When the COVID-19 crisis first capsized the U.S. economy, one of the cynical benefits that the pandemic sparked was the pivot to work-from-home initiatives. A realization occurred that people may not necessarily need to be physically tethered to their offices and cubicles. Still, with COVID fears fading, several employers have recalled their employees. However, to secure the remaining laggards, a battle may emerge, which could boost gig economy stocks PayPal (NASDAQ:PYPL) and H&R Block (NYSE:HRB).

Technically speaking, the gig economy is a fancier term to describe the marketplace for freelance workers. Unlike employees, so-called gig workers are essentially sole proprietors, thus operating for themselves. They must compete with other independent contractors to provide services for client enterprises. While this arena is risky due to a lack of long-term stability and benefits (such as healthcare insurance), the work-life balance can be ideal.

Because gig workers represent themselves, their ability to generate earnings depends entirely on their professional reputation and performance. Primarily, the advantage is that independent contractors secure the full benefits of any contracts they secure. Further, gig workers can operate anywhere they want – in an office, in a coffee shop, or at home. They don’t necessarily need to operate within the country of the underlying contract signatory.

Therefore, when the COVID-19 crisis struck, the surge of people working from home effectively created an unfair market. Employees can now enjoy the benefits of being on a corporate payroll (salary, health insurance, retirement plan) while also advantaging the benefits of being a gig worker (personal flexibility).

However, a number of employers recognize the unsustainability of telecommuting, particularly for their business models. Thus, several workers have already returned to the office. Still, many others are prepared to fight upper management to either secure telecommuting privileges full-time or part-time.

Given that employer-employee battles tend to be mismatched (after all, the entities signing the checks logically feature the greatest resources), the head-to-head may see a sharp lift in gig economy stocks.

PayPal

A financial technology (fintech) firm specializing in online payments, PayPal also delivers business management services for gig workers. Because many companies offer freelance contracts and pay the underlying service providers via PayPal, it represents one of the most important gig economy stocks.

Fundamentally, the sector will likely expand, whether the arena acquires disgruntled corporate employees or not. According to data from Statista.com, experts project the gig economy to reach a valuation of $455.2 billion by 2023.

Presently, the annual salary of a gig worker in California is about $49,912 a year. While this figure doesn’t sound like much compared to the Golden State’s average salary of $78,499 (or $37.74 per hour), the gig economy encompasses several professional avenues, from ride-sharing and food deliveries to data analytics and other specialties. PayPal provides the flexibility and utility to accommodate a range of users, making PYPL one of the gig economy stocks to consider.

In terms of growth, PayPal delivered impressively throughout the new normal. In the pandemic-disrupted year of 2020, PayPal posted revenue of $21.45 billion, up nearly 21% from one year ago. In 2021, PayPal rang up sales of $25.4 billion.

Still, investors have been scared off of PYPL due to the underlying firm posting a net loss of $341 million in the second quarter of 2022. While shares have slipped nearly 51% on a year-to-date basis, PayPal could make a comeback as people who received a taste of the freedoms associated with gig life decide to make the transition full-time.

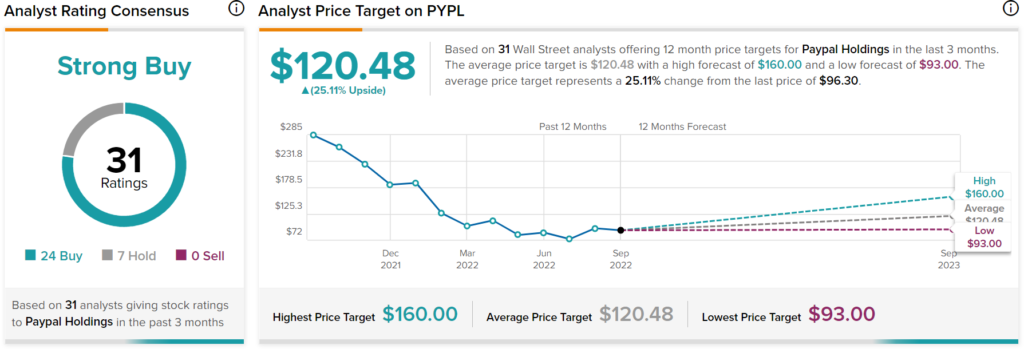

What is the Price Target for PYPL Stock?

Turning to Wall Street, PayPal has a Strong Buy consensus rating based on 24 Buys and seven Holds assigned in the past three months. The average PYPL stock price target of $120.48 implies 25.1% upside potential.

H&R Block

A rather unassuming market idea, H&R Block provides tax-preparation services. It operates in Canada, the U.S., and Australia. Mainly, H&R Block delivers significant value for first-time taxpayers and for people who have complex tax situations.

To provide a better understanding of why HRB represents one of the gig economy stocks to consider, investors should note that corporate employees file a W-2 tax form. Effectively, the employer automatically deducts taxes from the employee. Therefore, the worker largely only needs to input personal details (such as marital status and number of dependents) to determine whether the federal government took too much or too little.

On the other hand, independent contractors file a 1099 tax form. The pivot from W2 to 1099 could be incredibly complex. For one thing, the Internal Revenue Service may not always know what a gig worker earned in a given tax year. Therefore, it’s incumbent upon the sole proprietor to keep accurate records in case of an audit.

Further, the 1099 filer has the option of deducting valid expenses, thus lowering income and overall tax liabilities. For the first-time gig worker, the number of documents needed to be filed with the IRS could be daunting. Therefore, if investors anticipate that the gig economy will burgeon over the next several years, HRB could be one of the better gig economy stocks.

To be fair, H&R Block took a revenue hit, generating $2.64 billion in the fiscal year ending April 30, 2020. This translated to a nearly 15% loss compared to Fiscal Year 2019. However, being so close to the initial onslaught of the pandemic, this performance was understandable. In fiscal 2021, H&R Block posted $3.4 billion on the top line, representing a 10.3% jump from 2019’s result.

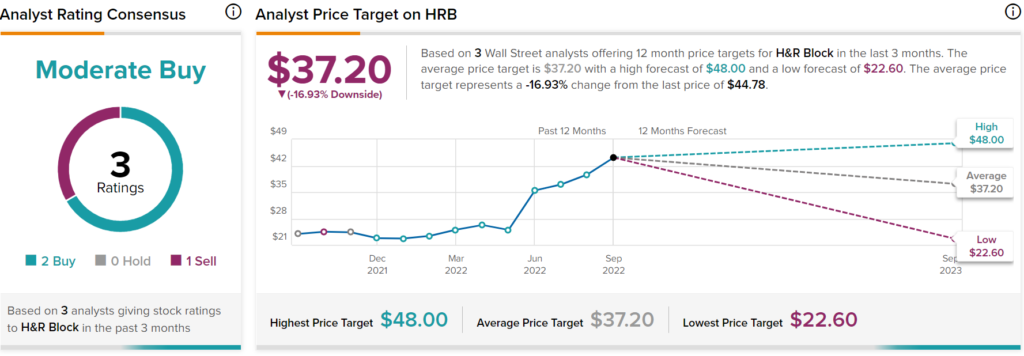

Is HRB Stock a Buy?

Analysts don’t have the same conviction in HRB stock, as it has a Moderate Buy consensus rating. This is based on two Buys and one Sell assigned in the past three months. Interestingly, the average HRB stock price target of $37.20 implies almost 17% downside potential.

Which Gig Economy Stock is Better?

While it’s difficult to pinpoint which one of the aforementioned gig economy stocks is appropriate for investors, it may come down to personal timeframe. If you’re seeking an investment that’s relevant right now, H&R Block may be the most appropriate choice. After all, Tax Day is only a few months away. On the other hand, if you have the patience for a longer-term hold, PayPal may be the superior idea. Should the gig economy blossom, PYPL, at its present discount, would be incredibly attractive.