Procter & Gamble (PG) is a consumer products behemoth operating in more than 180 countries.

The company’s well-known brands include Pampers, Luvs, Tide, Gain, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Old Spice, Dawn, Febreze, Swiffer, Crest, Oral-B, Scope, Olay, and many other established names.

The company’s business model leans on the continued growth and

success of its current brands and products, as well as through the innovation of new products and brands.

The consumer staples sector is incredibly competitive, and so PG’s sheer size makes for a great competitive advantage as it can achieve tremendous economies of scale through efficient cost and production management. The $376-billion company is the highest-valued company in the world in the sector, by far.

In my view, PG’s latest results once again demonstrated the company’s strength and resilience despite the ongoing challenges, including the current supply chain challenges.

That said, I continue to find the stock rather expensive, which could result in valuation headwinds going forward. For this reason, I am neutral on the stock.

Latest Results

PG’s Q2-2022 results came in quite strong, with net sales reaching $21 billion, an increase of 6% versus the prior-year period. PG enjoys top-tier production capabilities and solid pricing power due to its products having a robust brand value.

This was particularly demonstrated in Q2’s numbers, as growing revenues were supported by a 3% growth increase in shipment volumes and a 3% increase in prices.

Hence, the company was able to compensate for the significant commodity and overall input cost growth resulting from ongoing inflation.

Operating margins for the quarter actually declined 250 basis points year-over-year. However, the company still managed to post EPS of $1.66, a 13% increase versus the prior-year period, which included a charge for the early extinguishment of debt.

EPS growth was partially assisted by the company’s share repurchases, with the company repurchasing $5 billion worth of common stock during the quarter.

Amid better-than-expected results so far through the year, the company lifted its outlook for its full-year all-in sales growth from 2%-4% to 3%-4%.

Management expects EPS to land 6%-9% higher than its FY 2021 EPS of $5.50, implying FY 2022 EPS of ~$5.91 at the midpoint.

Valuation

Based on PG’s projected EPS of about $5.91 for the year, the stock is currently trading at a P/E of 26.6. In my view, this is a steep multiple for the stock, as it implies stronger growth rates that PG is currently delivering.

Investors are likely paying a premium for the stock, as they appreciate PG’s moat, competitive advantage, predictable sales, pricing power, and all such qualities that provide assurance in the current environment surrounded by uncertainty.

However, at its current valuation, shares could have limited upside ahead, while the 2.2% yield (as much impressive as featuring a 65-year consecutive dividend growth track record is), is not substantial enough to meaningfully add to total returns.

A P/E in the range of 20-24 would more reasonably value the company, in my view.

Wall Street’s Take

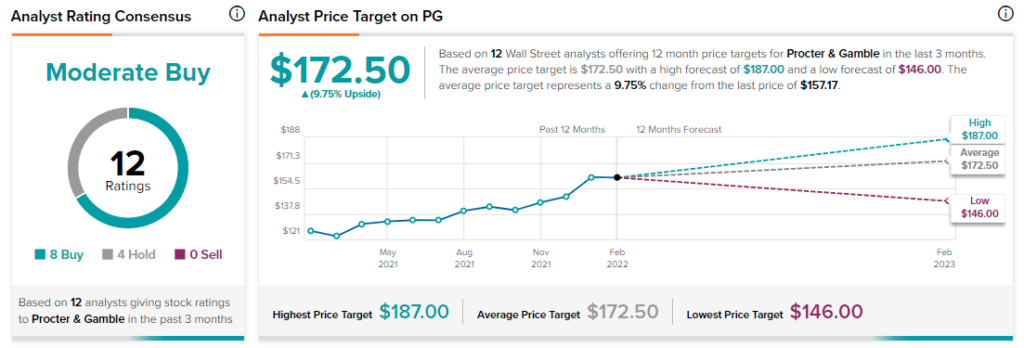

Turning to Wall Street, Procter & Gamble has a Moderate Buy consensus rating, based on eight Buys and four Holds assigned in the past three months.

At $172.50, the average Procter & Gamble price target implies 9.8% upside potential.

Conclusion

Dividend Aristocrat Procter & Gamble is definitely a high-quality company with multiple competitive edges.

While the stock is likely to continue performing well, especially for those seeking dividend growth, I find shares rather overvalued at their current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure