Rocket Lab USA (RKLB) investors’ Christmas came a few days early. The stock shot up by 23% in the final pre-Christmas session after the company announced a big contract win.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The commercial space company disclosed that its Rocket Lab National Security subsidiary secured a U.S. government contract worth up to $515 million. The agreement stipulates it will design and operate 18 space vehicles for a U.S. government client. Work will begin right away with the first launch slated for 2027, operation of the satellites taking place through 2030, while there’s also the option of a three-year extension.

The contract represents “another meaningful win” for the California-based company, says Stifel analyst Erik Rasmussen. “We see this award as offering good visibility into the business (10 year contract, with a majority of revenues recognized through 2027), while also effectively doubling the company’s backlog (which stood at $582M at the end of 3Q23),” the analyst explained. “As the U.S. Government’s requirements continue to advance, we see RKLB in a good position to win additional constellation business.”

Due to ongoing launch and space systems “award momentum”, in addition to management’s continued focus on scaling the business towards “attractive and profitable growth opportunities,” Rasmussen says he keeps a positive stance regarding the company’s longer-term prospects.

Rocket Lab aims to position itself as a comprehensive solution for the space sector, offering end-to-end services encompassing the design, construction, launch, and maintenance of satellites for its clients. The latest win, says Rasmussen, underscores the significant progress the company has made since going public in August 2021, making it “well positioned” to cater to this market.

Crucially, by establishing a distinct subsidiary specifically geared towards managing national security programs, Rasmussen sees Rocket Lab as creating a unique identity and generating value in a market expected to grow due to the “increasing needs” of the U.S. Government, particularly in areas like defense and intelligence.

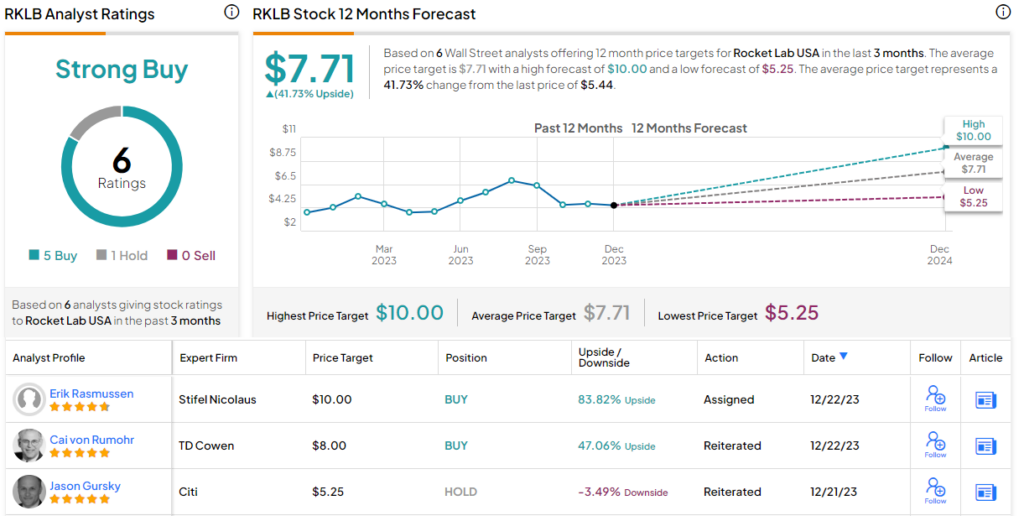

Accordingly, Rasmussen reiterated a Buy rating on the shares, backed by a $10 price target. There’s potential upside of 84% from current levels. (To watch Rasmussen’s track record, click here)

Rasmussen is not alone in his bullish take; 4 others join him in the bull camp with 1 skeptic unable to detract from a Strong Buy consensus rating. Meanwhile, the $7.71 average target makes room for one-year returns of 42%. (See Rocket Lab USA stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.