The rising mortgage rates, high inflation, and macro headwinds are leading buyers to postpone home-buying decisions. This is taking a toll on home builders like KB Home (NYSE: KBH) and Lennar Corporation (NYSE: LEN). Both KBH and LEN delivered year-over-year improvements in Q3 revenues. However, their top line fell short of Street’s estimates.

KBH posted revenues of $1.84 billion, up 26% year-over-year. However, it fell short of analysts’ estimate of $1.87 billion. Nevertheless, its earnings of $2.86 a share came ahead of Street’s expectations of $2.67. For the fourth quarter, KBH expects housing revenues to be $1.95 billion to $2.05 billion, well below the consensus estimate of $2.33 billion.

While KBH’s Q3 revenue and forecast disappointed, LEN’s Q3 revenue also fell short of the Street’s forecast. It delivered total revenues of $8.4 billion, up 29% year-over-year but missed the analysts’ estimate of $9 billion. However, its EPS of 5.03 came ahead of Wall Street’s projection of $4.88.

Is KBH a Good Buy?

Given the short-term challenges and lower-than-expected Q4 guidance, Street is cautiously optimistic about KBH stock. It has a Moderate Buy consensus rating on TipRanks based on five Buys, four Holds, and one Sell. Further, KBH’s average price target of $38.63 implies upside potential of 37.9%.

Nevertheless, KBH stock has positive signals from hedge fund managers, who bought 151.2K shares last quarter. Meanwhile, bloggers are also bullish about its prospects. Overall, KBH stock enjoys a ‘Perfect 10’ Smart Score on TipRanks, implying it could outperform the market.

Is Lennar Corporation a Buy, Sell, or Hold?

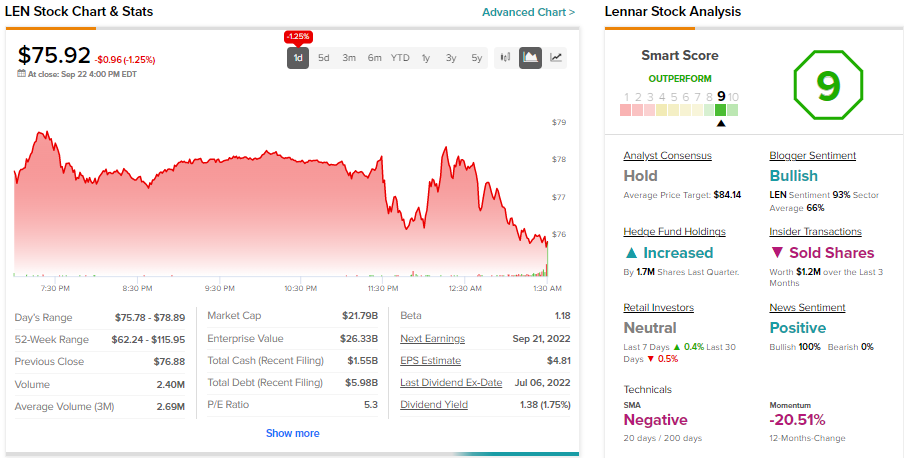

For Lennar stock, analysts prefer to remain on the sidelines. LEN stock commands a Hold consensus rating on TipRanks based on three Buys, four Holds, and two Sells. Further, LEN’s average price target of $84.14 implies upside potential of 10.8%.

While analysts remain sidelined, hedge funds bought 1.7M LEN stock in the last three months. Meanwhile, it has an Outperform Smart Score of nine out of 10.

Bottom Line

KBH and LEN stocks have Outperform Smart Scores on TipRanks due to the housing shortage and their ability to rightsize inventory and pricing. However, persistent demand weakness amid rising mortgage rates and an uncertain economic environment could impact their near-term financials and restrict their stocks’ upside.

Read full Disclosure