As we approach the end of National Prostate Cancer Month, we put the spotlight on Pfizer (NYSE:PFE) and Lantheus (NASDAQ:LNTH) — two stocks that have a long way to go as the market for prostate cancer treatments and therapies expands.

Most prostate cancer cases are diagnosed early and progress slowly, making it easier to develop treatments to manage this form of cancer.

Nonetheless, 3.1 million American men are living with prostate cancer in the U.S. currently, according to Lantheus. Also, the fact that prostate cancer remains the second leading cause of death in men in the U.S. underscores the urgency of developing advanced treatments for this disease.

Unfortunately, a survey earlier this year by cancer information website Cancer.net revealed that around 34,500 prostate cancer deaths are likely to occur in the U.S. this year. The survey also revealed that incidents of advanced-stage prostate cancer grew consistently by 4%-6% each year from 2014 to 2018.

Highlighting the market opportunity for pharma players in this area, a study by Data Bridge Market Research, the global prostate cancer therapeutics market is on track to witness a CAGR of 8.2% between 2022 and 2029, possibly reaching $21.90 billion at the end of the period.

On a broader basis, the global prostate health market size, which was $32.07 billion in 2021, is likely to reach $69.6 billion by 2030, according to Emergen Research.

Several pharma and biotech companies are constantly researching various treatment options and working on developing improved therapies.

To that end, Pfizer and Lantheus are among those companies whose focus on increasing the survival rate of their treatments is noteworthy. Their efforts have brought drugs and cancer-detecting agents to the market that aim to approach the disease from a new direction. This places them among the best candidates to cash in on the opportunity presented by the growing prostate cancer therapy market.

Pfizer (NYSE:PFE)

Pfizer’s two drugs dedicated to treating prostate cancer have two different approaches to therapy. Xtandi, which was created jointly with Astellas Pharma (ALPMF), is fast gaining market share due to its effectiveness.

Pfizer and Astellas’ phase 3 ARCHES study on Xtandi combined with androgen deprivation therapy (ADT) showed that the survival rate was 86% in the second year of treatment and 70.6% by the fourth year, both higher than placebo. The drug raked in sales worth $290 million in the second quarter of 2022. Xtandi is an androgen receptor inhibitor, which keeps the androgen hormone from binding and forming proteins called androgen receptors.

The other drug, Orgovyx, was developed in conjunction with Myovant Sciences and is an ADT-based drug.

When Xtandi is taken together with ADT, the chances of death dropped considerably by 34%, as compared to patients undergoing only ADT.

These numbers are increasing the drug’s visibility and adoption even in a market with stiff competition from the likes of Johnson & Johnson (NYSE:JNJ).

Apart from prostate cancer, Pfizer’s market-leading drugs for a range of other health issues are also worth mentioning. Last week, BMO Capital analyst Evan Seigerman appeared bullish on PFE in his research note following encouraging data related to the oral GLP-1 program (danuglipron and PF-07081532) for obesity. “At the ongoing EASD (European Association for the Study of Diabetes) annual meeting, ph 2a/b data from the danuglipron in T2D demonstrated stat. sig. reduction in HbA1c, fasting plasma glucose, and weight loss over 16 weeks, with acceptable tolerability (minor GI AEs). Early data from ‘1532 also demonstrated dose-dependent responses in glucose levels and weight loss,” noted the analyst.

Is PFE a Good Buy?

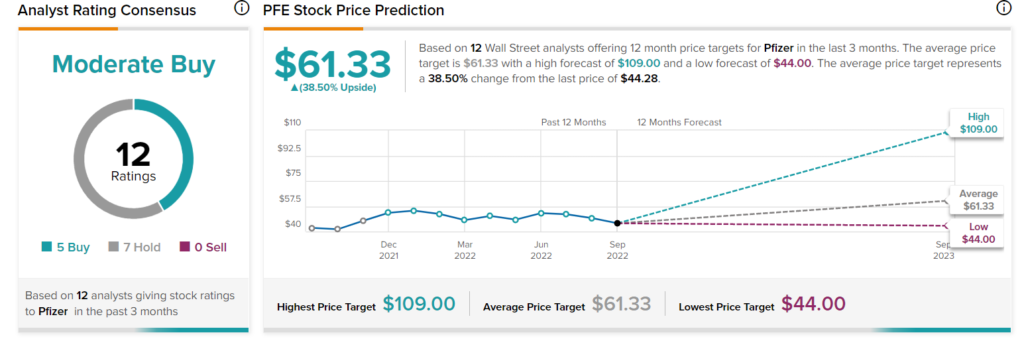

Seigerman keeps a Buy rating and $65.00 price target on Pfizer. Turning to Wall Street, we see a slightly more cautious stance, with a Moderate Buy rating based on five Buys and seven Holds. The average price target for PFE stands at $61.33 currently, indicating an upside of 39% from current price levels.

Lantheus Holdings (NASDAQ:LNTH)

Clinical assistance product and imaging agent provider Lantheus is probably best known for its game-changing heart ultrasound enhancing Definity. However, this underdog is fast gaining momentum and was thrust into the limelight last year when it unveiled Pylarify.

What is Pylarify Used For?

Interestingly, Pylarify is an injectable imaging agent that enhances the image of a PET scan, helping doctors spot cancer in the prostate gland much more clearly. In a recent independent study, the agent demonstrated a strong ability to quickly detect lesions and deliver reproducible quantitative assessment, in PET imaging.

The agent is widely believed to be a first-of-its-kind diagnostic tool and is preferred over conventional scans. Lantheus said that in the first half of this year, Pylarify was used in PET scans of over 50,000 men.

As therapies and prostate cancer testing guidelines improve, the market for this agent is also expected to expand. Already, the quick proliferation of diagnostic agents in the industry is impressing analysts. The agent can reduce the necessity of a biopsy.

Wall Street is bullish on the stock, with three analysts unanimously giving a Strong Buy rating to the LNTH stock. The average price target is $104, currently, 54% more than the current price.

Conclusion: Pfizer and Lantheus Have Tremendous Opportunity in the Growing Prostate Cancer Therapies Market

Lantheus and Pfizer have both opened the door to a solid opportunity to gain more clout in the world of prostate cancer. Pfizer currently has a price-to-earnings (forward 12-month) of around 8.6, which is in line with its 5-year minimum. This makes it an attractive stock to buy, keeping the long term in sight.

Turning to Lantheus, the current P/E is 156.7, which may be considered high. However, given that the company has a first mover advantage with the Pylarify agent, the valuation is expected to grow in the coming years.