Shares of streaming platform firm Roku (ROKU) are now sitting down around 83% from their all-time high hit just under a year ago. Despite the severity of the decline, ongoing rate-induced pressures, and rising competitive threats in the streaming space, innovation investor Cathie Wood is not yet ready to throw in the towel on the name. Arguably, she’s grown even more bullish, scooping up shares on the dip.

Roku: Is a Netflix Takeover All It Has Going for It?

With recent rumors surrounding a potential takeover by streaming kingpin Netflix (NFLX), Roku stock seems to be back in the headlines. Still, investors should take such rumors with a fine grain of salt. Netflix is in the business of creating content, and I find it doubtful that the firm would want to get into the business of streaming hardware.

Streaming hardware just isn’t the same growth engine it used to be. It’s a commoditized product that faces tremendous competition, not just from big-tech firms but from next-generation smart TVs, which may render streaming hardware obsolete.

Does Roku face an existential threat as it looks to make a splash in content production? It’s hard to say. I’d argue that Roku lacks a moat, making it vulnerable to more deep-pocketed rivals like Amazon (AMZN).

Had Netflix not been in such rough shape, I’m sure a Roku-Netflix deal would have made a lot of sense. With Netflix also attempting to pivot and regain its formerly rich valuation multiple, I’d argue that the firm is likelier to go down the route of organic innovation, rather than scooping up another firm with more than its fair share of baggage.

It’s hard to stay bullish on Roku stock at these depths with a seeming lack of catalysts. However, I remain bullish, as the 3.8 times sales multiple is absurdly low and discounts the firm’s recession resilience. Also, let’s not forget that Roku can solve its problems through innovation. Roku is a Cathie Wood stock for a reason, after all!

For these reasons, I remain bullish, even as most other investors turn against the stock.

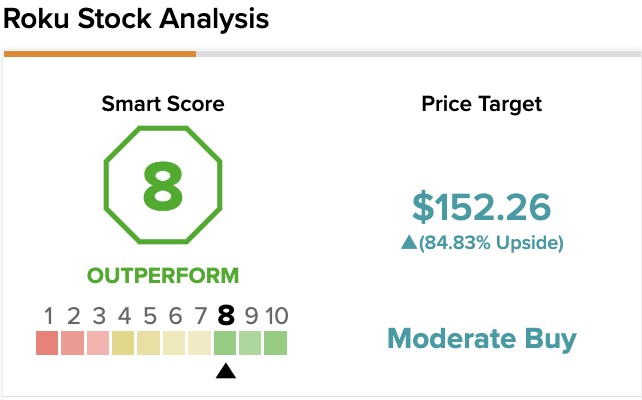

On TipRanks, ROKU scores an 8 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to outperform the broader market.

Roku Teams Up with Walmart on Intriguing Ad Concept

In an intriguing move, Roku announced its partnership with Walmart (WMT) to bring e-commerce to televised ads. It’s definitely not a concept that many consumers are familiar with. Still, it’s one that could pay significant dividends for both firms, especially as the American economy heads for a recession.

Through the intriguing ads, Roku viewers can purchase items from Walmart through Roku’s streaming service. While only time will tell if the partnership pays off, I find the move very interesting – one that could mark a leg of growth for the ailing streamers.

It’s an innovative concept, to say the least; it could find itself being copied by the likes of retail and streaming heavyweight Amazon.

Further, it’s not just ads that could entice users to buy items via the Roku platform. Product placement and strategically-placed ads could mark the next frontier in digital advertisement. The one-two combo of product placement and the convenience of buying from ads within Roku, I believe, could be unstoppable.

The Walmart partnership signals that Roku is still very much innovating. The company realizes that stream sticks are commoditized, and it’s ready to move on. I’m a big fan of Roku’s dealings with Walmart and think it could be the start of a very fruitful relationship that could see the latter scoop up the former.

Recession on the Way? Roku Could Outpace Rivals

It’s not just ads where Roku could innovate; Roku is a pioneer in the free, ad-based streaming tier with its Roku Channel. As Roku Channel gains more content, viewers could flood in, especially those who recently canceled Netflix to save money.

Arguably, the Roku Channel is one of the lowest-cost forms of entertainment (it’s effectively free to Roku users), and that could begin to pay off as economic times get tough.

Wall Street’s Take

According to TipRanks’ analyst rating consensus, ROKU stock comes in as a Moderate Buy. Out of 23 analyst ratings, there are 17 Buy recommendations, five Hold recommendations, and one Sell recommendation.

The average Roku price target is $152.26, implying an upside of 84.8%. Analyst price targets range from a low of $80.00 per share to a high of $240.00 per share.

The Bottom Line on Roku Stock

Although higher rates don’t bode well for innovative growth firms like Roku, its recession resilience could more than offset potential rate-induced economic headwinds on the horizon.

Teaming up with Walmart on an intriguing new ad concept proves that Roku is unwilling to back down without a fight. Should the Walmart-Roku deal show promise, I’d argue that Walmart is a far better suitor than Netflix.

Read full Disclosure