Prologis, Inc. (PLD) is by far the biggest industrial U.S. REIT, operating around 1 billion square feet of real estate in 19 countries. For perspective regarding its size, the second-largest industrial REIT in the country is Public Storage (PSA), with a market cap of around $67.7 billion, just over half that of Prologis. Prologis enjoys diversified cash flows, incorporating more than 5,800 individual tenants.

Powered by its sheer size, Prologis has been able to unlock economies of scale at a competitive advantage to its peers. Its financials keep expanding at an exciting pace, while the company has lately been accelerating dividend growth. Despite PLD’s favorable traits, however, I believe that its shares are rather overvalued at their current valuation multiple. For this reason, I am neutral on the stock.

Enduring Demand For Logistics Properties

Prologis Q1 results positively surprised investors and analysts alike, with the company growing further on top of last year’s inflated results. Revenues rose 6.1% to $1.22 billion, while FFO/share advanced by 12.3% to $1.09.

Despite earlier investor concerns regarding a slowdown in demand for logistics properties, Prologis painted a different picture. The company continued to experience record gains in market rents and valuations, which expanded its numbers. As management noted during the post-earnings call, demand for Prologis’ industrial properties retained the previous quarter’s strong momentum.

With supply chain bottlenecks persisting, distributors are striving for enhanced fulfillment rates and operational stability. As a result, Prologis has no trouble keeping its properties occupied. When referring to the possibility of consumers pivoting their spending to experiences versus goods amid moving on from the pandemic, CFO Tim Arndt mentioned in the earnings call that even if retail sales were to decline by around 5%, Prologis estimates that the market will still need an additional 800 million square feet of logistics space in the U.S. alone. This indicates no slowdown in demand for Prologis’ properties in the short-to-medium term amid a current overall shortage.

Prologis’ balance sheet remained promising, with debt as a percentage of its total market cap staying at a healthy 13.5%. Its weighted average borrowing rate came in quite low as well, at 1.7%. This exemplifies the power of Prologis’ scale and resilient portfolio to sustain cheap financing, which is going to be detrimental for REITs in a rising-rates environment.

Moreover, Prologis’ weighted average remaining lease term stood at 4 years at the end of Q1, shrinking sequentially (from 4.2 years) due to a lack of substantial lease extensions. However, this makes sense as tenants are likely hoping to extend their leases at potentially lower rates in the coming quarters thinking the current rent levels are overblown. It should not be translated negatively, in my view. After all, Prologis’ occupancy rate stayed extremely potent at 97.4%.

As a result of Prologis retaining robust momentum, management raised its fiscal 2022 outlook, estimating an FFO/share between $5.10 and $5.16 (up from $5.00 to $5.10 previously).

Dividend Growth Re-Accelerating

Prologis can count nine years of consecutive annual dividend increases. While the company was forced to slash its payout during the financial crisis amid an over leveraged balance sheet, its fundamentals have since improved dramatically while dividends have grown rather rapidly.

Prologis’ dividend growth rate would hover in the high-single to low-double digits over the past few years. However, back in February, management surprised investors by announcing a 25.4% dividend increase to a quarterly rate of $0.79. While this doesn’t indicate that future increases will be as assertive, it certainly suggests a potential re-acceleration to dividend growth as well as strong performance in the coming years. If that wasn’t the case, and instead management had predicted a slow down in demand for logistics properties, it would be very unlikely to see such a dividend hike. Further, at the midpoint of management’s guidance, the payout ratio stands close to 62%, further affirming there is enough room for above-average dividend hikes ahead.

Wall Street’s Take

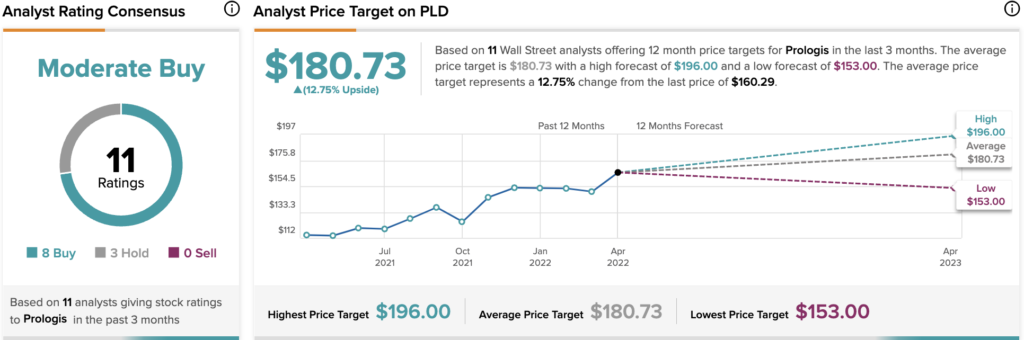

Turning to Wall Street, Prologis has a Moderate Buy consensus rating based on eight Buys and three Holds assigned in the past three months. At $180.73, the average Prologis stock forecast suggests an 12.75% upside potential.

Valuation & Takeaway

Prologis valuation would hover at fairly reasonable multiples over the past decade, with the stock’s price mostly ranging between 15 and 25 times the trust’s underlying funds from operations. Following the pandemic’s impact on numerous REITs, investors flocked to Prologis’ robust cash flows last year, expanding its valuation multiple. Yet, with Prologis’ momentum remaining strong, investors have continued to pay a premium for the stock. At its current price levels and the midpoint of management’s guidance, Prologis is trading at a rather expensive P/FFO of 31.4. This is also depicted in Prologis’ dividend yield. Despite Prologis’ substantial dividend hikes, its yield is currently hovering near the low-end of its decade-average range amid the stock price running ahead of the dividend growth pace.

Prologis’ performance metrics are still great and industrial properties will continue to be favored during the ongoing supply chain crisis. However, I believe that shares could easily experience a valuation compression if the valuation were to normalize. Thus, investors are subject to a rather thin margin of safety, in my view, as a valuation compression could easily eat away any gains attributed to the dividend and the underlying FFO growth.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure