonishing 78 million global active users for the month of August. That figure is amazingly close to the number of Americans (roughly 74 million) who voted for Donald Trump in 2020.

Maybe that’s just a coincidence – or maybe not. Either way, 78 million users in a month is a lot, and the data showed that a “substantial portion” of Rumble’s user growth came from Generation Z, or consumers aged 18 to 24. Thus, as Rumble captures the attention of the American youth, the platform could actually threaten more established, traditional political content outlets.

Don’t Worry Too Much about Anti-SPAC Bias

SPACs have a bad reputation. Rumble came from a SPAC, and some traders will shun RUM stock for that reason. However, it’s hasty to dismiss fast-growing Rumble just because of its SPAC origins.

There’s no denying that a number of SPAC stocks flew to dizzying heights in 2020 and 2021, only to flop and leave many investors holding the bag. This doesn’t have to be RUM stock’s fate, though. After all, we’re not talking about a pre-revenue “zombie” company here, as Rumble generated $9.5 million in revenue in 2021.

Again, consider where Rumble might be headed as a business venture, and don’t worry so much about what the anti-SPAC crowd might think. As a platform, Rumble is proudly “designed to be immune to cancel culture.” This off-the-grid attitude should appeal to younger generations of consumers who seek independence from their parents’ and grandparents’ media sources. Visionary investors should imagine that 78 million monthly global users may be just the beginning if Rumble plays its cards right.

Is RUM Stock a Buy, According to Analysts?

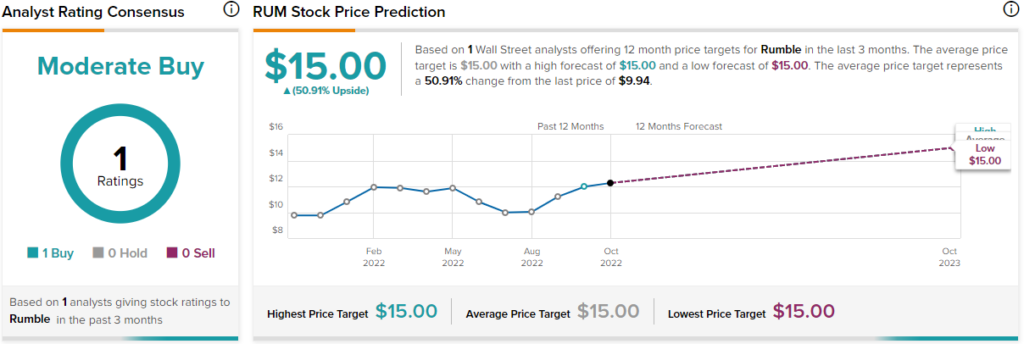

Turning to Wall Street, RUM is a Moderate Buy based on a single Buy rating. Rumble’s price target is $15, implying 50.9% upside potential.

Interestingly, RUM has a 9 out of 10 Smart Score rating on TipRanks, implying that there’s solid potential for the stock to outperform the market, going forward.

Conclusion: Should You Consider Rumble Stock?

If Rumble doesn’t comport with your political beliefs, you don’t have to invest in the company. However, it’s also fine to set your politics aside and focus on Rumble’s growth trajectory as a platform.

With user growth should come revenue growth and possibly higher share prices for RUM stock. Therefore, don’t assume that SPAC mania’s demise is problematic for up-and-coming Rumble; instead, consider holding a few shares as a wager on a platform that’s not quite unbiased but is certainly off the beaten path.