Looking for exposure to the sustainable fuel economy in 2023? Check out Plug Power (NASDAQ:PLUG) stock, one of the earliest publicly-listed competitors in the green hydrogen industry. I am bullish on PLUG as the stock’s price has already factored in Plug Power’s challenges without fully reflecting the company’s current and future growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Hailing from New York, Plug Power produces hydrogen and related products, including fuel cell systems. This is a fascinating company that recently made history by using hydrogen fuel cell technology to power a jet airliner.

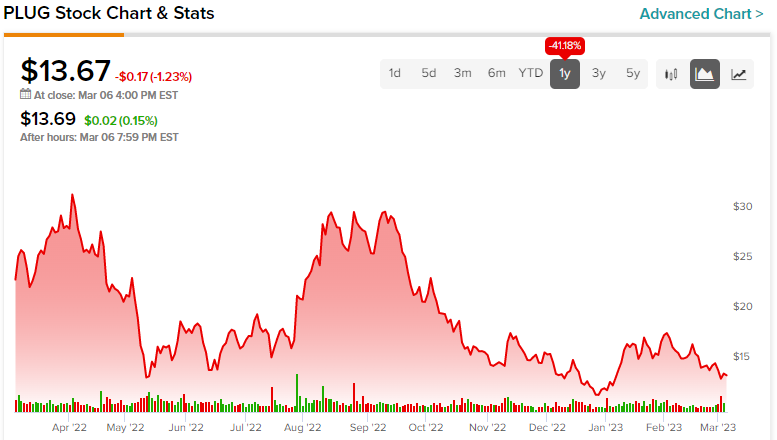

Besides, the Inflation Reduction Act has made it better for today’s forward-thinking investors to get some exposure to clean energy. PLUG stock is one way to achieve this, and you’re in luck as the shares happen to be trading at less than half of their $30 resistance level from last year.

Don’t get me wrong — there are risks involved with investing in Plug Power. As we’ll see, the company isn’t growing as fast as some folks might have hoped it would. Nevertheless, Plug Power’s management is preparing for an exciting and hopefully revenue-rich 2023, so now’s a great time to take a closer look at PLUG stock.

Plug Power’s Financial Profile Isn’t Perfect

In order to be fair and balanced, we should start off with the risks surrounding Plug Power. PLUG stock is volatile, and the company isn’t in perfect financial condition. As you’ll see from Plug Power’s earnings history, the company isn’t profitable and doesn’t have a stellar track record of EPS beats versus misses.

On the other hand, Wall Street has high hopes for PLUG stock — but more about that later. For now, we have to acknowledge that Plug Power reported -a 28% gross margin in 2022. This certainly isn’t ideal, and it seems to have prompted RBC Capital Markets analyst Chris Dendrinos to call Plug Power’s margins “challenged” and to be “less confident in the outlook” for Plug Power.

KeyBanc Capital analyst Sangita Jain also maintained a cautious tone, characterizing Plug Power’s fourth-quarter 2022 results as “lackluster.” Jain’s unimpressed attitude may be justifiable, as Plug Power’s Q4 revenue of $220.7 million missed the analyst consensus estimate of $281.2 million. Moreover, the company reported a quarterly loss of $0.38 per share, while Wall Street had only expected Plug Power to lose $0.25 per share.

It’s understandable if these financial facts are deal-breakers for some of you. I still encourage you to get the rest of the story, though, as Plug Power could be poised for a powerful recovery this year.

Plug Power’s “Gigafactory” Could Unlock Revenue and Margin Growth

Plug Power can’t change the past and can’t alter its negative margins from last year. However, the company can forge ahead with its hydrogen technology “Gigafactory” and thereby aim for positive margins and robust revenue.

First and foremost, it’s worth noting that, despite the less-than-optimistic remarks, Chris Dendrinos issued an Outperform rating and a $17 price target on PLUG stock. Jain also published an Outperform rating on Plug Power, assigning a $25 price target. Both of these price targets suggest that PLUG stock has room to move higher.

Maybe, these and other experts feel that Plug Power’s Innovation Center and Gigafactory in Rochester, New York, will help the company unlock revenue and margin improvements this year. This vast production facility will hopefully help Plug Power achieve its target of 100 megawatts of power for the company’s electrolyzers by the middle of 2023’s second quarter.

If all goes according to plan, Plug Power could actually turn margin-positive this year. Thus, the ramp-up of activity at Plug Power’s Gigafactory could help Plug Power achieve its 2023 revenue guidance of $1.4 billion and the company’s gross margin target of 10%.

Is PLUG Stock a Buy, According to Analysts?

Now, let’s talk about the analyst community’s general stance on PLUG stock. It might surprise you to discover how bullish Wall Street’s experts are on Plug Power. In fact, according to TipRanks, PLUG is a Strong Buy based on 14 Buys, four Hold ratings, and no Sell ratings whatsoever. Furthermore, the average Plug Power stock price target is $26.56, implying 94.3% upside potential.

Conclusion: Should You Consider Plug Power Stock?

Make no mistake about it — Plug Power will be a “show-me story” in 2023. Analysts and investors will want to see Plug Power achieve positive margins and will also expect the company to deliver impressive sales figures.

That’s a high hurdle to clear, but Plug Power could surprise Wall Street if the Gigafactory performs and produces as the company anticipates it will. Then, PLUG stock can fill the sizable gap above it, as the share price is currently far below its prior peak. Therefore, now is a good time to research the company and weigh the risks and possible rewards.