Founded in 1864, Royal Bank of Canada (RY), also known as RBC, is Canada’s largest bank in terms of market capitalization. It offers banking and financial services across Canada, the United States, and other countries.

It is involved in the following segments: Personal and Commercial Banking, Wealth Management, Insurance, Investor and Treasury Services, Capital Markets, and Corporate Support.

The Canadian banking sector is controlled by an oligopoly of five major players, including RBC. This allows these banks to enjoy a very large competitive advantage, creating large barriers to entry for smaller players. We are bullish on RY stock.

Growth Catalyst – Interest Rates

Inflation has been the talk of the world over the past six months. A large part of the problem is the fact that the central banks of the world have kept interest rates very low for longer than they should have.

However, to get ahead of inflation now, the central banks are forced to raise interest rates. Since markets are forward-looking, government bond yields have shot up to almost 3% in Canada and the U.S. on the long end of the curve.

Consequently, this has caused borrowing rates for consumers to increase as well. As a lender, RBC is set to benefit from higher interest rates, and it will increase its interest income.

Potential Headwinds

Although higher interest rates can increase income on existing loans, it does come with a few drawbacks. To begin with, higher interest rates lead to fewer loan originations because fewer people are able to qualify for them.

This is especially true for mortgages, where a 1% increase equates to thousands of dollars a year in additional interest. As a result, the volume of business decreases.

In addition, the net interest margin on loans doesn’t necessarily increase with higher interest rates because the bank’s cost of borrowing increases as well. As a result, it’s mostly older loans and deposits that are invested into government bonds that provide the most benefit when interest rates rise.

Moreover, higher interest rates tend to compress valuation multiples in the stock market. Therefore, this can impact the bank’s Capital Markets and Wealth Management business when stocks fall. Not only does the asset base decrease, but so do the fees that they are able to collect.

Dividend

For investors that like dividends, RY stock currently has a 3.38% dividend yield which is above the sector average of 1.63%. Furthermore, with a payout ratio of 35.8%, its dividend payment looks safe.

Taking a look at its historical dividend payments, we can see that its yield range has trended downwards in the past several years.

At 3.38%, the company’s dividend is near the lower end of its range, implying that the stock price is trading at a premium relative to the yields investors have seen in the past.

Valuation

To value RBC, we will use the excess returns model. This approach is more appropriate for financial companies because they tend to have volatile free cash flows. As a result, trying to create forecasts for them is futile. The excess returns model allows us to use historical numbers instead, which are actual results. The formulas required are as follows:

- Excess Return = (Average ROE – Cost of Equity) x Book Value Per Share

- Terminal Value = Excess Return / (Cost of Equity – Growth Rate)

- Fair Value = Book Value Per Share + Terminal Value

We will use the following assumptions for our calculations:

- Average ROE: 16.6% (five-year average)

- Cost of Equity: 7.9% (value taken from Finbox)

- Book Value: $52.16

- Growth Rate: 2.96% (used the 30-year U.S. Treasury yield as a proxy for long-term growth expectations)

Now that we have our assumptions, let’s plug them into the formulas:

- $4.54 = (0.166 – 0.079) x $52.16

- $91.9 = $4.54 / (0.079 – 0.0296)

- $144.06 = $52.16 + $91.9

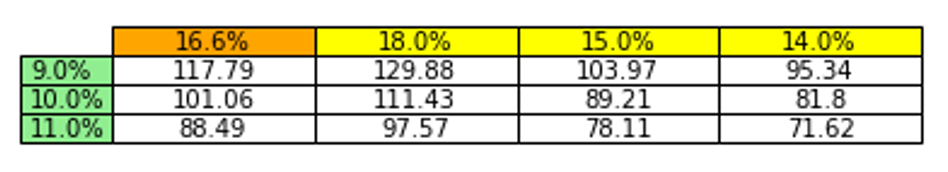

As a result, RY stock is currently worth $144.06 per share under current market conditions. Currently trading at around $110, this leaves a nice margin of safety. However, discount rates are always changing, and companies are likely to see changes in ROE. As a result, we have created the table below to show the valuation of Royal Bank under different conditions:

Note: Orange is the current average ROE, yellow is the valuation with different ROE values, and green is the cost of equity.

Wall Street’s Take

Turning to Wall Street, RY stock has a Moderate Buy consensus rating based on five Buys, two Holds, and zero Sells assigned in the past three months. The average Royal Bank of Canada price target of $121.74 implies 11.4% upside potential.

Analyst price targets range from a low of $117.74 per share to a high of $132.15 per share.

Final Thoughts

Royal Bank of Canada is undoubtedly a great company that investors with a long-term time horizon can’t go wrong with. The company has been around three years longer than the country of Canada itself. It is well managed and provides a steady and reliable 3%+ dividend yield for income investors.

Furthermore, as Canada’s largest bank, it stands to benefit the most from rising government bond yields because that translates into higher interest income.

In addition, under the current market conditions, it appears that the stock is undervalued. As a result, we are bullish on the stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure