While few enjoy conducting business with middlemen under the notion that they unnecessarily leach off primary parties to a transaction, staffing agency Robert Half (NYSE:RHI), which specializes in providing temporary, permanent, and consulting workforce solutions, could be poised for a quiet rebound as workforce realities set in. Put another way, the normalization process from the COVID-19 pandemic finally benefits the employment specialist. Therefore, I am cautiously bullish on RHI stock.

A Unique Labor Market Flirts with RHI Stock

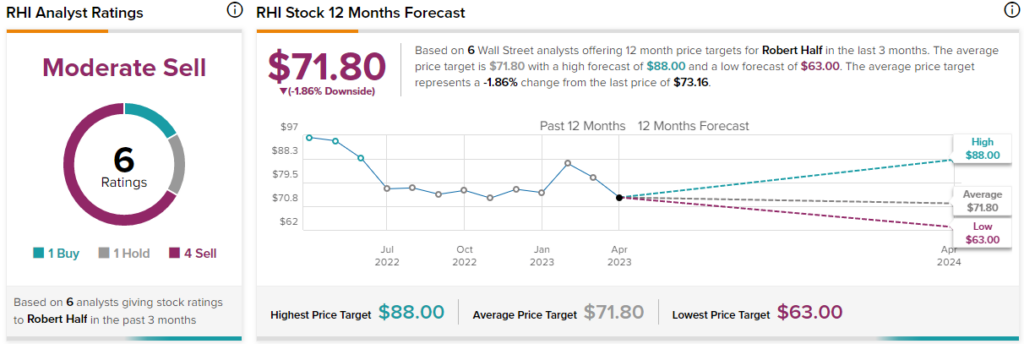

Take a quick peek at Wall Street analysts’ sentiment toward RHI stock, and you’re not going to receive any encouragement from the experts. With four out of six analysts rating shares a Sell, Robert Half seemingly careens toward disaster. A natural question then materializes – what gives?

Initially, RHI stock seemed to be a no-brainer investment. When the COVID-19 pandemic first capsized American society, practically all businesses not associated with directly addressing or mitigating the impact of the virus fell sharply. Even as the broader economy quickly bounced back, more than a few industries struggled due to jurisdictional restrictions.

On a cynical note, though, RHI stock benefited, as many desperate workers who lost employment sought to get back on their feet. When inflation began skyrocketing in 2022, causing the Federal Reserve to raise interest rates, this dynamic, too, should have bolstered Robert Half. After all, several enterprises – particularly technology firms – responded to the economic hit with mass layoffs.

However, RHI stock peaked in early 2022. By late April, shares were on a decided bearish trend. Notably, in the past 365 days, RHI stock gave up over 23% of its value. Basically, since March of last year, the unemployment rate stabilized around the 3.5% mark. In other words, those that wanted a job could get a job. Nevertheless, this “painful” circumstance for Robert Half may be coming to an end.

Both Sides of the Labor Equation Need Robert Half

Fundamentally, what separates the current juncture from the prior post-pandemic paradigm is that today, both sides of the labor market equation need Robert Half’s services. When the COVID crisis first struck, people needed jobs but couldn’t find them. During the recovery phase, willing employers sought workers but couldn’t find them. Right now, both sides see the value of the employment middleman.

For the workers, the momentum basically centers on desperation. Earlier, headlines involving layoffs focused on big tech companies. Now, though, workers must contend with pink slips from a range of formerly viable industries.

In addition, some employees may have inadvertently blacklisted themselves by vocally protesting their companies’ return-to-office mandates. With several Fortune 100 enterprises recalling their workers – either a full return or via a hybrid schedule – fewer remote opportunities exist. Therefore, workers may choose to enlist Robert Half’s services, either to search for those rare remote jobs or to help with image rehabilitation (for protestations which may be viewed as insubordination).

For employers, Robert Half may be particularly appealing because it adds another layer of prospective employee vetting. Once the economy began the process of normalizing society, the labor market became extraordinarily tight. In fact, early last year, Fed Chair Jerome Powell remarked that the labor market was “tight to an unhealthy level.”

Given that it was small pickings for employers at the time, many companies surely made less-than-desirable hires out of necessity. Now, faced with a deluge of desperate applicants, employers may want to ensure good decisions. That’s where Robert Half comes in.

Financials May Have “Bottomed Out”

At first glance, Robert Half’s financial performance doesn’t offer much confidence. True, in 2022, the company posted revenue of $7.24 billion, up significantly from the prior year’s result of $6.46 billion. However, in the fourth quarter of last year, revenue was only $1.73 billion, down 2.26% against the year-ago quarter’s result of $1.77 billion.

In the most recent Q1 report, Robert Half posted sales of $1.72 billion, which beat the consensus estimate slightly. However, this tally slipped about 5% on a year-over-year basis.

Still, these unfavorable comparisons may be due to the aforementioned tight labor market conditions. Once unwound, so to speak, these numbers should start improving.

Is RHI Stock a Buy, According to Analysts?

Turning to Wall Street, RHI stock has a Moderate Sell consensus rating based on one Buy, one Hold, and four Sell ratings. The average RHI stock price target is $71.80, implying 1.9% downside potential.

The Takeaway

While layoffs impacted the labor force, the low unemployment rate meant that job seekers could find another opportunity relatively easily. However, with pink slips affecting various sectors beyond tech, desperation will rise. As well, employers will want to ensure themselves of good hiring decisions, thus making RHI stock surprisingly relevant.