In a recent report by the US Equity Strategy Team, headed by Lori Calvasina, RBC looks at Wall Street’s likely course over the coming year – and they are encouraged by what they see. The key factor, for the RBC team, is that the election is past. More encouragingly, in RBC’s perspective, is the clear result: Democrat Joe Biden won the Presidency, but the Republicans proved unexpectedly resilient in Congress, making gains in the House and coming close to keeping control of the Senate outright.

The prospect of a divided government is an encouraging one; as the team notes, the market’s historical returns “have been a bit better when control of Congress is split between the two parties, with annual S&P 500 gains averaging 14% returns.”

Backing out, and taking a larger look, Calvasina’s team is impressed by the parallels between the market eleven years ago and today. They write, “[W]hat jumps out to us is that the S&P 500 continues to march along the path of the 2009 stock market recovery. The similarity in the price action is striking. If the index continues down the 2009 recovery path, it would peak at nearly 3900 in the year ahead, pointing to upside of at least another 4-6% from current levels. This suggests that even if the recovery is mostly baked in already, it may not be entirely baked in.”

Taking this into consideration, we took another look at three stocks RBC is bullish on, with the firm’s analysts projecting at least 30%-worth of upside potential for each. We also ran the three through TipRanks database to see what other Wall Street’s analysts have to say about them.

MediaAlpha (MAX)

We’ll start with MediaAlpha, a vertically integrated performance-based digital advertising company, serving the insurance industry. MediaAlpha is a newcomer to the stock markets, having gone public just this past October.

Last week, the LA-based company released its first quarterly report as a publicly traded entity. The results were encouraging. Transaction value, a key measure of the quantity of business that MAX does, grew 44% year-over-year to reach $271.6 million. Revenues hit $151.5 million, up 37% yoy. And the company revised its full-year revenue guidance to $558 million to $560 million, up 37% from last year’s results. A strong performance from the company’s Property & Casualty vertical led these gains, as that segment’s revenue grew 73% from the year-ago quarter.

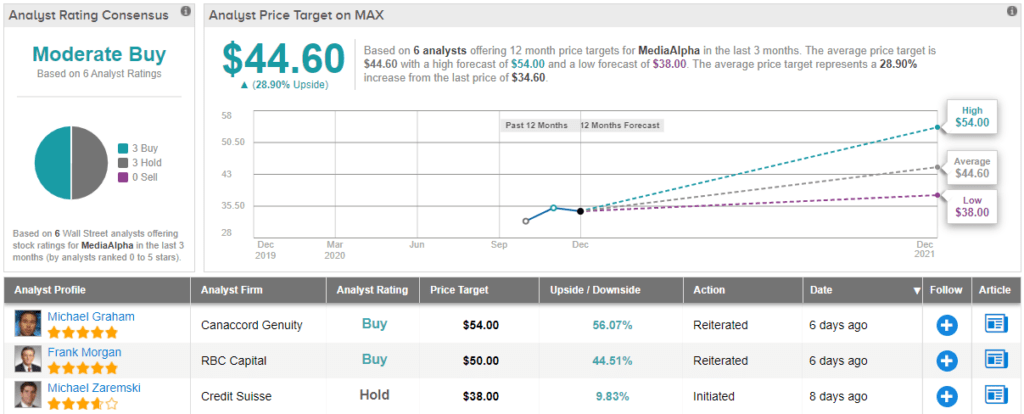

RBC analyst Frank Morgan notes the impressive quarterly results from MAX: “Impressive growth in transaction value, especially within existing partnerships reinforces the enormity of the growth opportunity we see for digital lead generation across MediaAlpha’s insurance verticals.”

The 5-star analyst goes on to outline the solid prospects for the company’s future repetition of these quarterly gains, writing, “As demand for digital distribution grows, so does the demand for high quality consumer referrals and the ability to match high-intent consumers with carriers and distributors selling insurance products that meet consumer-specific needs. This is precisely where MediaAlpha’s proprietary technology platform is focused.”

To this end, Morgan gives MAX an Outperform (i.e. Buy) rating, and his $50 price target suggests it has room for an upside potential of ~45% in the year ahead. (To watch Morgan’s track record, click here)

Overall, MediaAlpha has a Moderate Buy rating from the analyst consensus, based on an even split of 3 Buys and 3 Holds set in the last few weeks. The company’s stock sells for $34.60, and its $44.60 average price target indicates a possible 29% one-year upside. (See MAX stock analysis on TipRanks)

DocuSign (DOCU)

San Francisco-based DocuSign offers users a cloud-based electronic signature service, allowing customers to sign documents – in a verified, secure, manner – online. The savings for customers come in the form of efficiency: faster turnaround of important documents, less time wasted printing and distributing hard copies, and far less ink and paper used and wasted.

That DocuSign’s niche is valuable is clear from the company’s 2020 performance. In a year when markets saw the sharpest, steepest recessionary movement in history, DocuSign has seen steady growth in quarterly revenues and share price.

At the top line, revenues hit $382.9 million in the recently reported fiscal Q3. This was up 53% year-over-year, and was powered by a 54% yoy gain in subscription revenue. The company finished the quarter with over $675 million in cash and cash equivalents available.

Share price has marched upwards along with these quarterly results. DOCU shares have more than tripled in value this year, growing 220% year-to-date.

Writing the review on DocuSign for RBC is Alex Zukin, rated #6 out of 7,100 in the TipRanks analyst database. Zukin notes DOCU’s success, and the reasons for it: “Billings growth of +63.5% Y/Y accelerated for the third consecutive quarter while full year guide implies +55% Y/Y. Success was largely related to core eSig deals and was seen across geos and verticals.”

The analyst doesn’t stop there. He goes on to say that DocuSign’s success comes from finding and exploiting a need that most companies didn’t realize they had. He writes, “We see a company with a large, sustainable leadership position in a newer, underpenetrated TAM capable of sustaining durable growth. We believe both the e-signature and broader “system of agreement” provide one of the most tangible value propositions (removal of paper-based processes) in an organization’s digital-transformation journey.”

In line with his comments, Zukin rates DOCU an Outperform (i.e. Buy), and his $325 price target implies a 37% one-year upside for the stock. (To watch Zukin’s track record, click here)

The Strong Buy consensus rating on DOCU shares is supported by 13 reviews, breaking down to 10 Buys and 3 Holds. These shares are priced at $237, and their $274.92 average price target suggests they have room to grow 16% over the next 12 months. (See DOCU stock analysis on TipRanks)

Global Blood Therapeutics (GBT)

Last but not least is Global Blood Therapeutics, a clinical-stage biopharma company focused on developing treatments for sickle-cell disease. Sickle-cell is a genetically linked, hereditary blood disorder most commonly found among sub-Saharan African populations. GBT has an active pipeline of drugs in development or clinical testing, and one, Voxelotor, has just been approved for patients age 12 and older.

In November, a tablet form of Voxelotor, called Oxbryta, was granted accelerated approval by the FDA. The move means that GBT is now free to mass produce, market, and distribute the medication. According to the FDA, the potential patient base in the US alone is 100,000 strong. The company is still seeking approval for use of Oxbryta in children ages 4 to 11.

Among the bulls is RBC analyst Gregory Renza who writes: “We see Oxbryta as a first-in-class sickle hemoglobin (HbS) polymerization inhibitor with potential to become standard of care in sickle cell disease… We believe the value of GBT lies in the long-term potential of Oxbryta with upside opportunity from entrenchment, expansion efforts, and complementary pipeline assets.”

Renza rates GBT an Outperform along with a $75 price target. This figure indicates his confidence in a 76% upside potential for the stock. (To watch Renza’s track record, click here)

Overall, GBT gets a very high upside outlook from the Street, even more bullish than Renza’s. The average price target, $90.58, implies a 112% upside from the current trading price of $42.80. Meanwhile, the consensus rating is a Moderate Buy, based on 10 Buys and 4 Holds set in the past two months. (See GBT stock analysis on TipRanks)