The continued shift of content providers, audiences, and advertisers toward CTV (connected TV) is benefitting streaming technology company Roku (ROKU).

Thanks to the secular industry trends, Roku’s active accounts and ARPU (average revenue per user) have increased year-over-year and sequentially in the first two quarters of 2021. Despite the strength in its key performance metrics, Roku stock is down about 4.3% so far this year, underperforming the Nasdaq composite index by a wide margin.

The answer to this lies in its website traffic data. Thanks to the big financial data aggregator, TipRanks, one can now quickly ascertain how a company’s website traffic is trending. This is a powerful tool as it provides a glimpse of what lies ahead.

Take the case of Robinhood Markets (HOOD). Per TipRanks’ new Website Traffic tool, total website volumes for Robinhood.com fell over 50% since Q1. The decline in website traffic was well reflected in its weak Q3 print.

Similarly, Shopify’s (SHOP) Website Traffic volumes declined since the start of this year, following which the e-commerce company delivered lower-than-expected financial numbers in its recently concluded quarter.

Coming back to Roku, its total Website Traffic (including mobile and desktop) has declined by about 22% in the first half of this year and weighed on its streaming hours, and in turn, its stock price. Heightened competition and tough year-over-year comparisons are the reasons behind the slowdown in its website traffic volumes.

While Roku’s website visits slowed in H1 2021, it is showing signs of sequential improvement. Its total website traffic improved by 3.1% in Q3 from Q2, indicating that the company could post solid financials in Q3. Meanwhile, its active accounts and ARPU could continue to trend higher. I maintain a Bullish view on Roku.

Roku will be announcing its Q3 financial numbers on November 3. Wall Street expects the company to post adjusted earnings of $0.06 a share on revenues of $680.59 million.

While Roku’s top line is projected to increase both on a year-over-year and on a sequential basis, its earnings will likely trend lower due to increased operating expenses, including investments in sales & marketing, headcounts, and product development.

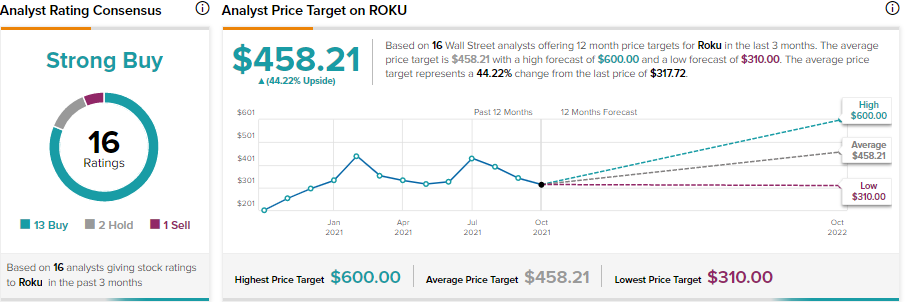

Meanwhile, on TipRanks, Roku stock sports a Strong Buy consensus rating, based on 13 Buys and 2 Holds. However, Roku scores a 7 out of 10 from TipRanks’ Smart Score rating system, indicating that it will likely perform in line with the market averages.

Nevertheless, the average Roku price target of $458.21 implies 44.2% upside potential to current levels.

Want to see the Fastest-Growing Streaming Services Websites? Click here.

Disclosure: On the date of publication, Amit Singh had no position in any of the companies discussed in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.