2021 was a bit of a game changer for bitcoin and the rest of the crypto space. While in the past the newfangled industry was viewed as the playground for scammers and had a whiff of danger about it, the past year has seen crypto shed much of its outlaw image on the path to mainstream adoption; NFTs have become immensely popular, and institutions and corporations are coming on board, all keen to claim a piece of the new asset class. There are now many crypto-focused companies operating in the public markets, amongst them several bitcoin miners.

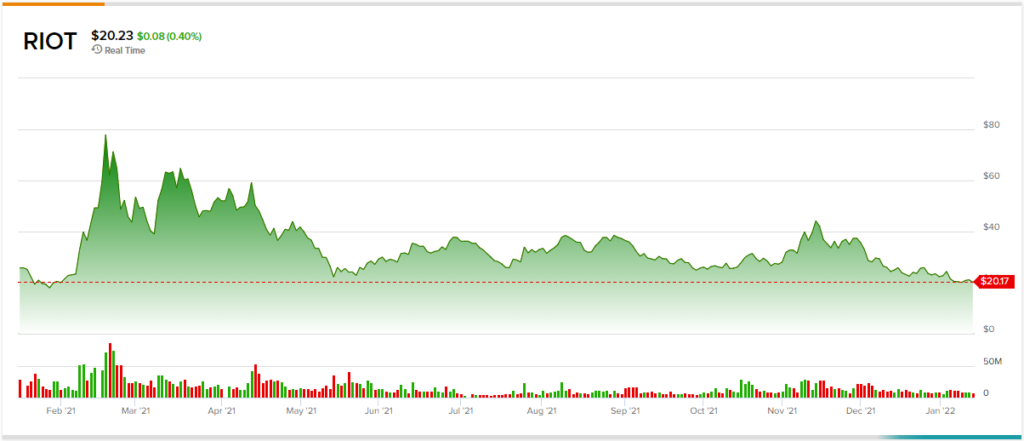

One of which is Riot Blockchain (RIOT), which via acquisition, currently operates North America’s largest Bitcoin mining facility.

Occupying 100 acres in Rockdale, Texas, the Whinstone facility currently has a capacity of 300 MW and when complete, will boast 750 MW in total with a best-in-class power rate of 2.4c/kWh.

The result, as noted by Northland’s Michael Grondahl, is a “high developed capacity, robust outlook for future capacity, leading hash rates and number of Bitcoin mined, and low cost of production.”

Seeing out 2021, Riot had 29,593 miners deployed which should increase to a total of 120,000 by the end of the year, with an expected hash rate of a “significant” 12.8 EH/s.

Of the 750 MW, 200 MW is anticipated to go toward an industrial-scale immersion-cooled mining operation which compared to traditional mining will lead to increased hash rates – the deployment should bring the hash rate to 13.8-14.3 EH/s – and “greater financial output.”

It should also be noted that 200 MW of capacity is currently dedicated to the hosting of institutional mining clients and by the sounds of it, approximately 25% of “future expansion” will be allocated to hosting.

While the crypto market has exhibited outside growth over the past few years, it is still projected to keep growing at a rapid pace; as such, Grondahl sees this “thought leader” in the space as “well-positioned for robust growth in the near future.”

Accordingly, the 5-star analyst initiated coverage of RIOT with an Outperform (i.e. Buy) rating and a $30 price target. The implication for investors? Upside of 42%. (To watch Grondahl’s track record, click here)

Those are some nice gains, but they are some way below the Street’s average target of $44.20, which is set to generate returns of ~119% over the next 12 months. Wall Street’s view on this one is unanimous; based on Buys only – 6, in total, the stock has a Strong Buy consensus rating. (See RIOT stock forecast on TipRanks)

To find good ideas for crypto stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.