Thursday was a good day for the Nasdaq, which closed the day up 1.8%. But Thursday was not a good day for investors in one of the best-known alternative energy plays on the Nasdaq: Hydrogen fuel cell company Plug Power (NASDAQ:PLUG), which closed the day down nearly 6%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

What went wrong with Plug stock? To find out, we need to travel back in time, to when Plug Power gave investors its 2023 January Business Update Wednesday evening.

Much of what Plug told investors came as no surprise. As before, Plug maintained its long-term guidance for achieving $5 billion in annual sales (and a 30% gross profit margin, and a 17% operating profit margin) by 2026. Plug also advised that it has an even greater longer-term goal to grow sales to $20 billion (with a 35% gross margin, and a 22% operating margin) by 2030.

Some of what Plug told investors was even good news. In particular, while the company has no intention of earning a profit this year, Plug is maintaining its guidance for $1.4 billion in sales, and for achieving a positive gross margin of 10%. Management also set the goal of narrowing its operating losses (which will be negative for most of the year) such that, by Q4 2023, the company intends to break even on an operating basis.

This implies (although Plug didn’t state it outright) that, as early as 2024, Plug Power might be GAAP profitable for the year — and for the first time ever in its history.

You might think investors would take that as good news — great news, even. Astounding news. After all, even analysts that are optimistic about Plug Power aren’t expecting the company to produce honest-to-goodness GAAP profits before 2025 at the earliest. So why aren’t investors happy with Plug stock?

We turn to J.P. Morgan for the answer.

J.P. Morgan analyst Bill Peterson explained that the bad news is that, in the course of laying out its long-term plans, Plug also dropped something of a short-term bombshell. Specifically, instead of growing its revenues 80% in 2022 (as it had promised), Plug says revenues actually grew closer to 45% to 50% last year. And even more specifically, this means that Plug will probably miss estimates for its 2022 sales by anywhere from $75 million to $100 million.

Thus, investors can probably expect 2022 revenues to come in somewhere between $725 million and $750 million.

Plug blamed “product launch delays, supply chain issues and customer site readiness delays” for the prospective sales miss. Peterson praised the company for giving investors a heads-up on the miss before it actually happened. As the analyst commented, by getting the sales miss news out of the way, Plug is actually allowing investors get their selling out of the way today, to move on from the miss, and to focus instead on the prospective good news in “2023 and beyond.”

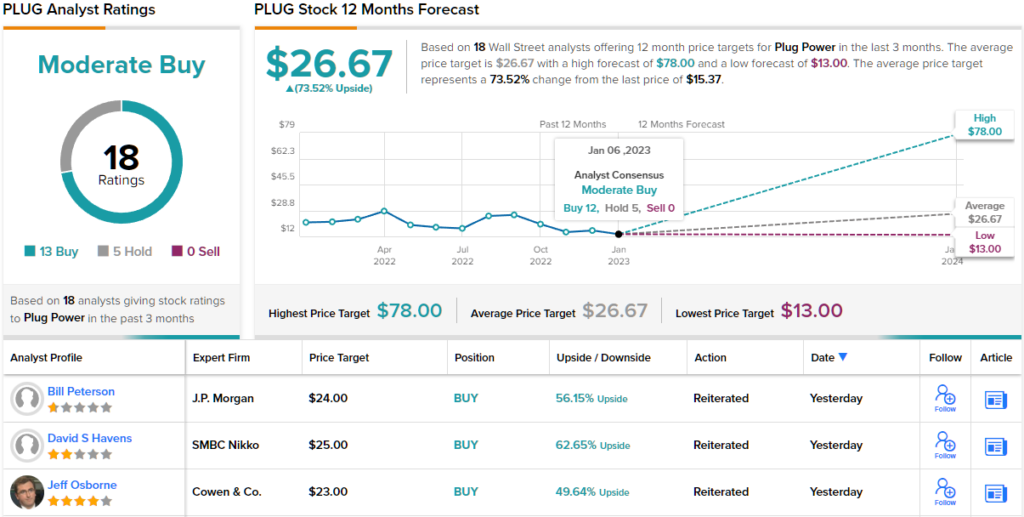

Which as noted above, Plug then proceeded to do itself — and which J.P. Morgan is doing too. In that regard, Peterson insists he remains bullish about Plug’s long-term prospects. While lowering his price target on the stock to $24 a share, he’s maintaining his overweight (i.e. Buy) rating on the stock. (To watch Peterson’s track record, click here)

“We continue to see significant upside in shares and recommend PLUG as a core holding for investors looking for hydrogen exposure,” Peterson summed up.

So, that’s J.P. Morgan’s view, what does the rest of the Street make of the latest Plug developments? The outlook remains upbeat. The stock boasts 13 Buys and 5 Holds, culminating in a Moderate Buy consensus rating. The shares are trading for $15.37 and their average target of $26.67 implies gains of 73.5% for the year ahead. (See PLUG stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.