Qualcomm Incorporated (QCOM) concentrates on progressing and commercializing critical technologies for the wireless industry. The company has a leading industry position globally.

Its technologies, products, and services are utilized in mobile devices and countless wireless products, such as network equipment, consumer electronic devices, and broadband gateway equipment.

Qualcomm’s innovations have contributed significantly to the sophistication of smartphones, helping connect billions of people. Specifically, Qualcomm has been a major player in 3G (third-generation), 4G (fourth-generation), and 5G (fifth-generation) wireless technologies. Moreover, the company should preserve its leading position over the long run due to its countless patents and unshared know-how.

I remain bullish on QCOM.

Recent Performance

The 5G market has been growing rapidly, but it’s still in the stages of adoption in multiple regions (e.g., Central America and other emerging markets). International telecom behemoths strive to achieve international scale in terms of 5G coverage, resulting in increasing demand for Qualcomm’s technologies. This was exhibited in the company’s latest results, with overall revenue growth retaining strong momentum.

In Fiscal Q2 2022, Qualcomm posted the fourth consecutive quarter of record sales, which grew 41% to $11.2 billion. Its QCT (Qualcomm CDMA Technologies) business remained the core growth engine of the company, with the company seeing strength across the entire portfolio. The segment’s revenues came in at $9.5 billion, also a record, reflecting year-over-year growth of 52%.

Qualcomm’s automotive design win pipeline also surpassed $16 billion, increasing by more than $3 billion quarter-over-quarter. A growing backlog means increased cash flow visibility for the company, allowing to grow the segment’s revenues in a predictable manner.

Accordingly, the company achieved record automotive revenues of $339 million in Q1, indicating growth of 41% year-over-year. Revenue growth was powered by the company gradually delivering on its backlog, including various launches in its digital cockpit platforms. As Qualcomm’s Snapdragon accomplishes increased adoption, the company’s automotive backlog is likely to keep extending, moving forward.

Further, IoT revenues rose 61% year-over-year, reflecting strong growth across all three classes of consumer products, especially in edge networking and industrial solutions. These numbers indicate that Qualcomm’s primary growth drivers remain robust, despite concerns over a slowing-down consumer economy.

Qualcomm’s scaling economics have resulted in unlocking cost efficiencies and expanding margins. As a result, net income grew quite more significantly than revenues, by 67% to $2.9 billion. On a per-share basis, net income grew by 68% to $2.57, further boosted by the company’s serial buybacks, which reduced the share count.

Management continues to see strong momentum in sales going forward, forecasting revenues between $10.5 billion and $11.3 billion in fiscal Q3. At the midpoint, it implies year-over-year growth of 35.2% to $10.9 billion, which would mark another quarterly record. EPS is also expected to land between $2.75 and $2.95, also suggesting a new record and year-over-year growth of 48.4% at the midpoint.

Capital Returns

Besides Qualcomm’s prospective growth potential, the company further features a very well-established track record of capital returns. Following Qualcomm’s latest dividend hike of 10.3% last March, Qualcomm’s dividend has risen annually for 19 consecutive years. Therefore, the company is progressing toward achieving a Dividend Aristocrat Status.

It’s also worth noting that this dividend increase was much larger than last year’s 4.6%. It could imply an acceleration in dividend growth moving forward, as the five-year dividend per share CAGR stands at 5.61%. The hike also outpaced inflation, which could be interpreted as management valuing the company’s income-oriented investors.

Moreover, Qualcomm has been regularly buying back stock, which further uplifts total shareholder returns. Since 2013, it has repurchased just over 1/3 of its total outstanding shares, which is rather admirable. During the latest quarter alone, the company returned $951 million to shareholders in the form of stock repurchases.

This implies a “buyback yield” of around 2.8% on an annualized basis based on Qualcomm’s present market cap of $135 billion, accompanying the 2.5% dividend yield.

Wall Street’s Take

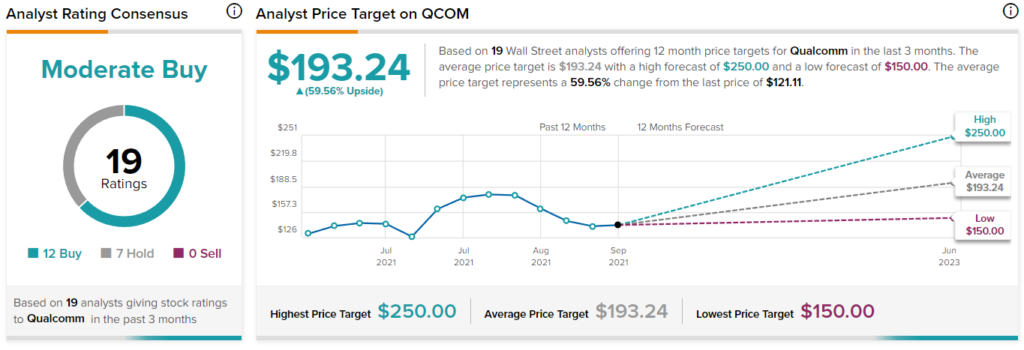

Turning to Wall Street, Qualcomm has a Moderate Buy consensus rating based on 12 Buys and seven Holds assigned in the past three months. At $193.24, the average Qualcomm stock forecast indicates 59.6% upside potential.

Takeaway

Qualcomm is one of the major beneficiaries of the increasing adoption of 5G and the increasing demand for smart devices. Its growth reflects the ongoing tailwinds in the space, with the company achieving and guiding for record revenues and net income levels. Its capital returns also appear quite enticing.

One major risk to consider is the present macroeconomic environment, which is quite treacherous. Various forces, including inflation and the possibility of a housing crisis as a result of rising rates, could result in lower consumer spending and thus lower sales for Qualcomm’s products and solutions.

That said, the company’s overall momentum remains robust, management’s forward guidance is rather optimistic, and its backlog should ensure some stability when it comes to future cash flows. With shares trading at around 11.2 times the midpoint of management’s guidance, investors’ margin of safety should be rather wide as well, assuming headwinds in valuations persist in the coming quarters.

For context, on a next twelve-month basis, the stock’s P/E stands at 9.3, which is the lowest multiple the company has traded at since its IPO in 1999.