There’s no denying it: investing in Rocket Companies (NYSE: RKT) has been brutal in 2022. Plus, America’s central bank has made it crystal clear that monetary policy tightening will persist for a while longer. Yet, contrarian investors should see the glass as half-full, as RKT shares have already been beaten down to the point where up is the most likely direction now. Therefore, I am bullish on RKT stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Rocket Companies is a mortgage originator and lender offering a home search platform called Rocket Homes. In order to wager on the growth of this company, you’ll at least want to assume that the U.S. housing market isn’t on the verge of collapse. Plus, you’ll need to have some confidence that the U.S. Federal Reserve won’t constrain the home-buying market too much.

That’s a lot to ask for, I’ll admit. Plus, given the persistent downward trajectory of Rocket Companies’ stock, it requires a great deal of faith to believe that there will be a turnaround in the near future. You don’t have to be in the business of timing stock bottoms, though. As long as extreme pessimism can give way to relief that conditions aren’t as bad as feared, there’s room for RKT shares to regain value – and indeed, value is what makes them so attractive now.

Rocket Companies: The Biggest Business You’ve Never Heard Of

Which company has been around since 1985, has a nearly $16 billion market cap, and is America’s largest mortgage lender? Funny enough, most people have never even heard of Rocket Companies. Yet, it’s an established giant in the mortgage origination business.

Today, the umbrella company’s divisions include Rocket Homes, Rocket Auto, and Rocket Mortgage. Additionally, Rocket Companies just added a Rocket Solar division “to provide financing to the company’s clients who want to help the environment and save money by generating their own electricity with the power of the sun.” Really, that’s just a fancy way of saying it will help people finance new solar electricity systems.

That’s actually a significant business addition and a major potential revenue source, which shouldn’t be ignored. Already, Rocket Solar operates in 42 U.S. metro areas across, comprising nearly 25% of the nation’s population. Furthermore, Rocket Companies cited a Department of Energy statistics that, by the year 2035, solar energy could power 40% of America’s electricity. If Rocket Solar can stake an early claim in this fast-emerging market sector, the income generation prospects would be substantial.

Rocket Companies’ Macro-Level Challenges are Already Known

Since the financial markets are forward-looking, they tend to price in worst-case scenarios sometimes. Such is the case with RKT stock, which has already been demolished due to known macro-level challenges.

For example, U.S. existing home sales just declined for the sixth consecutive month. Alarmingly, the July existing home sales reading indicated a 5.9% decline to an annual pace of 4.81 million. Reportedly, this is the weakest level for the nation’s existing home sales since May 2020.

To make matters worse, Federal Reserve Chairman Jerome Powell braced Americans for “higher interest rates, slower growth, and softer labor market conditions” in his recent Jackson Hole Symposium speech. Along with that, Powell prepared the nation for “some pain to households and businesses.” In other words, he’s almost guaranteed to continue raising interest rates, thereby throwing a wet blanket on the housing market in general and new mortgage loan originations in particular.

If there’s any silver lining to all of this, it’s that macro-level conditions have probably hit rock bottom for mortgage lenders like Rocket Companies. When it feels like the whole world is conspiring against you, that’s when your stocks are probably near or at their bottoming process – and I do mean process since it might take a while before Rocket Companies stock turns around.

There’s Strong Value in RKT Stock

It’s only amid seemingly dire conditions, though, that bargains appear. If Rocket Companies’ trailing 12-month P/E ratio of 4.4x doesn’t make your contrarian senses tingle, then I don’t know what would.

Besides, it’s not as if Rocket Companies completely fell apart while the Federal Reserve was tightening the proverbial screws. The company maintained an impressive 93% net client retention rate during the 12 months ended June 30, 2022. Thus, Rocket Companies’ clients aren’t running for the hills even when times are tough.

Furthermore, Rocket Companies reported $1.4 billion in total revenue and a net income of $60 million during 2022’s second quarter. It’s also worth noting that the company managed to generate $34.5 billion worth of mortgage origination closed loan volume in those three months. So, Rocket Companies has been quite busy, even while the skeptics are wringing their hands over monetary policy tightening and other concerns.

Is RKT Stock a Buy or Sell, According to Analysts?

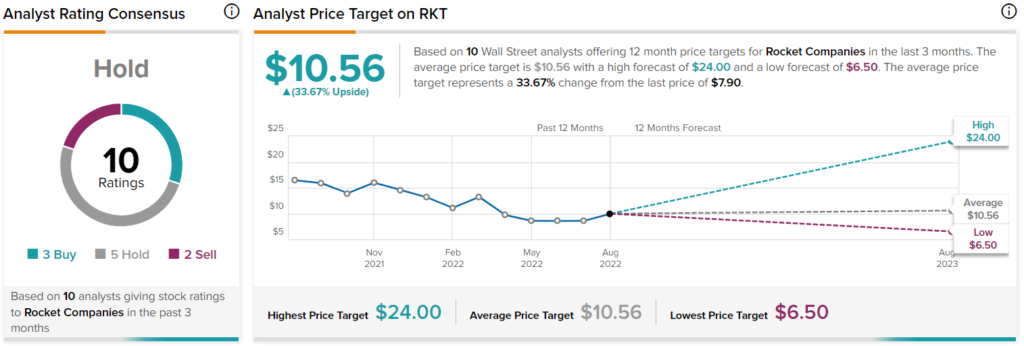

Turning to Wall Street, RKT stock is a Hold based on three Buys, five Holds, and two Sell ratings. The average Rocket Companies price target is $10.56, implying 33.7% upside potential.

Conclusion: Should You Consider Rocket Companies’ Stock?

Don’t expect a rocket ride with Rocket Companies stock, but a near-term turnaround is possible, and an eventual easing of the pessimism is almost inevitable. It requires a great deal of faith that the housing market will heal, but if you’re willing to bridge that gap, then you should find outstanding value in Rocket Companies stock.

Just be aware that the home-buying market is unpredictable, and so is the Federal Reserve. Therefore, cautious confidence and an appropriately moderate position size would be wise things to have if considering a long position in Rocket Companies stock.