The Real Estate Investment Trusts (REITs) sector is highly fragmented with several sub-industries. Each sub-industry has a unique set of features and factors that affect its performance. REITs typically give out 90% of their earnings as dividends, making them an attractive investment option for people looking for a regular income stream.

Let’s dive deeper into one such promising sub-industry- Residential REITs, which are poised for exponential growth in 2022. With increasing interest rates, mortgage rates are reaching all-time highs of ~4%, making home buying an expensive affair. As such, people are preferring to live on rent, thereby propelling the Residential REITs segment.

Notably, Residential REITs have witnessed rising occupancy and increasing rent rates through the end of 2021, and the uptick is expected to continue well into 2022. The sub-industry is further broken down into various segments depending on the location of the markets, namely coastal, suburban, central business district (CBD), etc., as well as based on the property type, namely apartment, multifamily, student housing, etc.

Deutsche Bank analyst Derek Johnston, who recently revisited the Residential REITs industry, has compelling insights into the sector. Based on the current economic environment, Johnston has increased the cap rates (yield on investment) and lowered the premiums applied to the company’s net asset value (NAVs). Moreover, the analyst has also adjusted earnings forecasts and lowered the price target on the stocks due to the changes.

Despite lower-than-market value to the valuation and cloudy macro-environment, Johnston remains bullish in the sector. The analyst forecasts an average funds from operations (FFO) growth of 18.8% for 2022 and 15.2% in 2023 for apartment REITs and single-family residences (SFR) segment.

Johnston noted the forces that are driving his optimistic view of the sector. “Aging millennials start families, roommates largely de-coupled during the pandemic, and home valuation spikes may lead to a downsize cycle, while first-time buyer affordability is stretched,” the analyst remarked.

Additionally, the analyst believes the industry is set to witness smaller year-over-year expense comp benefits as technological investments of the past start bearing fruit, lowering employee costs. Also, COVID-19-related expenses are easing out, further reducing the burden on the margins. The analyst expects outsized earnings growth in 2022 for the sector based on the above points.

Let’s look closer at three leading Residential REITs companies and what the analyst thinks about them.

AvalonBay Communities (AVB)

AvalonBay engages in developing, redeveloping, acquiring, and managing multifamily communities, primarily in high-barrier urban markets of New England, the New York/New Jersey metro area, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California.

Exposure to leading metropolitan areas with favorable characteristics such as growing employment in high wage sectors of the economy, lower housing affordability, and diverse and vibrant quality of life have all led to superior returns for the company’s investments.

As of December 31, 2021, AVB’s portfolio included 297 apartment communities hosting 87,992 apartment homes in 12 states.

According to analyst Johnston, AVB’s portfolio is “best positioned to benefit from ongoing suburbanization and coastal market revival” as seen from its February month update on revenue, occupancy, and rents. Moreover, the analyst sees 15% labor cost savings going forward with further digitalization.

Based on robust rent growth expectations, development completion, and stabilization tailwinds, the analyst has raised AVB’s FFO per share estimates to $9.59 (from $9.35) in 2022 and further to $10.68 (from $10.17) for 2023.

The analyst reiterated a Buy rating on the AVB stock but reduced the price target to $272 (from $285), which implies 8.8% upside potential to current levels. AvalonBay has a dividend yield of 2.57%.

The other Wall Street analysts have a Moderate Buy consensus rating on the stock with five Buys and eight Holds. The average AvalonBay price forecast of $270.31 implies 8.1% upside potential to current levels. Its shares have lost a little over 1% year-to-date, against a 37.4% gain over the past year.

Camden Property Trust (CPT)

Camden owns a portfolio of apartment communities with a focus in the sunbelt region across the U.S. The company specializes in leasing, managing, marketing, and maintaining apartment homes.

As of January 31, 2022, CPT’s portfolio included 171 properties hosting 58,300 apartment homes.

Compared to its peers, which had experienced a negative impact on their bottom lines from the pandemic over the last two years, CPT saw very little impact. Moreover, the company continued to earn favorable rent growth in both January and February 2022, and is expected to continue with the upward trend.

According to analyst Johnston, for CPT “This lack of an earnings ‘hole to fill’ (in regards to rental rates and occupancy) paves the way for additional acquisition/development investments like the recently announced $1.6B TRS acquisition.”

CPT operates in markets with limited 2022 inventory supply, which makes for a favorable “sticky” occupancy trend, which currently stands at around 97%. Moreover, the analyst expects CPT to earn FFO growth of 19.6% in 2022, translating to an increased FFO per share forecast of $6.45 (including TRS acquisition) from $6.22.

For 2023, FFO per share is upped to $7.11 from $6.76. The drivers for the increased FFO growth are improved tenant demand coupled with solid lease spreads.

The analyst reiterated a Buy rating on the CPT stock while reducing the price target to $190 (from $200), which implies 12.5% upside potential to current levels. Camden Property has a dividend yield of 2.08%.

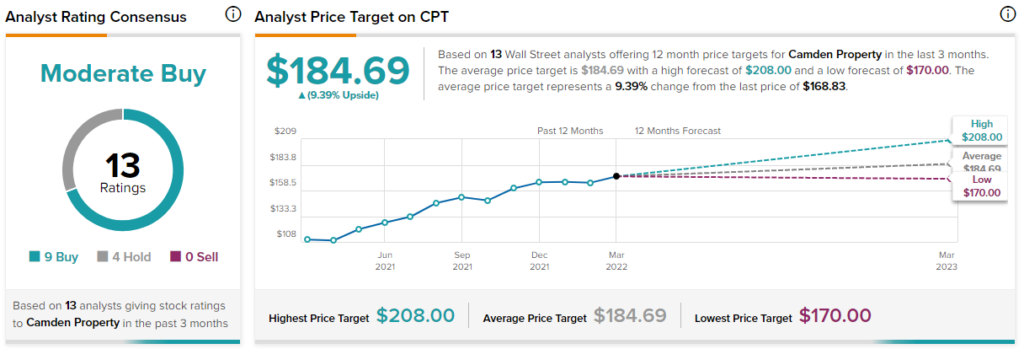

Overall, the Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on nine Buys and four Holds. The average Camden Property price forecast of $184.69 implies 9.4% upside potential to current levels. The CPT stock has lost 4.3% year-to-date, against a 55.4% gain over the past year.

Equity Residential (EQR)

Equity Residential focuses on the acquisition, development, and management of rental apartment properties in urban and high-density suburban coastal gateway markets, including Boston, New York, Washington, D.C., Southern California, San Francisco, and Seattle. EQR also has an expanding presence in Denver, Atlanta, Dallas/Ft. Worth and Austin.

As of December 31, 2021, EQR’s portfolio included 310 properties hosting 80,407 apartment homes.

According to analyst Johnston, EQR operates a blue-chip portfolio in the coastal market. Meanwhile, the company aims to increase its presence in growth markets, by funding through dispositions in its California, New York, and D.C. markets.

Commenting on the same, the analyst said, “While the Toll Brother’s partnership should ease this transition, we expect some dilution near term as EQR builds scale to match efficiencies enjoyed in long-standing markets such as New York City and Southern California.”

For EQR, too, the February year-to-date metrics showed continued momentum in rental rates. However, occupancy has lost some ground (-20 bps YTD) and stands at 96.4%.

Notably, owing to enhanced artificial intelligence-driven prospect communications and self-guided tours, management expects about $25 million to $30 million in cost savings going forward.

Based on the above assumptions, analyst Johnston increased the FFO per share estimates for EQR to $3.45 (from $3.31) for 2021 and further to $3.83 (from $3.61) for 2023.

The analyst reiterated a Hold rating on the EQR stock while reducing the price target to $93 (from $94), which implies 3.2% upside potential to current levels. Equity Residential has a dividend yield of 2.73%.

The other analysts on the Street, too, are cautiously optimistic about the stock, with a Moderate Buy consensus rating based on five Buys and 10 Holds. The average Equity Residential price forecast of $98.33 implies 9.2% upside potential to current levels. Its shares have remained almost flat year-to-date, against a 28.3% gain over the past year.

Points to Ponder

The very nature of REITs makes it an exciting investment option since investors get exposure to the real estate sector with so many diverse segments. Additionally, mandatory dividend payments ensure regular income streams and a return on investment, which could also be a motivating factor for investors.

Residential REITs are expected to do well in 2022, making it a compelling investment option with so many players to choose from. The majority of the companies in the sub-industry consistently outperformed FFO expectations in 2021 and several have raised their full-year 2022 outlook on the back of strong underlying demand and favorable rent growth.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure