Qualcomm Inc. (QCOM) is a leader in mobile semiconductors and the leading supplier of such giants as Apple, Samsung, Google, and Microsoft, with a market share of about 30%. To reduce dependence on the mobile semiconductor market, the company began to diversify its business, emphasizing promising Automotive and IoT markets. Acquired for $4.5 billion, Veoneer has already brought orders worth $10 billion.

I expect solid competitive positioning in the mobile segment and the anticipated dynamics of the automotive segment to ensure stable growth in the coming years.

Because of the active shares repurchase, Qualcomm has achieved very high profitability. According to my valuation, the company is trading more than 25% below its fair price. I am bullish on QCOM.

Company Profile

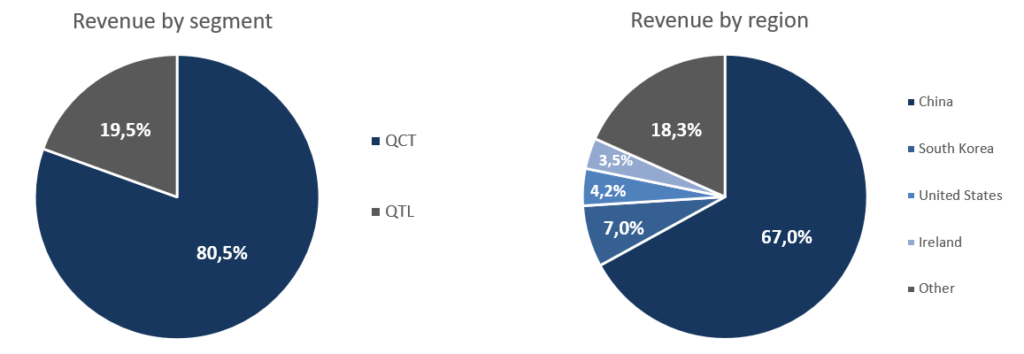

Qualcomm Inc. is a semiconductor company that develops and implements technologies for wireless communications around the world. The revenue structure is divided into three segments: QTC (integrated circuits and software based on 3G/4G/5G and other technologies for wireless voice and data transmission); QTL (licensing and sale of intellectual property rights), and QSI (investing in companies at early stages of development, including 5G, AI, automotive, consumer and IoT market).

The largest segment is QTC (80.5%), which consists of the following categories: Handsets (62.3%); IoT (18.7%); RFFE (15.4%) and Automotive (3.6%).

Business Diversification

In 2019, Qualcomm Inc. developed a new strategy, according to which it wants to move away from the dependence of mobile semiconductors in favor of the automotive and IoT markets. Currently, QCOM is the leader of mobile semiconductors and occupies about 30% of the market.

Nothing threatens the company in this market, and the competitive positioning is strong. The mobile phone market will grow at a CAGR of 9.5% and reach $795.3 billion by 2027.

The company expects to increase revenue from cars to $3.5 billion. (with a CAGR of 89%) until 2024, and $8 billion by 2031 (with a CAGR of 24%). Revenue from IoT will be $9 billion by 2024 (with a CAGR of 33%).

Thus, in 2021, revenue from the Internet of Things and automotive semiconductors is 17.9%, and in three years, it will increase to 30%. According to Bloomberg, the automotive market will grow at an 11.8% CAGR from 2021 to 2030.

New agreements on the supply of semiconductors for manufacturers such as BMW, Renault, Honda, Volvo, and General Motors will ensure revenue growth. This number of new partnerships was facilitated by the purchase of the Swedish company Veoneer in 2019, together with SSW Partners. The value of the transaction was $4.5 billion.

During Q3 2021 conference call, the CEO said:

As demand for automotive solutions increases, we’re pleased to report that our automotive revenue design win pipeline has reached approximately $10 billion.

Thus, the portfolio of future orders exceeded the purchase price by more than two times. Given the strong competitive advantage in the mobile market and the dynamics of the Automotive market, I expect the revenue to grow in all segments.

Financial Performance

2021 was a record year for both revenue and profit for the company. Such financial indicators were the result of rising prices for semiconductors due to an imbalance of supply and demand. Revenue grew by 42.8% and profit by 74%.

The net profit margin remained at the same level for 10 years. In 2018, a significant decline was caused by various factors, including a decrease in licensing revenue, a court case against Apple, a fine of 870 million pounds, and a penalty for an imperfect M&A transaction of $2 billion.

Management predicts that the operating margin will remain at 30% until 2024. These are realistic expectations since historically this indicator has been in the 25-32% range, with the exception of 2017-18.

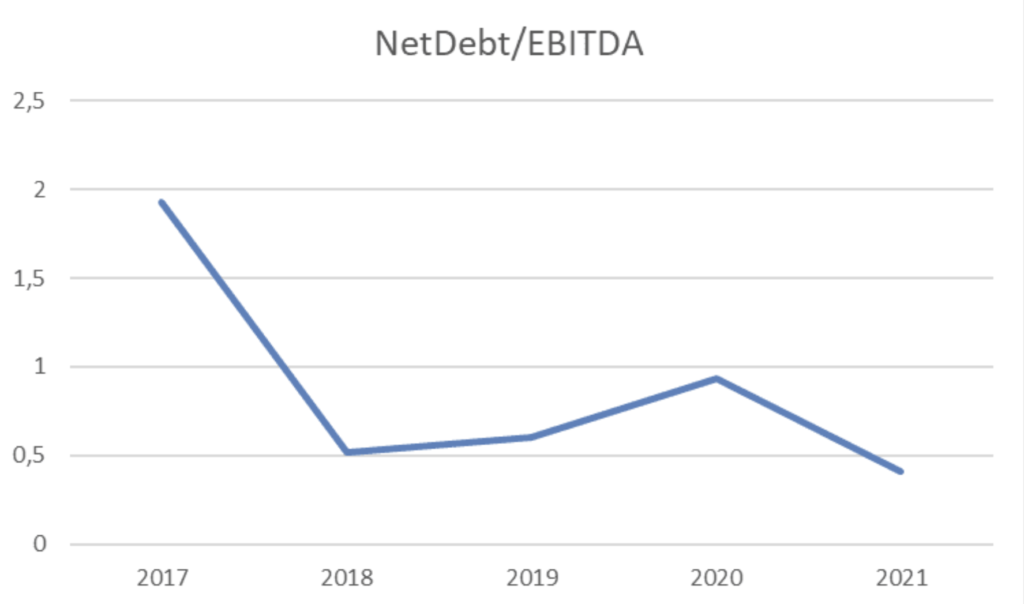

The asset-to-equity ratio reached 4.14 at the end of the last reporting period. However, the growth of financial leverage is a significant decrease in the equity balance due to a massive buyback. The company has a low debt burden. The net-debt-to-EBITDA ratio is 0.4. The interest coverage ratio is 17.5.

Asset turnover has grown significantly over the past five years, from 0.33 in 2017 to 0.81 by the end of 2021. The company uses its assets efficiently.

Due to the steadily growing turnover of assets and the growing marginality of net profit, Qualcomm earns a return on assets of 22% (ROA = Return on Net Profit x Turnover of Assets).

Due to high financial leverage, the company earns a 90.8% return on equity for its shareholders. QCOM retains the potential to increase ROE, primarily due to a possible increase in the net margin and a new share repurchase program worth $10 billion.

In 2018, due to the failed purchase of NXP Semiconductors (NXPI), the board of directors authorized a $30 billion buyback program. This event had an impact on the current indicators of profitability and financial leverage. The total cost of the last two repurchase programs exceeds $40 billion.

Valuation

In the DCF model, I made several assumptions. I expect revenue to grow in line with management’s expectations, with a subsequent slowdown in growth. Relative indicators, including margins, are predicted based on historical dynamics. The terminal growth rate is 3%. The assumptions are presented below:

Based on the assumptions, the expected dynamics of key indicators are presented below:

With the cost of equity equal to 10%, the weighted average cost of capital (WACC) is 9.6%.

With terminal EV/EBITDA equal to 10.67x, the company’s fair value is $238.6 billion or $219.77 per share. Thus, QCOM is trading at an over 25% discount to its fair price.

The company has fairly low P/E and EV/EBITDA indicators, second only to Skyworks Solution. According to multipliers, QCOM trades as a mature and well-established business.

Wall Street’s Take

From Wall Street analysts, Qualcomm earns a Buy analyst consensus based on 12 Buys and nine Hold ratings assigned in the past three months. At $198.11, the average Qualcomm price target implies 20.6% upside potential.

Conclusion

Qualcomm Inc. is a mature and well-established company that is a leader in mobile semiconductors with a market share of about 30%. The possibilities of the automotive and IoT are huge, and its competitive positioning in the mobile semiconductor market are powerful, so I expect growth in all segments.

In addition, regular share buybacks are an important growth driver. According to the valuation, the company is trading at a discount to a fair price. It is noteworthy that my price target is in line with the Wall Street consensus. I am bullish on QCOM.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure