The clock is ticking down on 2021, and you know what that means: It’s time for Wall Street analysts to tempt fate, clamber out on limbs, and make predictions about what will happen in 2022.

Unable to overcome the temptation, RBC Chief US Economist Tom Porcelli joined the parade of prognosticators, and laid out his prediction for 2022.

“Let us help you shake off any economic fear that is seemingly gripping so many on the back of omicron: the coming year is going to be another strong one. No one wants to hear that when you are dealing with a variant. We all get caught up in the immediate fear. And we have no doubt that some people will even start talking about the silly idea of stagflation again. But once we move beyond omicron (as we have with each wave, and have come through less scathed each time), the fundamentals are in place for another strong year,” Porcelli opined.

Taking Porcelli’s outlook into consideration, we wanted to take a closer look at two stocks earning a round of applause from RBC, with the firm’s analysts forecasting over 80% upside potential for each.

Tremor International (TRMR)

We’ll start in the ad-tech realm, with Tremor International. This company offers capabilities in digital advertising for video, data, and CTV applications. Advertisers can use the platform to deliver branded stories to carefully screened audiences, parsing them by demographic and data factors such as age, gender, location, and mobile device habits. The company has global reach, and offices in the US, Canada, Europe, the Asia-Pacific region, and Australia.

Tremor was founded back in 2007, but only entered the public markets in June of this year. The company put up about 6.8 million American Depositary Shares (ADSs, each representing 2 ordinary shares) at $19 each. Overall, Tremor brought in 129 million in gross proceeds.

Since the IPO, the stock has been volatile, and while it has peaked above $20 a few times, it is down 23% from the initial pricing.

Despite the disappointing performance, the company has important assets for investors to consider. Among these is sheer scale. Tremor fulfils 100 billion ad requests daily, which lead to 250 million ad impressions. Every day, the company processes over 500 terabytes of data from some 100 million websites and apps.

In addition to scale, Tremor has been reporting strong revenue growth this year. The top line in Q3, of $87 million, was up 55% year-over-year, while the three-quarter total of $239 million was up 84%. Of perhaps more importance for investors, Tremor is profitable, with $12 million in net income representing a healthy 14% margin. And, the company generated $44 million in cash from operations during Q3, giving it a healthy balance sheet with no net debt.

Covering Tremor for RBC, analyst Matthew Swanson sees reason for optimism, writing: “The runway in CTV remains attractive with multiple investments in the quarter including the acquisition of Spearad, an exclusive data partnership with VIDAA and a newly launched Programmatic TV Marketplace to simplify campaign activation easing the transition from linear. We believe this leaves the company well-positioned to continue to gain share in the vertical, which is currently, in our view, an opportunity under-appreciated by the market. With that as a backdrop, we continue to view shares of TRMR as attractively valued…”

Swanson’s comments back up his Outperform (i.e. Buy) rating, and his $34 price target indicates potential for ~134% share appreciation in the next 12 months. (To watch Swanson’s track record, click here)

Overall, Tremor has picked up 3 analyst reviews recently, and they all agree that it is a stock to buy – making the Strong Buy consensus rating unanimous. The shares are priced at $14.56 and the $30.67 average target implies an upside of 110%. (See Tremor stock analysis on TipRanks)

Earthstone Energy (ESTE)

From digital ad tech we’ll switch to something more earthy – energy extraction. Earthstone Energy is a small-cap hydrocarbon exploration and production company, valued at $543 million, with assets primarily in the rich oil producing Midland Basin of Texas. The company also operates in the Eagle Ford formation.

In recent months, Earthstone has made major moves to increase its footprint. The company spent $73.2 million to acquire additional Midland assets from Foreland Investments. That deal, consisting of $49.2 million in cash and the balance in stock, closed in November. Earlier this month, Earthstone entered a $604 million agreement with Chisholm Energy Holdings to buy assets in the northern part of New Mexico’s Delaware Basin. This rich oil formation straddles the border of New Mexico and Texas, and expands Earthstone’s footprint in the larger Permian Basin, which also includes the company’s Midland holdings. The assets from Chisholm include over 36,000 acres with current production of 13,500 barrels of oil equivalent daily.

Taking Foreland expansions and existing assets together, (the Chisholm acquisition is not complete yet) Earthstone boasts proven reserves of 160 million barrels of oil equivalent. The company saw an average daily production exceeding 25,000 barrels of oil equivalent per day during 3Q21, and brought in revenue of just over $110 million. This was up 23% sequentially and 168% yoy, and beat the estimates by 25%. On earnings, the company reported 35 cents per adjusted diluted share, nearly 6x the year-ago figure and 11 cents better than the estimates.

Energy exploration is a volatile business, and Earthstone’s share price reflects that. The stock has seen its ups and downs this year – but is currently up 91% year-to-date.

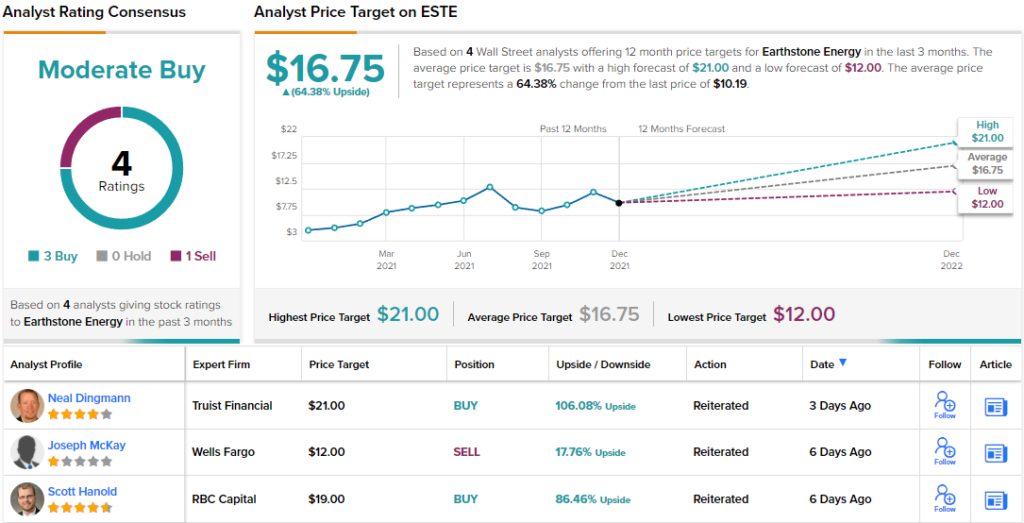

RBC’s 5-star analyst Scott Hanold is among those saying there’s more room for growth. Hanold rates ESTE an Outperform (i.e. Buy) and his $19 price target indicates confidence in ~86% upside this year. (To watch Hanold’s track record, click here)

Backing his bullish stance, Hanold writes: “ESTE is one of the most active relative consolidators in the sector, and we don’t see that ending anytime soon. The entrance into the Delaware portion of the Permian expands its consolidation playing field. The company’s additions over the last year also created more relevant scale and the niche market they transact in allow highly accretive deals. The Chisholm transaction boosts production by 40% and FCF by nearly double our prior forecast.”

Overall, ESTE shares have a 3 to 1 split between the Buys and the Sells, giving the stock a Moderate Buy consensus rating. The average price target is $16.75, which indicates room for 64% growth from the current share price of $10.19. (See ESTE stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.