Third quarter earnings are right around the corner, so get ready for a steady stream of news, analysis, and opinion. Every publicly traded company in the market will release, over the next several weeks, Q3 financial results, and investors will be watching closely to see what they say.

There is an interesting point that has gone somewhat overlooked, however. Of the companies that normally have given forward guidance on their earnings results, most are holding back this year. That’s not surprising considering the ongoing ‘corona crisis,’ but it does mean that investors may lack one of their usual yardsticks for measuring stock performance.

The common wisdom is, we should expect more year-over-year losses in Q3, but like Q2 those losses will probably not be as deep as we fear. The economy has been rebounding faster than expected, with gains in the hospitality and home construction sectors showing that consumers do have money – and are starting to spend again. And that’s the outlook as we get ready to hear from the giants of the tech sector.

At the end of this month, the FAANGs will release their earnings. We’ll hear from Facebook, AAPL, Amazon, Netflix and Alphabet (Google), all five of which have thrived during the ‘time of corona.’ Social distancing, stay-at-home orders, and remote work have changed the way we interact and the way we do our shopping – and they have changed it to the benefit of the big online tech names.

Writing from RBC Capital, 5-star analyst Mark Mahaney, rated #77 overall in the TipRanks database, has taken the measure of the techs, and their earnings potential. Here is what he has to say about Amazon, Facebook, and Alphabet.

Amazon (AMZN)

One of the original online tech companies, and a survivor of the 90s-era dot.com bubble, Amazon has been famous in recent years for, among other things, the sheer size and scope of its online retail operations as well as the high – and growing – value of its shares. Amazon has fueled its share price growth by showing performance at the sales level, meeting customer demands and changing the face of online retail.

Amazon surpassed the expectation in the last quarter, showing a 40% yoy gain as revenues reached $88.9 billion. EPS for the second quarter came in at $10.30, far ahead of the forecasts. RBC’s Mahaney estimates Q3 revenue at $92.1 billion, for 31.7% yoy growth. His EPS estimate, of $6.08, is below the Street’s consensus but still 43% ahead of the year-ago quarter.

Mahaney writes of Amazon’s third quarter prospects: “Positive eCommerce data from the U.S. Census Bureau & YipitData suggest that eCommerce demand remained elevated in Q3 vs. pre-COVID levels, with Amazon almost surely one of the biggest beneficiaries. We also believe that AMZN Ads experienced healthy demand based on our 16th semi-annual Ad Age survey results. Accordingly, we see more upside than downside to Street Q3 estimates.”

In line with his stance, Mahaney rates AMZN an Outperform (i.e., a Buy), and his $3,800 price target suggests a 10% growth from current levels. (To watch Mahaney’s track record, click here)

Overall, Amazon has a unanimous Strong Buy consensus rating, based on 37 buys in recent weeks. The shares are selling for an impressive $3,461 and the average price target of $3,764 implies nearly 9% upside potential. (See Amazon stock analysis on TipRanks)

Facebook (FB)

Next up is Facebook, the social media giant that forever changed the way we use the internet. Facebook’s growth, powered by the innovative use of AI user tracking algorithms and targeted advertising revenues, has brought investors a return of over 600% since the company’s 2012 IPO.

Facebook showed strong year-over-year earnings in the first half of this year, of 101% in Q1 and 97% in Q2. Second quarter revenues hit $18.7 billion, for 5.6% sequential growth. Mahaney is predicting Q3 revenues of $19.4 billion, and EPS of $1.82. These results are slightly lower than the Street consensus, but still indicate a likely sequential gain.

In his comments, Mahaney notes that the size of Facebook’s audience provides some insulation from market shocks.

“Based on intra-quarter data points, and our model sensitivity work, we view current Street September quarter and H2:20 estimates as reasonable to modestly conservative… We also see FB benefitting from Political Ads and Social Commerce in H2:20. Our advertiser survey did suggest a notable blemish on advertiser sentiment from the Social Media boycotts, but we still expect limited impact given FB’s dramatically large advertiser base of 9MM,” Mahaney commented.

Mahaney reiterates his Outperform (i.e. Buy) rating on the stock as well as his $320 price target, indicating his confidence in a 16% upside for the year ahead.

Overall, Facebook shares have a Strong Buy analyst consensus rating, based on 39 reviews which include 34 Buys, 4 Holds, and 1 Sell. The stock has an average price target of $297.31, suggesting nearly 8% growth from the share price of $275.43. (See Facebook stock analysis on TipRanks)

Alphabet (GOOGL)

Last on today’s list is Alphabet, the parent company of internet giant Google. Like Facebook, Google generates revenues through targeted advertising. It has, over the past 15 years, brought us SEO optimization and PPC ads, innovations that have changed the way professional use and manipulate the internet.

Most of Alphabet’s revenue still comes from Google’s advertising sales, and the results speak for themselves. Over the past four quarters, Alphabet’s revenues have run between $38 and $46 billion. Mahaney, in his RBC report, sees the company reporting $43.66 billion at the top line for Q3, which would mark a 5% year-over-year decline, but a 14% sequential gain. His EPS estimate is $11.80, or 16% better than last year’s Q3.

Mahaney’s views are higher than the Street consensus, which he freely admits, saying, “Based on intra-quarter data points and our model sensitivity analysis, we believe Street Ad Revenue estimates for Q3 (+1%) and Q4 (+7%) are ballpark reasonable to potentially conservative given the relatively low bar and (very modest) reopening of economies since Q2 EPS.”

With that in mind, Mahaney reiterates his $1,700 price target and Outperform (i.e. Buy) rating on GOOGL shares. His target implies an upside of 9% from current levels. (To watch Mahaney’s track record, click here)

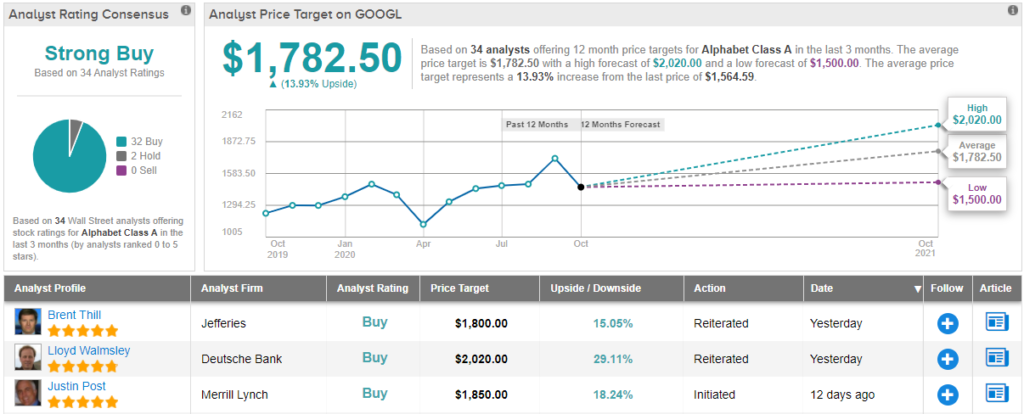

All in all, the Strong Buy consensus on GOOGL is based on 32 recent Buy overbalancing 2 Holds. Shares are priced at $1,561.48, and the average target of $1,782.50 suggests an upside for the stock of nearly 14%. (See Alphabet’s stock analysis at TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.