Semiconductor stocks have been under tremendous pressure lately. This is not unreasonable, considering that semiconductor sales are heavily reliant on a strong economy. Thus, semiconductor manufacturers can be heavily impacted during economic downturns. The market expects that consumers’ purchasing power will decline in the coming quarters due to macroeconomic conditions. However, some companies in the space offer more defensive characteristics, like Qualcomm (NASDAQ: QCOM).

Qualcomm’s extensive patent portfolio and mission-critical services should help the company keep producing relatively resilient cash flows, moving forward.

A good example is the company’s vital position in the profession of 5G (fifth-generation) wireless technologies. In fact, telecom companies are likely to keep pumping money into 5G-related tech in order to expand their 5G network coverage globally, even if the economy enters a prolonged recession.

Accordingly, I remain bullish on the stock.

Fiscal Q3: Robust Performance, Positive Developments

As I mentioned, Qualcomm is not just another semiconductor company. Its patents and proprietary solutions are critical for the development and deployment of multiple technologies out there. This was displayed in the company’s most recent results, which indicated robust growth momentum without any signs of slowing down.

For its Fiscal Q3 2022, Qualcomm reported revenues of $10.9 billion, implying a significant year-over-year increase of 46%. The company’s QCT (Qualcomm CDMA Technologies) segment remained the primary growth engine of the company, exhibiting strength across Qualcomm’s entire portfolio. The segment’s revenues reached $9.4 billion, suggesting year-over-year growth of 45%.

Handset revenues also came in quite impressive, at $6.1 billion, implying a 59% year-over-year increase. This growth was driven by the strength of Qualcomm’s Snapdragon product portfolio, predominantly in the premium and high tiers.

Qualcomm’s automotive design win pipeline also topped $19 billion, expanding by around $3 billion against fiscal Q2. This goes back to my previous point regarding the differentiation Qualcomm features against the overall industry, as an evolving backlog implies improved cash flow visibility for the company. In addition, it reduces risks and much of the underlying uncertainty regarding the development of Qualcomm’s top line moving forward.

The strength of Qualcomm’s automotive backlog was showcased in its fiscal Q3 results, as the segment achieved record automotive revenues of $350 million, implying growth of 38% compared to last year.

Besides revenue growth in the segment being powered by Qualcomm increasing production to deliver on its backlog, as Qualcomm’s Snapdragon achieves expanded adoption, the company’s automotive backlog itself is also likely to keep advancing higher in the coming quarters.

Moving to IoT revenues, they climbed 31% year-over-year, also suggesting robust growth across consumer products, particularly in edge networking and industrial IP. According to this, I would argue that Qualcomm’s key growth drivers continue to show no signs of slowing down, disproving the ongoing sentiment of a worsening consumer economy.

Regarding its profitability, Qualcomm’s improving economies of scale continue to unlock cost efficiencies and expand margins. Indeed, net income increased significantly more than revenues, by around 84% to $3.7 billion. On a GAAP per-share basis, net income grew by 86% to $3.29, as Qualcomm’s aggressive buybacks reduced the share count, further boosting the metric over net income growth.

Qualcomm’s management believes that the currently-assertive momentum will last, going forward, forecasting revenues between $11.0 billion and $11.8 billion in fiscal Q4. At the midpoint, it implies year-over-year growth of 22% to $11.4 billion, which would celebrate a new record in terms of quarterly revenues. Adjusted EPS is also expected to land between $3.00 and $3.30, also suggesting an impressive year-over-year growth rate of 23.5% at the midpoint.

Overall, I believe that Qualcomm’s latest numbers established that the industry trends currently propelling demand for the company’s technologies remain intact, despite the admittedly heavy headwinds currently impacting the industry.

Heavy Capital Returns to Reduce Uncertainty

If Qualcomm’s latest results are not enough to reduce any uncertainty surrounding the company’s shares, its solid track record of rising capital returns should. Following Qualcomm’s latest dividend increase of 10.3% back in March, the company can now claim it has increased its dividend annually for 19 successive years. It is, in fact, likely to soon attain a Dividend Aristocrat Status if it stays on course.

It’s also important to highlight that this dividend raise was quite thicker than the one before it, at 4.6%. In my view, this indicates management’s optimistic, forward-looking outlook regarding Qualcomm’s net income growth, which should further inspire confidence among investors.

Another catalyst that should sustain Qualcomm’s stock price from violent declines is its constant share repurchases. Qualcomm has bought back and retired over 1/3 of its total outstanding shares since 2013, which is quite praiseworthy. During the latest quarter alone, the company repurchased $500 million worth of stock.

What is QCOM Stock’s Price Target?

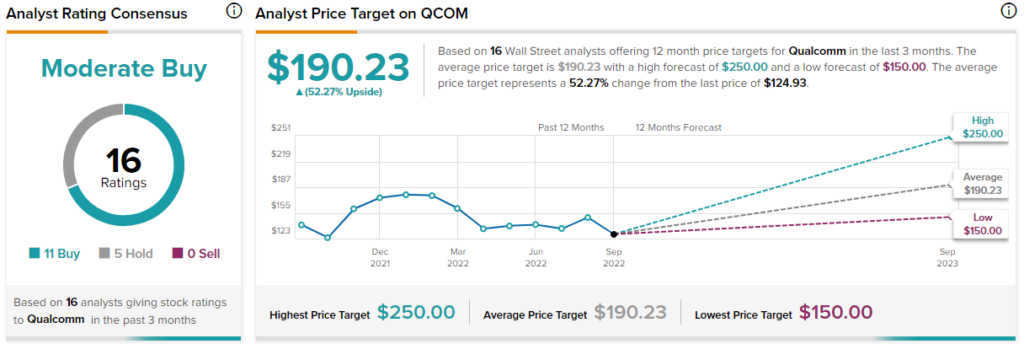

Turning to Wall Street, Qualcomm has a Moderate Buy consensus rating based on 11 Buys and five Holds assigned in the past three months. At $190.23, the average Qualcomm price target suggests 52.3% upside potential.

Conclusion: Solid Momentum and Alluring Capital Returns

Qualcomm’s growth momentum remains sturdy, despite the various challenges surrounding the semiconductor industry. The company’s growth echoes its unique positioning among its industry peers and its expanding backlog, which should keep advancing revenues higher for many quarters to come.

To seal the deal, management’s forward-looking guidance also suggests that Qualcomm’s future results will continue to be rather impressive. With its capital returns remaining juicy, too, I continue to be bullish on Qualcomm stock.